CFDs and Spread Bets are complex instruments and come with a high risk of losing money rapidly due to leverage. 70.5% of retail investor accounts lose money when trading CFDs and Spread Bets with this provider. You should consider whether you understand how CFDs and Spread Bets work and whether you can afford to take the high risk of losing your money.

SEARCH

-

AllTradingPlatformsAcademyAnalysisPromotionsAbout

-

Keywords

Popular Search

HK SHARES TRADING

HK SHARES TRADING

Start trading HK shares from just £0.01 per trade.

Start TradingWHAT ARE HK SHARES?

HK shares refer to shares of companies listed on a HK stock exchange like the Hong Kong Stock Exchange. The HK shares market is diverse and encompasses a wide range of industries and sectors, including finance, technology, healthcare, energy, and more. Investors can choose from a vast array of companies to build a diversified portfolio that aligns with their investment goals and risk tolerance. Popular HK shares include Tencent, Anta Sports and AIA Group.

WHY TRADE HK SHARES WITH VANTAGE?

-

Accessibility to Popular HK Shares

see moreSpeculate on 50 HK shares by trading CFDs through highly liquid global stock exchange markets.

-

Tight Spreads on Vantage Raw ECN Accounts

see moreWith competitive spreads from 0.0*, trade the world's most traded forex pairs at minimum cost.

*Other fees may be applicable -

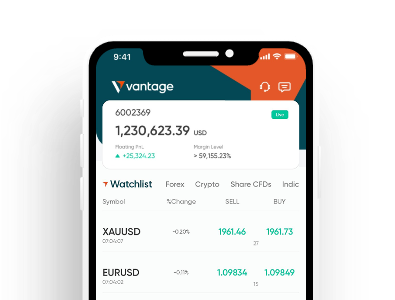

Trade On The Go

see moreBuy and sell anytime. React swiftly to news on our trading platform and mobile app.

-

Low & Transparent Costs

see moreStart trading with $0 deposit fees* with no hidden fees.

*Other fees may be applicable -

Free Educational Material

see moreEquip yourself with HK shares trading knowledge through free educational materials on our academy.

-

Trade Bull & Bear Markets

see moreFlexibility to trade in both rising and falling HK shares markets.

-

Risk Management Tools

see moreVantage offers negative balance protection, price alerts and stop loss tools.

-

MT4 & MT5 Account

see moreGet access to HK shares markets with powerful MetaTrader 4 and MetaTrader 5 trading platforms.

How Does UK Shares Trading Work with Vantage?

-

1

Choose the trading account type that best aligns with your trading style

-

2

Open your trading account

-

3

Allocate funds to your newly created account

-

4

Analyse the shares markets to identify the trading opportunity among the various products available

-

5

Purchase the shares and monitor them

-

6

When the time is right, sell your shares to complete the trade

POPULAR HK SHARES SPECIFICATION

|

Instrument |

Buy |

Change |

% |

TRADE |

|---|---|---|---|---|

|

MENGNIU HKEx-2319-MENGNIU DAIRY |

-

- (-) |

- |

- |

TRADE |

|

ICBC HKEx-1398-ICBC |

-

- (-) |

- |

- |

TRADE |

|

HKEX HKEx-388-HKEX |

-

- (-) |

- |

- |

TRADE |

|

TENCENT HKEx-700-TENCENT |

-

- (-) |

- |

- |

TRADE |

|

PINGAN HKEx-2318-PING AN |

-

- (-) |

- |

- |

TRADE |

|

OVERSEAS HKEx-688-CHINA OVERSEAS |

-

- (-) |

- |

- |

TRADE |

|

CMBANK HKEx-3968-CM BANK |

-

- (-) |

- |

- |

TRADE |

|

CSPCPHARMA HKEx-1093-CSPC PHARMA |

-

- (-) |

- |

- |

TRADE |

|

UNICOM HKEx-762-CHINA UNICOM |

-

- (-) |

- |

- |

TRADE |

|

CHINALIFE HKEx-2628-CHINA LIFE |

-

- (-) |

- |

- |

TRADE |

-

Best CFD

Broker GlobalGrand Brands Magazine

-

Best Trade

ExecutionGlobal Forex Awards

-

Best Professional

Trading PlatformProfessional Trader Awards

TRADING ACCOUNTS

-

1

Novice

-

2

Experienced

-

3

Professional

-

1

Register

Quick and easy account

opening process. -

2

Fund

Fund your trading account

with an extensive choice of

deposit methods. -

3

Trade

Trade with spreads starting as

low as 0.0* and gain access

to over 1,000+ CFD

instruments.

*Other fees may be applicable

FREQUENTLY ASKED QUESTIONS

-

1

How to trade Hong Kong shares in the HK?

You can start trading HK shares by setting up a trading account with Vantage. Then, fund your account using our range of convenient funding methods, all available without any deposit fees. Next, select your preferred HK shares and open a position. When you feel the time is right, close the position to complete your trade. If you're completely new to trading shares, you can tap on our library of free educational materials to better understand the product and trading strategies. -

2

What is the minimum lot in HK stocks?

In the Hong Kong stock market, the concept of a 'lot' refers to the standard number of shares set for trading a particular stock. This number can vary significantly from one stock to another. For instance, some stocks might have a minimum lot size of 100 shares, while others might have different requirements. When it comes to trading Hong Kong stocks with Vantage, it's possible to start trading with a much smaller amount compared to traditional lot sizes. You can begin trading with as little as 0.01 lot, which can amount to as low as 50 HKD or 0.25% of the transaction value per trade, whichever is greater. -

3

What is HK 50?

The Hong Kong 50 Index, also known as HK50, is a benchmark stock market index comprising the top 50 companies listed on the Hong Kong Stock Exchange. This index is widely regarded as a barometer of the Hong Kong stock market and is comparable to other major indices such as the S&P 500 in the United States or the FTSE 100 in the United Kingdom. -

4

Is it good to trade in Hong Kong stocks?

Trading HK stocks comes with both benefits and risks that should be carefully considered. Understanding the nature of the stock market and the various factors that can cause values to fluctuate is important. It's recommended to thoroughly research your trading options and possibly seek advice from a financial advisor or professional before engaging in HK stock trading. You can also visit our library of free educational materials and articles to help improve your understanding before you begin trading stocks. -

5

What is the major stock market index in Hong Kong?

The major stock market index in Hong Kong is the Hang Seng Index (HSI). It is a market capitalisation-weighted index that tracks the performance of the largest and most liquid companies listed on the Hong Kong Stock Exchange. The HSI is widely recognised as the primary indicator of the overall market performance in Hong Kong.