CFDs and Spread Bets are complex instruments and come with a high risk of losing money rapidly due to leverage. 70.5% of retail investor accounts lose money when trading CFDs and Spread Bets with this provider. You should consider whether you understand how CFDs and Spread Bets work and whether you can afford to take the high risk of losing your money.

SEARCH

-

AllTradingPlatformsAcademyAnalysisPromotionsAbout

-

Keywords

Popular Search

WHAT ARE EU SHARES?

EU shares represent portions of ownership in companies incorporated and operating within the member countries of the European Union (EU). Like other shares, these units of ownership collectively form what's commonly known as stocks.

The process of buying and selling these shares is referred to as stock trading. Through this activity, traders can venture into some of the most dynamic and prominent markets in Europe, trading stocks from pioneering companies across various industries such as technology, finance, manufacturing, and more.

Start trading popular UK and European share CFDs including Heineken (HEIA), LVMH (LVMH), Sanofi (SANOFI), L’oreal (OR), BNP Paribas (BNP), and more on Vantage.

WHY TRADE EU SHARES WITH VANTAGE?

-

ACCESSIBILITY TO

see more

POPULAR EU SHARESTrade over 200+ European shares via CFDs on highly liquid global stock exchange markets.

-

Tight Spreads On

see more

Vantage Raw ECN AccountsWith competitive spreads from 0.0*, trade the world's most traded forex pairs at minimum cost.

*Other fees may be applicable -

TRADE

see more

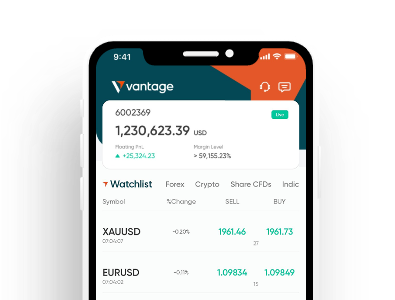

ON THE GOBuy and sell anytime. React swiftly to news on our trading platform and mobile app.

-

LOW & TRANSPARENT

see more

COSTSStart trading with $0 deposit fees* with no hidden fees.

*Other fees may be applicable -

FREE EDUCATIONAL

see more

MATERIALSEquip yourself with EU shares trading knowledge through free educational materials on our academy.

-

Trade Bull & Bear Markets

see moreFlexibility to trade in both rising and falling EU shares markets.

-

Risk Management

see more

ToolsVantage offers negative balance protection, price alerts and stop loss tools.

-

MT5 Account

see moreGet access to EU shares markets with powerful MetaTrader 5 trading platforms.

HOW DOES EU SHARES TRADING WORK WITH VANTAGE?

-

1

Choose the trading account type that best aligns with your trading style

-

2

Open your trading account

-

3

Allocate funds to your newly created account

-

4

Analyse the shares markets to identify the trading opportunity among the various products available

-

5

Purchase the shares and monitor them

-

6

When the time is right, sell your shares to complete the trade

TOP 10 CURRENCY PAIRS

|

Instrument |

Buy |

Change |

% |

TRADE |

|---|---|---|---|---|

|

ASML ASML N.V. |

-

- (-) |

- |

- |

TRADE |

|

OR L'oreal |

-

- (-) |

- |

- |

TRADE |

|

SAP SAP |

-

- (-) |

- |

- |

TRADE |

|

CDI Christian Dior SE |

-

- (-) |

- |

- |

TRADE |

|

PRX Prosus NV |

-

- (-) |

- |

- |

TRADE |

|

SIE Siemens AG |

-

- (-) |

- |

- |

TRADE |

|

UNA Unilever N.V. |

-

- (-) |

- |

- |

TRADE |

|

AIR Airbus Group |

-

- (-) |

- |

- |

TRADE |

|

ITX Ind. De Diseno Textil (Inditex) |

-

- (-) |

- |

- |

TRADE |

|

SU Schneider Electric SE |

-

- (-) |

- |

- |

TRADE |

-

Best CFD

Broker GlobalGrand Brands Magazine

-

Best Trade

ExecutionGlobal Forex Awards

-

Best Professional

Trading PlatformProfessional Trader Awards

TRADING ACCOUNTS

-

1

Novice

-

2

Experienced

-

3

Professional

-

1

Register

Quick and easy account

opening process. -

2

Fund

Fund your trading account

with an extensive choice of

deposit methods. -

3

Trade

Trade with spreads starting as

low as 0.0* and gain access

to over 1,000+ CFD

instruments.

*Other fees may be applicable

FREQUENTLY ASKED QUESTIONS

-

1

How can I trade European stocks?

You can start by setting up a trading account with Vantage. Then, fund your account using our range of convenient funding methods, all available without any deposit fees. Next, select your preferred EU shares and open a position. When you feel the time is right, close the position to complete your trade.

If you’re completely new to trading shares, you can tap on our library of free educational materials to better understand the product and trading strategies. -

2

Is there an EU stock exchange?

Yes, there are several stock exchanges within the European Union (EU). Each member country typically has its own national stock exchange.

Euronext stands out as one of the leading stock exchanges in Europe. It oversees markets in a number of major cities, including Paris, Amsterdam, Brussels, and Lisbon. This makes it a crucial hub for European trading activity.

Germany's trading activities are largely centred around Deutsche Börse, while Italy's main exchange is Borsa Italiana. Each of these exchanges plays a significant role in the broader European economic framework.

It's important to note that while these exchanges operate within the EU, they each have their own rules and regulations for trading. -

3

What is the largest EU stock?

The largest EU stock, as measured by market capitalisation, is currently LVMH (EPA: MC). This stock is listed on the Euronext Paris exchange, one of Europe's leading stock markets.

LVMH, an abbreviation for Moët Hennessy Louis Vuitton, is a distinguished French multinational corporation. It operates as a conglomerate and is globally renowned for its luxury goods.

The origins of the company can be traced back to 1987 when the esteemed fashion brand Louis Vuitton merged with Moët Hennessy. Interestingly, Moët Hennessy itself is the result of a merger in 1971 between two famous entities: Moët & Chandon, a celebrated champagne producer, and Hennessy, a distinguished manufacturer of cognac.

-

4

How many EU markets are there?

There are about 56 stock exchanges in the EU markets. These exchanges are integral parts of the countries' financial infrastructure, supporting trade and investment.

Some of the most notable include the Euronext, Deutsche Börse, and Borsa Italiana. Euronext operates markets in Paris, Amsterdam, Brussels, and Lisbon, thereby extending its reach across multiple countries.

Vantage offers access to a variety of these EU markets, providing a broad spectrum of opportunities for trading. With Vantage, expanding your trading horizons in EU markets has never been easier. -

5

Where can I buy European shares?

You can buy or trade European shares with Vantage. Vantage offers EU shares CFDs with leverage of up to 20:1, allowing you to trade in both long and short positions.

When you begin trading European shares CFDs with Vantage, you can benefit from some of the lowest trading costs in the industry. With commissions as low as €0.01 per trade, traders can save on trading expenses while enjoying unparalleled access to a wide range of Stocks CFDs through the MetaTrader 5 platform.