Sterling sees buyers emerge as USD rally stalls

Headlines

* GBP strengthens on new Northern Ireland protocol deal

* Australian retail sales rebound, keeping pressure on the RBA

* China’s yuan trades around two-month low, focus turns to key 7 mark

* Asian shares edge higher after slight gains on Wall Street

FX: USD made another new high at 105.35 first thing yesterday before turning lower. The index closed at 104.67 which ended four straight days of gains. But the DXY index did post its fourth positive week in a row. This was last seen in May. The benchmark US Treasury 10-year yield is consolidating just below recent highs. 4% is the key level.

EUR snapped its 5-day losing streak. The world’s most traded currency pair closed higher by 0.5% at 1.0607. But it has lost the 1.06 handle this morning. GBP surged by more than 1% to 1.2063. There was much Brexit-related optimism after the UK and EU reached an agreement in principle on Northern Ireland trade. USD/JPY was rangebound between 135.90 and 136.20. The BOJ Deputy Governor nominees reiterated the need to continue monetary easing. AUD now trades just below its 100-day SMA at 0.6733. The aussie was only briefly supported by mostly better-than-expected data. The NZD breakdown through the January low sees that level as resistance now at 0.6191. The 100-day and 200-day SMAs form a zone at 0.6196 and 0.6179.

Stocks: US equities closed off their highs after mixed data releases. US durable goods posted a wider-than-forecast contraction. Pending home sales topped estimates. The benchmark S&P 500 gained +0.31% but remains below 4,000. The Nasdaq 100 was up 0.74%. Modestly lower rates in the US helped the tech-heavy index. Tesla gained 5.46% on reports that its German plant has hit a weekly production level of 4,000 weeks ahead of schedule. The Dow inched up 0.22%.

Asian stocks traded mixed heading into month-end. The Nikkei 225 initially gained after the BoJ nominees continued their dovish line. But mixed data including the biggest monthly decline in industrial production in eight months was a headwind. The Hang Seng failed to sustain an opening bid. This came even on reports that the White House is scaling back plans to regulate US investments in China.

US equity futures are marginally in the red. European equity futures are pointing to a flat open. The Euro Stoxx 50 cash market surged 1.7% higher yesterday.

Gold made a fresh cycle low at $1806 before closing at $1817. Sellers have emerged this morning.

Event Takeaway – Brexit deal gives a GBP a short-term bid

Sterling outperformed yesterday as a deal was announced on the Northern Ireland Protocol. Briefly, this agreement tackles the thorny post-Brexit issue of implementing an EU-border between the Republic of Ireland and Northern Ireland. This could have violated the vital 1998 peace agreement but also needed to keep the UK internal market intact.

Markets took this a positive sign even though it still needs sign off from a crucial unionist Northern Ireland political party (DUP). A deal is a small long-term positive for GBP as it removes the tail risk of a UK-EU trade war. It has given the pound a modest, psychological boost. But going forward, the UK budget on March 15 and the BoE meeting will be key.

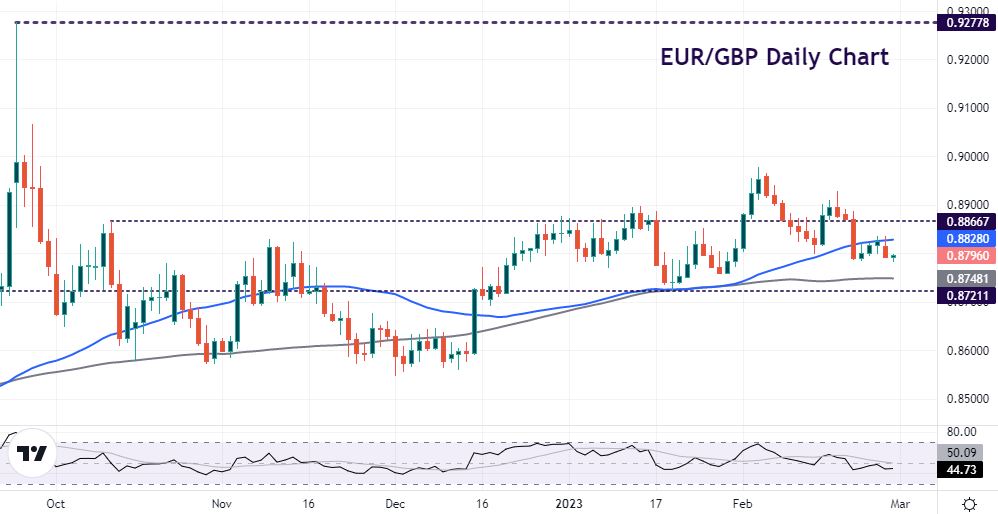

Chart of the Day – EUR/GBP sideways trade

This pair traded lower yesterday as markets bought the pound. An improvement in UK-EU relations probably does little for GBP, save that psychological lift. More important are the central bank settings. The ECB terminal rate has risen close to 4%. That means markets are pricing in a 50bp hike next month. Then another 100bps into the summer. Thursday’s core eurozone inflation data will be the near-term focus. BoE pricing is more modest with another roughly 50bps expected to come.

EUR/GBP is fairly quiet. Prices broke above the October high at 0.8866 at the start of this month. But the pair is back under there and the 50-day SMA at 0.8827. Support comes around the June 2022 high at 0.8721.

The information has been prepared as of the date published and is subject to change thereafter. The information is provided for educational purposes only and doesn't take into account your personal objectives, financial circumstances, or needs. It does not constitute investment advice. We encourage you to seek independent advice if necessary. The information has not been prepared in accordance with legal requirements designed to promote the independence of investment research. No representation or warranty is given as to the accuracy or completeness of any information contained within. This material may contain historical or past performance figures and should not be relied on. Furthermore estimates, forward-looking statements, and forecasts cannot be guaranteed. The information on this site and the products and services offered are not intended for distribution to any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.