CFDs and Spread Bets are complex instruments and come with a high risk of losing money rapidly due to leverage. 70.5% of retail investor accounts lose money when trading CFDs and Spread Bets with this provider. You should consider whether you understand how CFDs and Spread Bets work and whether you can afford to take the high risk of losing your money.

SEARCH

-

AllTradingPlatformsAcademyAnalysisPromotionsAbout

-

Keywords

Popular Search

Markets

ETFs

-

What is an ETF?

-

Why Trade ETFs with Vantage?

-

How Does ETF Trading Work with Vantage?

-

Popular ETFs Specification

-

Trading Platforms

-

Trading Accounts

-

Frequently Asked Questions

What is an ETF?

Exchange traded funds (ETFs) are baskets of pooled trading products such as stocks, commodities or bonds. ETFs are typically structured to replicate the performance of a stock market index such as the S&P 500 or DAX. These indices are not tradable directly, but ETFs can be traded similarly to individual stocks on the stock exchange (unlike mutual funds).

This distinctive characteristic enables traders to diversify their portfolio by gaining exposure to multiple assets in single trade. Explore the benefits of diversification with Vantage by incorporating ETF CFDs into your trading strategy, which provide an opportunity to gain exposure to a variety of markets.

Why Trade ETFs with Vantage?

-

Accessibility to

see more

Popular ETFsSpeculate on ETF prices of over 50+ global ETFs by trading CFDs through our liquid global stock exchange markets.

-

Tight Spreads On

see more

RAW ECN AccountsWith competitive spreads from 0.0*, trade the world's most traded forex pairs at minimum cost.

*Other fees may be applicable -

Trade

see more

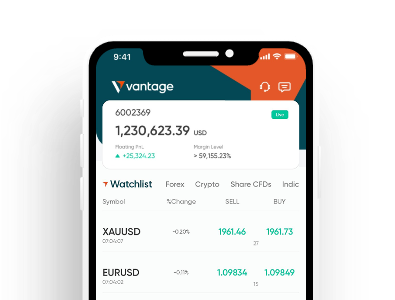

On The GoBuy and sell anytime. React swiftly to news on our trading platform and mobile app.

-

Low & Transparent

see more

CostsStart trading with $0 deposit fees* with no hidden fees.

*Other fees may be applicable -

Free Educational

see more

MaterialsEquip yourself with ETFs trading knowledge through free educational materials on our academy.

-

Trade Bear & Bull

see more

MarketsFlexibility to trade in both rising and falling ETFs markets.

-

Risk Management

see more

ToolsVantage offers negative balance protection, price alerts and stop loss tools to help you manage your downside risk.

-

MT4 & MT5

see more

AccountGet access to ETFs markets with powerful MetaTrader 4 and MetaTrader 5 trading platforms.

How Does ETF Trading Work with Vantage?

-

1

Open a live account with Vantage

-

2

Deposit funds to your newly created account

-

3

Analyse the ETF markets and determine which ETF you wish to trade

-

4

Open and monitor your first trading position

-

5

When you think it’s time, close the position to complete the trade

Popular ETFs Specification

|

Instrument |

Buy/ |

Change |

% |

TRADE |

|---|---|---|---|---|

|

SPY SPDR S&P 500 ETF Trust |

-

- (-) |

- |

- |

TRADE |

|

QQQ Invesco QQQ Trust |

-

- (-) |

- |

- |

TRADE |

|

GLD SPDR Gold |

-

- (-) |

- |

- |

TRADE |

|

FXI iShares China Larfe-Cap ETF |

-

- (-) |

- |

- |

TRADE |

|

USL United States 12 Month Oil Fund LP |

-

- (-) |

- |

- |

TRADE |

|

VGT Vanguard Information Technology ETF |

-

- (-) |

- |

- |

TRADE |

|

GSG iShares S&P GSCI Commodity-Indexed Trust |

-

- (-) |

- |

- |

TRADE |

|

USO United States Oil Fund LP |

-

- (-) |

- |

- |

TRADE |

|

DBC Invesco DB Commodity Index Tracking Fund |

-

- (-) |

- |

- |

TRADE |

|

QCLN First Trust NASDAQ Clean Edge Green Energy Index Fund |

-

- (-) |

- |

- |

TRADE |

-

Best CFD

Broker GlobalGrand Brands Magazine

-

Best Trade

ExecutionGlobal Forex Awards

-

Best Professional

Trading PlatformProfessional Trader Awards

Trading Accounts

-

1

Novice

-

2

Experienced

-

3

Professional

-

1

Register

Quick and easy account opening process.

-

2

Fund

Fund your trading account

with an extensive choice of

deposit methods. -

3

Trade

Trade with spreads starting as

low as 0.0* and gain access

to over 1,000+ CFD

instruments.

*Other fees may be applicable

Frequently Asked Questions

-

1

Are ETFs good for beginners?

ETFs can be good for beginners as they offer numerous advantages, including diversification and a wide range of investment choices, typically at low cost. This makes ETFs suitable for various trading strategies used by new traders and investors.

The unique structure of ETFs combines the benefits of mutual funds and individual stocks, making them versatile and accessible.

With Vantage, you can open a live trading account and start trading ETFs via CFDs. -

2

Is it good to trade an ETF?

Trading ETFs can be advantageous for traders and investors due to several reasons.

Firstly, ETFs provide instant diversification by offering access to a product that has pooled together multiple securities, spreading risk.

They also offer liquidity as they can be bought or sold throughout the trading day at market prices. ETFs are transparent, with daily disclosure of their holdings, allowing traders to make informed decisions. Moreover, they often have lower costs compared to mutual funds, reducing fees and potentially improving long-term returns.

ETFs also provide flexibility, covering various investment themes and asset classes. However, it's important to be aware of associated risks and conduct thorough research before trading ETFs. -

3

Are ETFs better than stocks?

Both ETFs and stocks have their own advantages and considerations. ETFs offer diversification, flexibility, and the ability to invest in a specific market or sector.

On the other hand, individual stocks provide the potential for higher returns but also come with more risk. The choice between ETFs and stocks ultimately depends on your trading goals, risk tolerance, and personal preferences.

Many traders choose to have a mix of both in their portfolios to balance risk and reward. -

4

What are the types of ETFs?

There is a wide range of ETFs available to suit various trading preferences. Here are the few common types of ETFs traded:

Equity ETFs, or stock ETFs: These track a specific stock market index, such as the S&P 500, and provide exposure to a broad range of stocks. Bond ETFs: These focus on fixed-income securities like government or corporate bonds, offering potential income generation and diversification. Sector ETFs: These target specific industry sectors, allowing investors to focus on a particular area of the market, such as technology or healthcare. Commodity ETFs: These provide exposure to commodities like gold, oil, or agricultural products, offering a way to diversify beyond traditional asset classes. Country/Region-based ETFs: ETFs that focus on securities in a country or geographical region. These can range from ETFs based around mature economies to ones that track emerging markets. -

5

What do I need to know before trading ETFs?

Trading ETFs, like any trading decision, involves potential benefits and risks that should be carefully considered.

Understanding the nature of the ETF market and the various factors that can cause values to fluctuate is important. It's recommended to thoroughly research your trading options and possibly seek advice from a financial advisor or professional before engaging in ETF trading.

You can also visit our library of free educational materials and articles to help improve your understanding before you begin trading ETFs.