CFDs and Spread Bets are complex instruments and come with a high risk of losing money rapidly due to leverage. 70.5% of retail investor accounts lose money when trading CFDs and Spread Bets with this provider. You should consider whether you understand how CFDs and Spread Bets work and whether you can afford to take the high risk of losing your money.

SEARCH

-

AllTradingPlatformsAcademyAnalysisPromotionsAbout

-

Keywords

Popular Search

Markets

Bonds

-

What are Bonds?

-

Why Trade Bonds with Vantage

-

How Does Bond CFD Trading Work with Vantage?

-

Popular Bonds Specification

-

Trading Platforms

-

Trading Accounts

-

Frequently Asked Questions

What are Bonds?

Bonds are forms of debt securities which represent loans made by lenders to borrowing entities like governments or corporations.

The appeal of bonds comes from coupon payments as an interest of your principal amount - the periodic payments you receive until the bond matures. At the end of the tenure, the bond issuer is obligated to repay the principal amount to the bondholder.

Vantage allows traders to engage in bond trading by providing Contracts for Difference (CFDs) on bonds. These CFDs allow traders access to the trading opportunities of the underlying fixed-income debt securities without requiring direct ownership of the bond. Traders can participate in this market at a fraction of cost than the actual bond price.

Why Trade Bonds with Vantage

-

Accessibility to

see more

Popular BondsTrade highly-rated bonds from both EU and US, such as Treasury bonds and government bonds, and speculate on their prices using CFDs.

-

Start Small

see more

from 1 LotWith competitive spreads from 0.0*, trade the world's most traded forex pairs at minimum cost.

*Other fees may be applicable -

Trade

see more

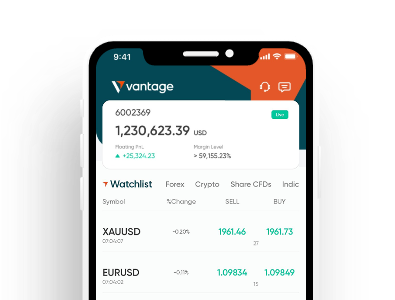

On The GoBuy and sell bonds anytime. React swiftly to news on our trading platform and mobile app.

-

Low & Transparent

see more

CostsStart trading with $0 deposit fees* with no hidden fees.

*Other fees may be applicable -

Free Educational

see more

MaterialsEquip yourself with bonds trading knowledge through free educational materials on our academy.

-

Trade Bull & Bear

see more

MarketsFlexibility to trade in both rising and falling bond markets.

-

Risk Management

see more

ToolsVantage offers negative balance protection, price alerts and stop loss tools to help you manage your downside risk.

-

MT4 & MT5

see more

AccountGet access to bond markets with powerful MetaTrader 4 and MetaTrader 5 trading platforms.

How Does Bond CFD Trading Work with Vantage?

-

1

Open a live account with Vantage

-

2

Deposit funds to your newly created account

-

3

Analyse the bond markets before deciding to buy and sell bonds

-

4

Open and monitor your first bond trading position

-

5

When you think it’s time, close the position to complete the trade

Popular Bonds Specification

|

Instrument |

Buy/ |

Change |

% |

TRADE |

|---|---|---|---|---|

|

FGBL Euro - Bund Futures |

-

- (-) |

- |

- |

TRADE |

|

FGBM Euro - BOBL Futures |

-

- (-) |

- |

- |

TRADE |

|

FGBX Euro - BUXL Futures |

-

- (-) |

- |

- |

TRADE |

|

FGBS Euro - Schatz Futures |

-

- (-) |

- |

- |

TRADE |

|

FLG UK Long Gilt Futures |

-

- (-) |

- |

- |

TRADE |

|

FEI EURIBOR Futures |

-

- (-) |

- |

- |

TRADE |

|

TY US 10 YR T-Note Futures Decimalised |

-

- (-) |

- |

- |

TRADE |

-

Best CFD

Broker GlobalGrand Brands Magazine

-

Best Trade

ExecutionGlobal Forex Awards

-

Best Professional

Trading PlatformProfessional Trader Awards

Trading Accounts

-

1

Novice

-

2

Experienced

-

3

Professional

-

1

Register

Quick and easy account

opening process. -

2

Fund

Fund your trading account

with an extensive choice of

deposit methods. -

3

Trade

Trade with spreads starting as

low as 0.0* and gain access to over 1,000+ CFD instruments.

*Other fees may be applicable

Frequently Asked Questions

-

1

What are the risks of bond trading?

Bond trading involves risks such as interest rate, inflation risk, market volatility and credit risks. To attempt minimising these risks, it's crucial to conduct thorough research, have a well-defined trading strategy, and practise sound risk management. -

2

What are the potential advantages of bond trading?

Here are a few potential advantages of bond trading: Potential opportunities: Bond trading provides traders with potential opportunities due to the fixed interest rate of regular coupon payments that come with bonds.Greater liquidity: Bond markets can offer higher liquidity compared to certain other trading options, allowing traders to easily buy or sell bonds and adapt to market conditions.Bond trading also comes with some risks. Traders should prioritise conducting thorough research and understanding the risks associated with bond trading before making any trading decisions. -

3

How are bonds different from stocks?

Bonds and stocks are two distinct financial products that are traded in the market. Bonds serve as trading instruments that represent a loan provided by an investor or trader to a borrower, typically a corporation or government body. Stocks on the other hand, represent partial ownership of a company. If the company experiences good performance, the value of your stocks could have the potential to increase based on market supply and demand. While there are some similarities between the two, given that they are both financial instruments used to raise capital, they operate in fundamentally different ways and have their own market risks. You can tap on our library of free educational materials to better understand the difference between bonds and stocks. -

4

What is the difference between government and corporate bonds?

Government bonds and corporate bonds generally pay fixed interest rate to investors. They are issued by governments and corporations to generate funds. In exchange for the money they receive, bondholders receive regular interest payments and get back the initial amount invested when the bond reaches its maturity date.However, they also do differ in several ways:Issuer: As their names suggest, government bonds are issued by governments, either at the federal or local level; while corporate bonds are issued by corporations.Credit Risk: Government bonds are backed by the government's full faith and credit. On the other hand, corporate bonds come with a higher risk of default since companies could potentially go bankrupt and default on these loans.Interest Rate: Due to the higher risk, corporate bonds often offer higher interest rates than government bonds to compensate investors for the increased risk.