Nvidia boosts US equity futures amid cautious risk taking

Headlines

* Fitch places US “AAA” on rating watch negative

* FOMC minutes reveal officials were divided over June rate pause

* Dollar ascendant amid resilient US economy, haven demand

* Asian stocks sink on US debt ceiling jitters

FX: USD traded to a fresh two-month high this morning. Again, a lack of progress over raising the US debt limit impacted investors’ risk appetite. The DXY is up above 104 at the time of writing. The 2-year yield printed a fresh cycle high at 4.41%. The 10-year yield is trying to beat the two-month high at 3.76%. It currently trades at 3.75%. Fed officials were divided on the need to raise rates in June, with some ready to pause. Buts market bets are now piling up on a “skip” at the June meeting and another 25bp rate hike in July.

EUR is printing new cycle lows today after it broke short-term support around 1.0760. Next major support is 1.0716. GBP dropped to a seven-week low at 1.2332. The 100-day SMA resides at 1.2283. USD/JPY is making new highs this morning as it heads towards 139 and into overbought territory. AUD closed below strong support around 0.6560/70. It is falling today to levels last seen in early November. NZD plunged through the 200-day SMA at 0.6152 after the dovish RBNZ hike and forecasts. The major fell 2.17% and is down again today through 0.61 and currently the March low at 0.6084.

Stocks: US equities slid as investors continue to fret about the looming debt ceiling deadline. Republican House Speaker McCarthy warned the two sides were “still far apart” on a number of issues. Renewed inflation fears were also to blame for a more muted risk environment. The benchmark S&P 500 closed 0.73% lower with all sectors in the red except energy. The Dow lost 0.77% and the Nasdaq 100 finished down 0.5%. The tech-heavy index is still up some 19% for the year even with the fiscal drama. It is likely to rise further given very bullish sales projections by Nvidia after the close. The data centre revenue rise was led by growing demand for generative AI and large language models using GPUs. Bullish forecasts prompted a rise of nearly 25% in after-hours trading. That would bring the market cap close to the fabled club of trillion-dollar companies.

Asian stocks were mostly lower after Wall Street losses. Fitch placing US AAA sovereign rating on watch negative and ongoing debt ceiling fears continue to hinder risk taking. The Nikkei 225 was kept afloat but the upside was capped. The Hang Seng was pressured after the index slipped below 19,000.

US equity futures are strong on the back of Nvidia’s very strong revenue projections. Nasdaq 100 futures are currently surging over 1.35%. European equity futures are pointing to a lower open (-0.4%). The Euro Stoxx 50 closed down 1.81% yesterday.

Gold fell to the bottom of the recent range. It is clinging onto support around $1959. Lack of progress in the debt talks has driven up yields and supported the dollar which is bad for the precious metal. But the turmoil has seen some support for the safe haven asset. Recession risks linger with the 50-day SMA at $1992 needing to be beaten to resume the uptrend. The 100-day SMA is below at $1934 as support.

Day Ahead – Pound struggles after shocking CPI

Pressure on the Bank of England to hike rates further increased yesterday. The UK’s stubbornly high inflation rate fell by less than expected last month while core, which excludes volatile food and energy costs, and service sector prices surged to a 31-year high. Money markets rushed to price in BoE policy rates rising another 75 bps to 5.25% by September. A June quarter point increase is baked in now.

The pound popped higher initially but then fell. The impact of future interest rate rises will hit UK activity and growth. Stagflation – high inflation and low growth – is being mentioned again. The headline should keep falling as high energy costs drop off due to base effects. Food inflation, which rose above 19% at the fastest rate since 1977, will be the focus, along with services prices.

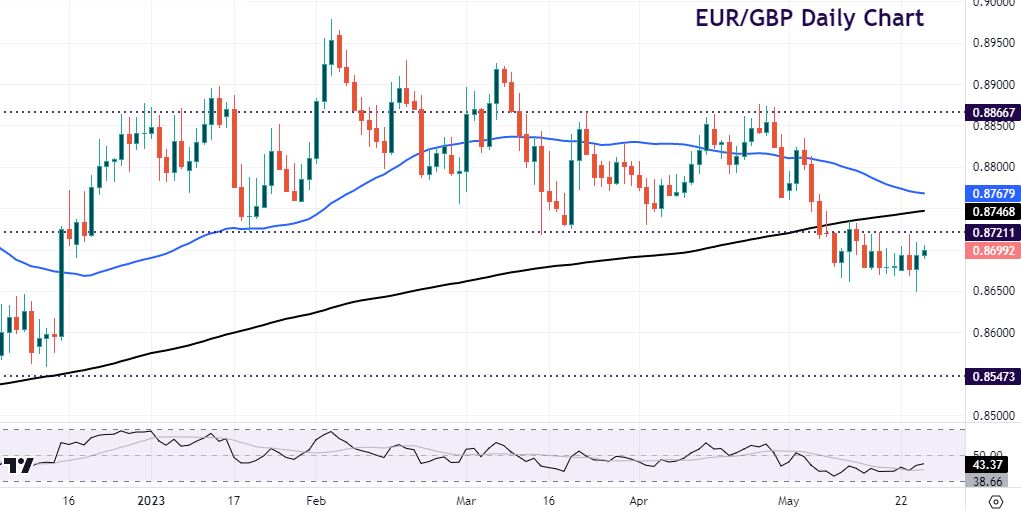

Chart of the Day – EUR/GBP false break?

There are several interesting GBP set-ups at present. GBP/JPY is consolidating near its highs again after the pair dipped down below the April 2022 top at 168.43 earlier this month. The October peak at 172.12 needs to be beaten decisively with a strong weekly close above it. GBP/AUD is also interesting as it breaks higher through 1.88 towards its year-to-date high at 1.9035.

We’ve gone with EUR/GBP as it looked to have broken down after recent sideways trading and th strong CPI report. But yesterday’s low at 0.8648 could now be a false breakdown as buyers try to get back above 0.8721. The 200-day SMA sits above at 0.8745.

The information has been prepared as of the date published and is subject to change thereafter. The information is provided for educational purposes only and doesn't take into account your personal objectives, financial circumstances, or needs. It does not constitute investment advice. We encourage you to seek independent advice if necessary. The information has not been prepared in accordance with legal requirements designed to promote the independence of investment research. No representation or warranty is given as to the accuracy or completeness of any information contained within. This material may contain historical or past performance figures and should not be relied on. Furthermore estimates, forward-looking statements, and forecasts cannot be guaranteed. The information on this site and the products and services offered are not intended for distribution to any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.