CFDs and Spread Bets are complex instruments and come with a high risk of losing money rapidly due to leverage. 67.8% of retail investor accounts lose money when trading CFDs and Spread Bets with this provider. You should consider whether you understand how CFDs and Spread Bets work and whether you can afford to take the high risk of losing your money.

SEARCH

-

AllTradingPlatformsAcademyAnalysisPromotionsAbout

-

Search query too short. Please enter a full word or phrase.

-

Keywords

Popular Search

Markets

Indices

-

What are Indices?

-

Why Trade Indices with Vantage?

-

How Does Indices Trading Work with Vantage?

-

Global Indices Specification

-

Trading Platforms

-

Trading Accounts

-

Frequently Asked Questions

What are Indices?

An index tracks the performance of a group of securities or assets. Indices can be grouped based on factors such as the asset class, industry, market capitalisation, geographical location, and more.

Engaging in index trading through Contracts for Difference (“CFDs”) provides traders with the opportunity to capitalise on the rise or fall of a diverse group of assets.

Trading stock market indices CFDs also offers greater diversification when compared to trading individual shares as stock market indices represent a specific section of the stock market, offering a glimpse into the performance of that sector.

Some of the most traded stock market indices include:

-

DJ30

The Dow Jones Industrial Average measures the value of the 30 biggest blue-chip companies in the US. -

Nasdaq 100

This index includes the 100 largest non-financial companies in the US, and is dominated by tech companies and big names such as Apple and Amazon. -

S&P500

This index comprises the largest 500 companies in the US and is seen as the benchmark for the overall health of the US stock market.

-

1 DJ30

The Dow Jones Industrial Average measures the value of the 30 biggest blue-chip companies in the US.

-

2 Nasdaq 100

This index includes the 100 largest non-financial companies in the US, and is dominated by tech companies and big names such as Apple and Amazon.

-

3 S&P500

This index comprises the largest 500 companies in the US and is seen as the benchmark for the overall health of the US stock market.

Indices also serve as a benchmark to compare individual securities or portfolios, enabling investors to track market trends and make informed decisions.

Why Trade Indices with Vantage?

-

Flexible Lot Sizes

see more

Starting with 0.1 LotDive into the world of indices trading starting with just 0.1 lot. Embrace the adaptability offered by our range of flexible contract sizes, crafted to suit your individual trading style.

-

Tight Spreads on Vantage

see more

Raw ECN AccountWith competitive spreads from 0.0*, trade the world's most traded forex pairs at minimum cost.

*Other fees may be applicable -

Trade

see more

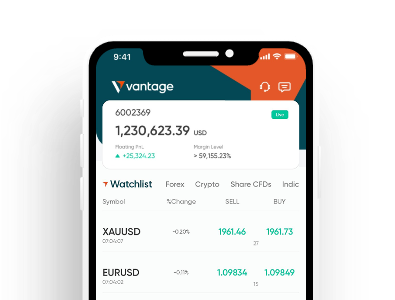

On The GoBuy and sell anytime. React swiftly to news on our trading platform and mobile app.

-

Low & Transparent

see more

CostsStart trading with $0 deposit fees* with no hidden fees.

*Other fees may be applicable -

Free Educational

see more

MaterialEquip yourself with indices trading knowledge through free educational materials on our academy.

-

Trade Bull & Bear

see more

MarketsFlexibility to trade in both rising and falling indices markets.

-

Risk Management

see more

ToolsVantage offers negative balance protection, price alerts and stop loss tools to help you manage your downside risk.

-

MT4 & MT5

see more

AccountGet access to indices markets with powerful MetaTrader 4 and MetaTrader 5 trading platforms.

How Does Indices Trading Work with Vantage?

-

1

Open a live account with Vantage

-

2

Deposit funds to your newly created account

-

3

Analyse the index markets and determine which indices you wish to trade

-

4

Open and monitor your first trading position

-

5

When you think it’s time, close the position to complete the trade

Global Indices Specification

|

Instrument |

Buy/ |

Change |

% |

TRADE |

|---|---|---|---|---|

|

DJ30 Dow Jones Index Cash CFD (USD) |

-

- (-) |

- |

- |

TRADE |

|

DJ30ft DJ30 Future |

-

- (-) |

- |

- |

TRADE |

|

FRA40 France 40 Index |

-

- (-) |

- |

- |

TRADE |

|

UK100 UK100 Index Cash CFD (GBP) |

-

- (-) |

- |

- |

TRADE |

|

GER40 GER40 Index Cash CFD (EUR) |

-

- (-) |

- |

- |

TRADE |

|

HK50 HK50 Future |

-

- (-) |

- |

- |

TRADE |

|

NAS100 NAS100 Cash |

-

- (-) |

- |

- |

TRADE |

|

NAS100ft NAS100 Future |

-

- (-) |

- |

- |

TRADE |

|

SP500 S&P Index Cash CFD (USD) |

-

- (-) |

- |

- |

TRADE |

|

US2000 US Small Cap 2000 |

-

- (-) |

- |

- |

TRADE |

-

Best CFD

Broker GlobalGrand Brands Magazine

-

Best Trade

ExecutionGlobal Forex Awards

-

Best Professional

Trading PlatformProfessional Trader Awards

Trading Accounts

-

1

Register

Quick and easy account

opening process. -

2

Fund

Fund your trading account

with an extensive choice of

deposit methods. -

3

Trade

Trade with spreads starting as

low as 0.0* and gain access

to over 1,000+ CFD

instruments.

*Other fees may be applicable

Frequently Asked Questions

-

1

What is the meaning of indices in trading?

Indices represent the price performance of a segment of stocks from a specific stock market or exchange. For instance, the FTSE 100 follows the top 100 companies listed on the London Stock Exchange. Indices trading offers an opportunity to gain exposure to an industry, a sector, or an entire economy with a single transaction. By trading through CFDs, you can take positions on indices prices going up or down, without the need to own the underlying asset. Indices also provide a highly liquid trading market and their extended trading hours allow for greater access to potential market opportunities. -

2

How do you trade indices?

Indices trading can be conducted through various vehicles such as futures, options contracts, exchange-traded funds (ETFs), or CFDs. After determining the specific stock index you wish to trade, it is essential to establish a clear and effective trading strategy before opening a position. The use of technical and fundamental analysis can assist in pinpointing optimal moments to enter and exit your position. -

3

What are examples of indices in trading?

Here are some of the most popular indices in the world. Many of the top stock market indices in the world include blue chip stocks. Blue chip can be defined as a well-established company with a market cap in the billions and considered a market leader. Dow Jones Industrial Average – DJIA S&P 500 EURO STOXX 50 Nasdaq 100 FTSE 100 DAX 30 CAC 40 Nikkei 225 Hang Seng ASX 200 -

4

Is trading indices better than forex?

Both trading methods have their own advantages and disadvantages, which cater to different traders based on their individual preferences. For example, index trading, with its diversified nature, could be more suitable for beginners and traders who prefer lower risk and longer-term positions. On the other hand, forex trading is known for its fast-paced and more volatile nature, potentially offering higher profitability (or losses) for experienced traders who understand the intricacies of the forex market. Ultimately, the choice among the two depends on your specific circumstances, considering that each approach carries its own set of risks and rewards. -

5

What are the top 3 indices?

The top 3 most followed indices are the Dow Jones Index (DJ30), the l'Nasdaq Composite Index and the S&P 500 Index (SP500)