The U.S. Presidential Elections are among the most closely watched geopolitical events by investors. Afterall, the potential for stock market upheavals depending on who becomes the next President of the world’s largest economy cannot be underestimated.

While who comes to power in the White House can impact the stock markets, a look back at historical data revealed these tend to be more palpable over the long term. Importantly, it was found that policy changes, rather than any particular candidate, elicited the greater response in affected sectors [1].

Furthermore, greater economic and inflation trends – more so than election outcomes – had tended to have a stronger, more consistent relationship with market returns.

Hence, the average investor should maintain a pragmatic approach and not overly commit to a position or strategy based solely on which candidate they expect to win.

With that rule of thumb in mind, let’s take a closer look at how U.S. markets react in the wake of the presidential elections, and which sectors (if any) are more sensitive.

Key Points

- Historical data shows that stock market performance in U.S. election years typically reflects broader economic conditions rather than the election outcome itself.

- Presidential policies can influence market dynamics, but their actual effects are often moderated by the actions of Congress.

- Investors are advised to maintain a long-term investment strategy during election years, focusing less on short-term uncertainties related to election results.

Statistical Analysis of Market Performance in Election Years [2]

Let’s start by taking a look at historic statistical data on stock market performance during election years.

According to data by Fidelity, since 1950, the S&P 500 have managed average returns of 9.1% during election years. Given that U.S. stocks have historically risen over the long term, this finding isn’t anything out of the ordinary.

There are a couple of nuances to understand here. Firstly, some investors may take this statistic as proof that the party in power tries to ramp up the U.S. economy as a means to secure votes. However, worldwide economic data suggests that such tactics are more effective in developing countries; in an advanced economy like the U.S., politically driven economic cycles are less relevant.

Secondly, and perhaps more importantly, it should be noted that the market sees larger swings during election years.

As shown in the screenshot above, note that the S&P 500 can range between negative-40% to positive 30% during Year 4 of the election, which is significantly more volatile than other years. In contrast, the year immediately before election year, the S&P 500 has shown the best performance, with 14.7% average returns, and a volatility range of negative 10% to positive 30%.

Another interesting fact to note from historical data is this: The markets are non–partisan, and which party is in power generally does not matter.

Have a look at the following chart, which shows the average annual performance of the S&P 500 based on the balance of power in the White House.

Historically, the U.S. market performs the best with a divided Congress. This is true whether with a Democratic or Republican president.

Which Sectors Shine During U.S. Election Years?

As different administrations come into power, policy changes are implemented that can impact various sectors. This naturally leads to the question of which sectors may benefit during election years.

For instance, despite strong regulatory headwinds, interest in cryptocurrency remains high among U.S. investors. This was clearly demonstrated when Bitcoin ETFs were officially launched on Jan 11 – US$4.6 billion worth of shares changed hands on the first day of trading [3]. Also, the price of Bitcoin has surged by nearly 25% since the launch of the ETFs [4].

Given these developments, it’s logical to conclude that should the coming administration decide to adopt crypto-friendly policies, the price of Bitcoin would likely embark on a bull rally.

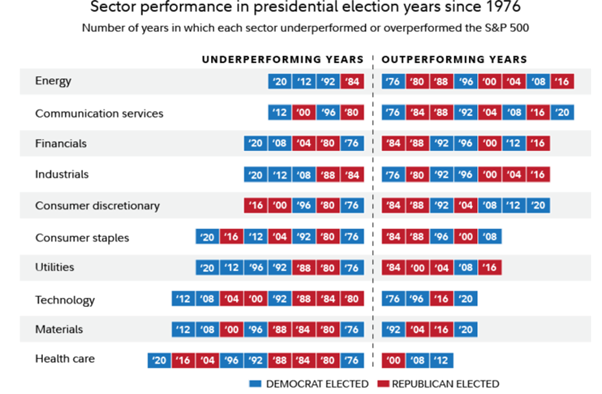

As in many instances, cryptocurrency may once again be the outlier here. Historical data of other, more established sectors show no correlations between performance and election years, as visualised in the following graphic:

Based on data stretching back to 1976, different sectors all have had their fair share of under- or over-performing the S&P 500. This was independent of whether the President was a Democrat or a Republican.

The key takeaway here is that investors should be careful not to take too large bets on sectoral plays based solely on the candidates running for pole position. Investors should recognise the difficulty of predicting how high-level policy decisions may play out in the markets.

Also, as our cryptocurrency example demonstrates, it is the tone and tenor of policy changes that may be more impactful, compared to the views or stances espoused by politicians running for office.

Presidential Policies and Market Dynamics – Trump vs Harris [5]

The reset button has been hit for the presidential race as President Joe Biden announced his withdrawal on 21 July, endorsing Vice-President Kamala Harris as his successor.

What does this mean for the markets?

By now, it should be clear that macroeconomic factors, rather than election results, are the main drivers of the stock market, even during election years.

As it turns out, the effectiveness of presidential policies are much dependent on Congress, which has the power to alter or even outright block policy proposals submitted by the president’s administration.

And with control of Congress expected to remain divided in this upcoming election, it is likely that both candidates would see core policy proposals watered down significantly, most notably on tax reform, public spending and investment.

With Harris as the Democratic nominee just four months before the election, it is anticipated that she will primarily follow President Biden’s economic agenda on key issues including taxes, trade, and immigration.

Still, it is worthwhile understanding each party’s key policy implications, especially given the stark differences in approach between both sides.

Monetary Policy [6,7]

The last two elections had clear impacts on the strength of the US Dollar, as shown:

When Trump won the race in 2016, the US Dollar strengthened, but an opposite effect was seen when Biden came into power in 2020.

Of course, a strong (or weak) Dollar isn’t inherently good or bad. When the Dollar strengthens, domestic exporters become less competitive on the global stage, as the price of U.S. goods and services become more expensive to overseas buyers. American companies operating overseas also suffer from exchange rate depreciation.

On the positive side, a strong Dollar benefits tourists. And because imported goods become cheaper, a strong Dollar can also lower inflation. Clearly, currency strength is a complex issue and should be taken in conjunction with other key economic data.

Nonetheless, it is interesting to see the real-world impact that can be wrought by different policies. Notably, the U.S. Dollar’s rise in strength was thought to be partly fuelled by the trade tariffs that Trump imposed on China during his presidency. This helped the Dollar rise almost 5% against other major currencies. Tellingly, the increase receded over time, marking a knee-jerk reaction from the market.

Implications for 2024 U.S. Election

To help strengthen the American economy, Trump has vowed to impose a flat 10% tariff on all international imports – and raise tariffs on Chinese imports to 60%. If he wins the election, higher tariffs are likely, which will impact importers and could further boost the Dollar.

Biden has maintained Trump’s tariffs on 10% of U.S. imports, including numerous goods from China. Additionally, he recently implemented targeted tariff increases on Chinese electric vehicles and solar panels.

If elected, Harris is expected to uphold these existing import tariffs. Investors can look forward to a smaller reaction on the currency markets as a result.

Industrial and Trade Policy

Rebuilding industrial capacity is a top priority for both candidates, as is continued trade protectionism. However, Harris and Trump would deploy significantly different approaches.

Biden’s administration has already put several measures in place, including the Inflation Reduction Act (IRA), the CHIPS and Science Act, and the infrastructure bill passed in 2021. If Harris wins the election, she is likely to continue delivering on these initiatives, while increasing investments in clean technology and climate transition.

Meanwhile, Trump aims to undo some of these measures, including repealing the IRA’s clean industry tax credits. He is also expected to chip away at funding for conservation, forestry, building efficiency, and other Department of Energy grants and loans. Furthermore, As President, Trump may initiate executive action to free up currently protected federal land for drilling, while imposing new tax incentives for domestic oil and gas production.

As for trade policy, Harris is likely to continue Biden’s approach, emphasising climate change initiatives and scrutinising anticompetitive practices by large corporations.

During her Senate tenure, Harris voted against the United States-Mexico-Canada Agreement (USMCA), citing climate concerns. Similarly, she opposed the Trans-Pacific Partnership (TPP) in 2016 for related environmental reasons.

This could suggest Harris’ priority on environmental and climate concerns over trade deals.

Trump’s proposal to increase trade tariffs would inflame tensions with major trade partners, leading to disrupted trade and near-term uncertainty.

Foreign Policy [8]

Economic rivalry with China is expected to be the main focus of U.S. foreign policy no matter who wins the presidency.

Leaving Trump’s trade tariffs largely in place, the Biden administration has pivoted to non-trade barriers, such as restrictions on investments deemed sensitive to national security concerns, and export bans on advanced semiconductor chips to China.

As relations continue to deteriorate between the two superpowers, the scope of restrictions could expand to include electric vehicles, potentially affecting manufacturers such as Tesla, renewable energy, and even imposing blanket bans on Chinese investments in sensitive industries.

In most areas, Harris is expected to maintain many of Biden’s foreign policy objectives regarding Ukraine, China, and Iran, while potentially adopting a firmer stance on Israel concerning the Gaza conflict.

To the extent that such measures prove effective, Trump could be inspired to continue with them if he wins the election.

Growing rivalry notwithstanding, neither administration is expected to take things much further, given the risk to the global economy should trade completely break down between the two countries.

Public Health Policy [9,10]

During his stint as President in 2016, Trump famously worked hard to repeal the Affordable Care Act (ACA). Although he failed, he nevertheless succeeded in pulling back federal funding for the programme, causing falling enrolments.

When he took office, Biden revived the ACA by restoring federal funding – by some accounts, increasing funding by 10-fold. His position on the ACA is clear – Biden has pledged a further US$500 million over the next five years to continue supporting the public health insurance scheme.

If Trump wins the election, it is unclear if he would continue his efforts to dismantle the ACA, a continued hot-button topic among Republicans. However, given his past policies and actions, it is expected that Trump would adopt a deregulatory approach to health insurance.

On the issue of high drug prices, Biden’s Inflation Reduction Act includes a breakthrough provision for Medicare to negotiate the prices of costly prescription drugs, which is expected to bring significant benefits to patients. Furthermore, Biden has also capped out-of-pocket costs for medical drugs required by people on Medicare.

In contrast, Trump tried to lower drug costs by allowing drug importation from countries with cheaper drugs. This policy has not seen widespread success, due to the reluctance of other countries to share their drug supply with the U.S.

It is not known what policies or actions Trump would continue to pursue should he be re-elected in November. However, it seems likely that his administration will seek to repeal Medicare price negotiation, which is viewed as a form of government price control.

Harris is expected to take a strong position in support of abortion access compared to Biden, contrasting sharply with former President Donald Trump, who has openly opposed it.

It is essential to understand that public health policy is highly complicated in the U.S., and investors seeking to decipher the potential impact of policy changes brought by either candidate would benefit from more in-depth research on the topic.

Navigating the 2024 Stock Market

Before Biden’s withdrawal announcement, polls favoured Trump’s victory in this year’s presidential election, prompting investors to shift towards assets and stocks expected to perform well under a Republican White administration, such as cryptocurrencies and energy stocks [11].

The introduction of a new Democratic presidential candidate could lead to a closer race than previously anticipated, potentially increasing volatility in US markets as investors attempt to assess which party and their economic policies will win in November.

Before we close this article, it might be helpful to address three common stock market myths during election years that investors seem to believe.

Myth 1: The Stock Market Performs Badly in Election Years

As we’ve discussed earlier, historical data thoroughly debunks this myth. Recall that the S&P 500 returned an average 9.1% during election years, which is close to long-term yearly average of 9.95% [12].

What investors should take note of, however, is the increased volatility in the stock market during election years. Historically, the S&P 500 has shown returns ranging from an increase of 25.77% in 1980 to a decrease of 38.49% in 2008 [13].

The increased volatility is correlated to the level of uncertainty, leading to hedging actions among investors, including temporarily cashing out of the market, and buying back in after more policy clarity becomes available. Traditionally, after polling results are announced and the uncertainty dissipates, stocks have tended to rally.

Myth 2: Markets will go Down if (a particular candidate) Wins

In reality, the U.S. stock market reacts more strongly to macroeconomic conditions rather than who wins the election. While surprise results can inspire a market upheaval, this tends to be short-term in nature, and the market corrects itself soon after.

Some notable examples include the 2020 elections, during which the markets fell due to COVID lockdowns, rather than Biden’s win. The same can be seen during 2008, in which the subprime mortgage crisis was already underway when Obama took office.

Myth 3: There won’t be Federal Reserve Policy Changes During Election Years [14]

The fact is the US Fed Chair has never shied away from making changes deemed necessary even during an election year. This further reinforces the idea that the U.S. stock market tends to respond to macroeconomic conditions rather than who becomes President.

Here’s a chart detailing all the rate changes implemented by the U.S. Fed during election years:

As you can see, interest rate cuts or hikes have been carried out when they were needed, even during election years.

In particular, note the 4% hike in 1980, spiking the effective federal funds rate from 14% to between 19% and 20% within the year. This was implemented to bring down inflation, which had soared to a record 14.6%.

Conclusion: Keep a Steady Hand During the U.S. Elections

After understanding how the U.S. presidential elections impact the stock market, the key takeaway is to maintain a steady approach as the presidential race heats up. Be ready for short-term volatility, but resist the urge to act when uncertainty is high.

Remember, history has shown that it matters far less to the stock markets who end up winning the elections. Rather, it is the overarching macroeconomic climate that counts. It is helpful taking note of policy changes that could impact certain sectors, but high-level changes may not always produce the expected trends in the market.

As you navigate the election season, maintaining a long-term perspective and adhering to strategic approaches is advisable. This mindset can help you stay focused despite the election-related market fluctuations.

Are you ready to harness the potential of the US stock markets? Open a live account with Vantage today and start trading both long and short positions with stock CFDs or index CFDs to take advantage of varying market conditions.

Dive into the market with confidence, supported by our robust trading platform.

References:

- “How presidential elections affect the stock market – U.S. Bank”. https://www.usbank.com/investing/financial-perspectives/market-news/how-presidential-elections-affect-the-stock-market.html. Accessed 15 July 2024.

- “The election and markets: 5 takeaways – Fidelity”. https://www.fidelity.com/learning-center/trading-investing/election-market-impact. Accessed 15 July 2024.

- “US bitcoin ETFs see $4.6 billion in volume in first day of trading – Reuters”. https://www.reuters.com/technology/spot-bitcoin-etfs-start-trading-big-boost-crypto-industry-2024-01-11/. Accessed 15 July 2024.

- “Bitcoin – CoinGecko”. https://www.coingecko.com/en/coins/bitcoin. Accessed 15 July 2024.

- “Biden vs Trump: key policy implications of either presidency – Economist Intelligent, EIU”. https://www.eiu.com/n/biden-vs-trump-key-policy-implications-of-either-presidency/. Accessed 15 July 2024.

- “Election year investing jitters? Considerations that could set you at ease – JP Morgan”. https://privatebank.jpmorgan.com/nam/en/insights/markets-and-investing/ideas-and-insights/election-year-investing-jitters-considerations-that-could-set-you-at-ease. Accessed 15 July 2024.

- “Kamala Harris’ economic policies may largely mirror Biden’s, from taxes to immigration – USA Today”. https://www.usatoday.com/story/money/2024/07/23/kamala-harris-economic-policies/74501488007/. Accessed 24 July 2024.

- “Tougher tone on Israel, steady on NATO: how a Harris foreign policy could look – Reuters”. https://www.reuters.com/world/us/tougher-tone-israel-steady-nato-how-harris-foreign-policy-could-look-2024-07-21/. Accessed 24 July 2024.

- “On health policy, Biden and Trump both have records to run on — and stark contrasts – NPR”. https://www.npr.org/sections/shots-health-news/2024/06/07/nx-s1-4970819/biden-trump-health-insurance-abortion-trans-health-policy-drug-costs. Accessed 15 July 2024.

- “Kamala Harris, once Biden’s voice on abortion, expected to take an outspoken approach to health – CBS News”. https://www.cbsnews.com/news/kamala-harris-campaign-abortion-outspoken-approach-health/. Accessed 24 July 2024.

- “Here’s what investors are saying about Biden dropping out — and what it means for your 401(k) – MoneyWatch”. https://www.cbsnews.com/news/biden-out-kamala-harris-what-it-means-for-economy-trump-trade/. Accessed 24 July 2024.

- “S&P 500 Annual Total Return (I:SP500ATR) – Y Charts”. https://ycharts.com/indicators/sp_500_total_return_annual. Accessed 15 July 2024.

- “S&P 500 and the U.S. Presidential Election – S^P Global”. https://www.spglobal.com/en/research-insights/market-insights/sp-500-and-the-u-s-presidential-election. Accessed 15 July 2024.

- “Fed’s interest rate history: The federal funds rate from 1981 to the present – Bankrate”. https://www.bankrate.com/banking/federal-reserve/history-of-federal-funds-rate/. Accessed 15 July 2024.

The information has been prepared as of the date published and is subject to change thereafter. The information is provided for educational purposes only and doesn't take into account your personal objectives, financial circumstances, or needs. It does not constitute investment advice. We encourage you to seek independent advice if necessary. The information has not been prepared in accordance with legal requirements designed to promote the independence of investment research. No representation or warranty is given as to the accuracy or completeness of any information contained within. This material may contain historical or past performance figures and should not be relied on. Furthermore estimates, forward-looking statements, and forecasts cannot be guaranteed. The information on this site and the products and services offered are not intended for distribution to any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.