Sour sentiment seeps back into markets, oil lower again

Overnight Headlines

*Biden to call on Congress to pass a gas tax holiday

*Asian equity markets slide as recession angst drives tech selling

*Bitcoin sinks again as risk-off mood returns on recession fears

*Yen bruised as Japan’s rates gap widens with the rest of the world

US equities gained with the S&P500 posting its best day since late May. The benchmark index rose 2.4% while the tech-heavy Nasdaq closed 2.5% higher. Energy and consumer sectors were the biggest risers. This move reversed some of the recent losses in recent weeks. But Asian markets are lower as Wall Street optimism peters out. European and US futures are firmly in the red.

USD is gaining this morning after closing very marginally lower. JPY continued its slide versus all the major currencies and was weakest the most against CAD closing down by 1.61%. USD/JPY touched another 24-year cycle top at 136.70, hitting the highest level since October 1998. This morning has seen a bid for safe havens, so the yen is clawing back some of its losses. EUR is moving below 1.05 today while GBP has had a couple of narrow range days above 1.22.

Market Thoughts – Oil breaks down as risk sentiment reverses

Oil prices have resumed their sell-off today. The crude market continues to be driven by external influences reflecting the lack of fundamental catalysts. The more aggressive Fed is not helping, as the taming of inflation without a hard landing may prove challenging. China’s continued lockdown situation is also hurting the demand side currently.

But oil fundamentals remain constructive with the market expected to tighten through the year. The EU’s ban on Russian crude will start to bite soon. There is also noticeable tightness in the refined products market. Inventories are at multi-year lows while there is limited spare capacity generally among producers. A global pick up in travel should provide additional support for crude going forward. Demand from China, the world’s largest importer, is expected to gradually recover through the year.

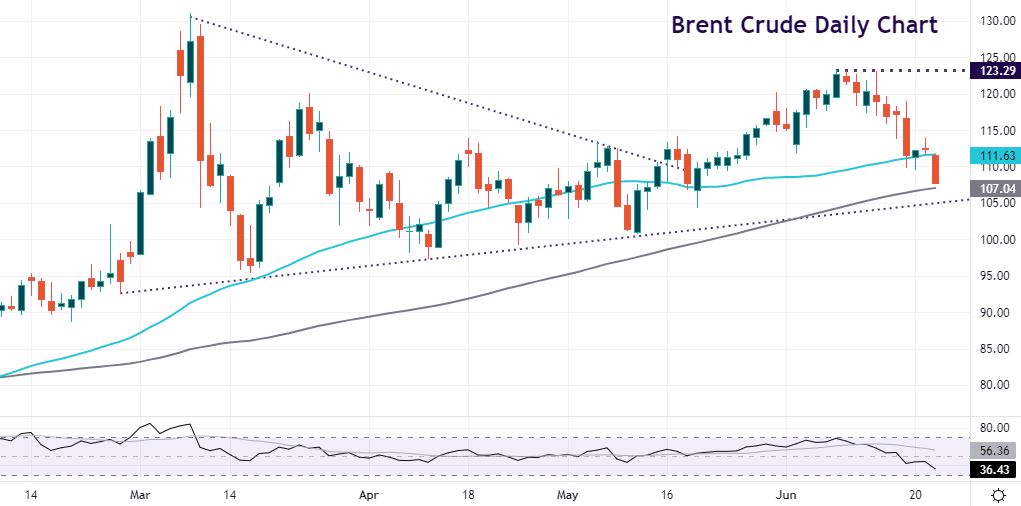

Chart of the Day –Brent moves below 50-day SMA

We highlighted the prospect of Brent crude breaking higher in mid-May. Prices eventually pushed north, getting to a top of $123.29. But buyers couldn’t sustain these gains. Friday’s selling especially was strong with crude losing some 7% on the day.

The 50-day SMA has been acting as support over the last few days. That sits at $111.64 so is now resistance. The 100-day SMA is at $107.04 with trendline support just below. Initial resistance is at $113.87.

The information has been prepared as of the date published and is subject to change thereafter. The information is provided for educational purposes only and doesn't take into account your personal objectives, financial circumstances, or needs. It does not constitute investment advice. We encourage you to seek independent advice if necessary. The information has not been prepared in accordance with legal requirements designed to promote the independence of investment research. No representation or warranty is given as to the accuracy or completeness of any information contained within. This material may contain historical or past performance figures and should not be relied on. Furthermore estimates, forward-looking statements, and forecasts cannot be guaranteed. The information on this site and the products and services offered are not intended for distribution to any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.