CFDs and Spread Bets are complex instruments and come with a high risk of losing money rapidly due to leverage. 57.7% of retail investor accounts lose money when trading CFDs and Spread Bets with this provider. You should consider whether you understand how CFDs and Spread Bets work and whether you can afford to take the high risk of losing your money.

SEARCH

-

AllTradingPlatformsAcademyAnalysisPromotionsAbout

-

Search query too short. Please enter a full word or phrase.

-

Keywords

Popular Search

WHAT IS GOLD?

Gold is a popular precious metal known for its rarity, decay resistance, and malleability, having been valued for creating luxury goods and decorative items for years. Its enduring worth and resilience also establishes gold as a sought-after safe haven asset that can stand the test of time.

The increasing demand for gold has contributed to its ever-rising price.

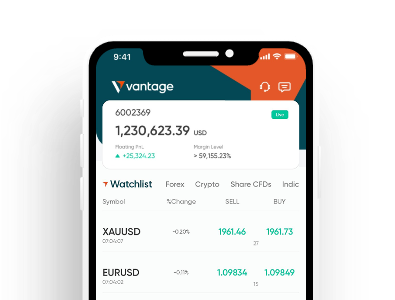

With a Vantage live trading account, you can try trading gold via Contract for Differences (CFDs). By trading gold (XAUUSD) CFDs, you can seize trading opportunities on the rise or fall in prices of these products, without having to own the physical metal.

Alternatively, explore Spread Betting as another way to trade gold with Vantage. Spread betting allows you to trade on the price movements of financial markets without owning the underlying assets. You can speculate on whether prices will rise or fall. There are no commissions (*other fees may be applicable), and in the UK, profits are tax-free*.

TRADE GOLD WITH VANTAGE

-

Flexible Lot Sizes

see more

Starting with 0.1 LotDive into the world of gold trading starting with just 0.1 lot. Embrace the adaptability offered by our range of flexible contract sizes, crafted to suit your individual trading style.

-

Tight Spreads on

see more

Vantage Raw ECN AccountsWith competitive spreads from 0.0*, trade the world's most traded forex pairs at minimum cost.

*Other fees may be applicable -

Trade

see more

On The GoBuy and sell anytime. React swiftly to news on our trading platform and mobile app.

-

Low & Transparent

see more

CostsStart trading with $0 deposit fees* with no hidden fees.

*Other fees may be applicable -

Free Educational

see more

MaterialsEquip yourself with energy trading knowledge through free educational materials on our academy.

-

Trade Bear & Bull

see more

MarketsFlexibility to trade in both rising and falling energy markets.

-

Risk Management

see more

ToolsVantage offers negative balance protection, price alerts and stop loss tools to help you manage your downside risk.

-

MT4 & MT5

see more

AccountGet access to energy markets with powerful MetaTrader 4 and MetaTrader 5 trading platforms.

HOW DOES GOLD TRADING WORK WITH VANTAGE?

-

1

Open a live account with Vantage

-

2

Deposit funds to your newly created account

-

3

Analyse the gold markets and determine which product you wish to trade

-

4

Open and monitor your first trading position

-

5

When you think it’s time, close the position to complete the trade

GOLD PRICE SPECIFICATION

-

Best CFD

Broker GlobalGrand Brands Magazine

-

Best Trade

ExecutionGlobal Forex Awards

-

Best Professional

Trading PlatformProfessional Trader Awards

TRADING PLATFORMS

MetaTrader4

- 30 built-in technical indicators

- 31 analytical charting tools

- 9 time-frames

- 4 types of trading orders

MetaTrader5

- 38 built-in technical indicators

- 44 analytical charting tools

- 21 time-frames

- 6 types of trading orders

TradingView

- 15+ chart types

- 100+ in-built indicators

- 50+ drawing tools

- 12 alert conditions

TRADING ACCOUNTS

-

1

Novice

-

2

Experienced

-

3

Professional

-

1

Register

Quick and easy account

opening process. -

2

Fund

Fund your trading account

with an extensive choice of

deposit methods. -

3

Trade

Trade with spreads starting as

low as 0.0* and gain access

to over 900+ CFD

instruments.

*Other fees may be applicable

Frequently Asked Questions

-

1

How do you trade in gold?

There are several ways to engage in gold trading, including buying and selling spot gold, gold futures, gold options, CFDs or investing in gold stocks and ETFs.

To execute a trade on Vantage, you'll require a live trading account. This enables you to participate in the gold market and seize trading opportunities on the price movements of gold. -

2

Is trading gold profitable?

Gold is a dynamic and frequently traded market, known for its liquidity and price volatility. Engaging in gold trading can offer potential opportunities for profitability, provided you develop a robust trading system that suits your individual preferences and goals.

However, it is essential to acknowledge the inherent risks associated with trading. Losses can occur, and it is crucial to exercise due diligence before making any trades. It is advisable to trade only with funds that you can afford to lose, ensuring that your financial stability remains intact. -

3

How risky is gold trading?

Trading gold carries risks owing to market fluctuations. One key factor for price change is caused by the supply and demand of the metal. For example, if a mining company underperforms, demand may exceed supply, pushing gold prices higher. Financial stress can also increase demand for gold. For instance, during the 2008–12 financial crisis, gold prices surged by more than 230%.

Geopolitical events can also drive investors to seek the safety of gold, causing price fluctuations. On the contrary, with its negative correlation to the stock market, Gold tends to fall when stocks are doing well. Ultimately, traders should do their due diligence to ensure that they understand the market and risks involved. -

4

How much money do you need to trade gold?

When using Vantage, you have the option to begin trading with a minimum deposit of USD$50.

Trading gold as a CFD offers traders the opportunity to leverage their capital, enabling them to open larger trade positions with a relatively small amount of funds. Leverage has the potential to amplify profits; however, it is important to note that it also exposes traders to the risk of losses that may exceed the margin available in their trading accounts. It is crucial to exercise caution and carefully manage risk when utilising leverage in gold trading or any other financial markets. -

5

How to invest in gold for beginners?

ETFs are the best way for a beginner to invest in gold. You can start your trading journey with Vantage by opening a live or demo account. A gold ETF has the advantage of having indirect ownership of physical gold, which is less risky than other options.

Some examples of gold ETFs are SPDR Gold Minishares Trust ETF (GLDM) and iShares Gold Trust (IAU), although there are others.