Cautious optimism helps stocks, USD turns lower

Headlines

* China’s consumer inflation slows, producer prices fall further

* New BoJ Chief Ueda backs ultra-easy policy at first press conference

* Bitcoin breaks above $30k for the first time since June 2022

* Equities climb amid buoyant sentiment, US CPI released tomorrow

FX: USD edged higher yesterday but has given back half those gains this morning. Traders are getting back to their desks after the extended weekend. The US Treasury 2-year yield continued higher as bond investors viewed the latest US jobs report as reaffirming expectations of another 25bp rate hike in May. But the yield still trades just below 4% and the 200-day SMA. The 10-year yield currently trades around 3.40% after last week’s low at 3.25%.

EUR dropped below 1.09 but has found a bid this morning. GBP fell to a one-week low of 1.2344 yesterday. But cable tops 1.24 today on dollar-driven price action. USD/JPY popped higher and has hit long-term SMAs. The AUD is the outperformer today after five straight days of selling. That has not been seen since last November. Trade tensions eased as Australia reached an agreement on a WTO dispute regarding Chinese duties on its barley.

Stocks: US equities were flat on Easter Monday in slow trade. The benchmark S&P 500 added 0.10%. The Nasdaq 100 closed down 0.09%. The Dow edged up 0.30%. Earlier losses after Friday’s NFP were unwound. Some analysts cited a Bloomberg report indicating much reduced borrowing in the Federal Home Loan Bank system as a reason for the more positive turn in the risk mood.

Asian stocks traded generally higher as some markets return from the long weekend. The Nikkei 225 reclaimed 28k with yen weakness helping. The Hang Seng was mixed with cooling inflation battling with geopolitical tensions in Taiwan.

Gold dropped to $1981 yesterday but is trading around $2k again today on the softer USD.

Day Ahead – Markets digest recent solid NFP

Good Friday’s US jobs report lifted US Treasury yields over Easter as the critical two-year attempted to regain 4%. Recovering labour force participation continues to ease labour shortages which is supporting headline jobs growth. Wage growth still exceeds pre-pandemic average levels but is benign. The jobless rate remained very close to multi-decade lows at 3.5%.

This all supports one more 25bp May Fed rate hike. The odds are now above 70% which is a marker the Fed has used previously so as not to upset market pricing. Rate cuts are priced in towards the end of summer. Of course, Wednesday’s US CPI is the next big risk event. The DXY remains in a bearish channel. Bulls need to beat 103.05 to change the downtrend.

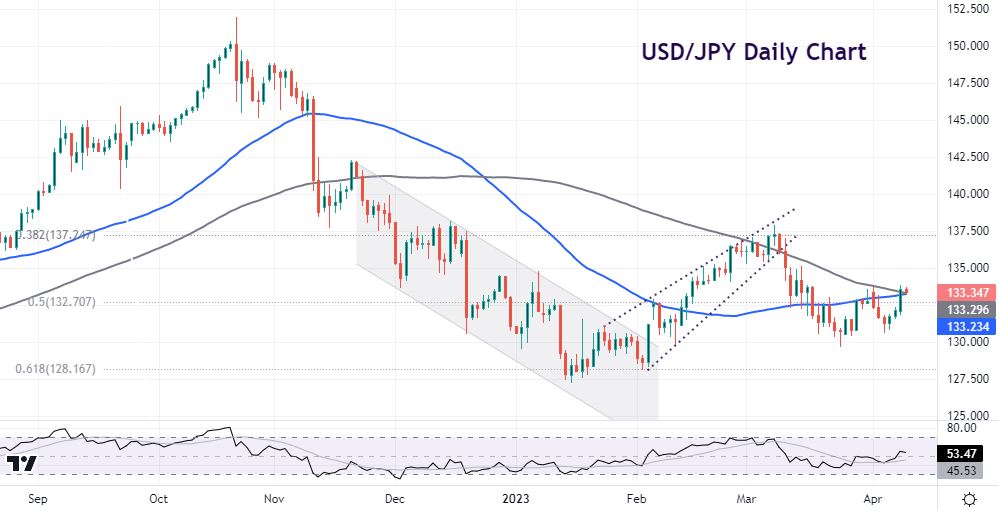

Chart of the Day – USD/JPY hits long-term moving averages

Risk markets welcomed the new BoJ governor’s first public remark. Ueda reiterated the current ultra-loose monetary policy of his predecessor and said it is appropriate given the economic conditions. Big policy adjustments would be made if inflation is above target in a sustainable manner. But changes will be gradual, and a cautious approach remains.

USD/JPY has been choppy since breaking down out of a rising wedge pattern just over a month ago. That pattern shows up when the price moves upward with pivot highs and lows converging to a single point known as the apex. The halfway point of the 2022 rally sits at 132.70. The 50-day and 100-day SMAs are at 133.23 and 29. Break above these and the major can get to 136.

The information has been prepared as of the date published and is subject to change thereafter. The information is provided for educational purposes only and doesn't take into account your personal objectives, financial circumstances, or needs. It does not constitute investment advice. We encourage you to seek independent advice if necessary. The information has not been prepared in accordance with legal requirements designed to promote the independence of investment research. No representation or warranty is given as to the accuracy or completeness of any information contained within. This material may contain historical or past performance figures and should not be relied on. Furthermore estimates, forward-looking statements, and forecasts cannot be guaranteed. The information on this site and the products and services offered are not intended for distribution to any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.