Will NFP rebound and price out a 50bps Fed rate cut?

Headlines

* Stocks lacked direction amid mixed US data

* Dollar fell after ADP jobs figures ahead of NFP

* Wall Street ends marginally lower after dovish Fed comments and soft data

* Brent crude was choppy on the OPEC+ announcement, eventually settling flat

FX: USD slid to a one-week low even as ISM services unexpectedly very modestly rose. The weekly initial jobless claims also fell meaning a slightly stronger labour market. The odds of a 25bps September Fed rate cut sit at 61%, versus 39% for a bigger sized half point move.

EUR saw buying for a second day taking the major above 1.11. German Factory Orders rose 2.9% in July, a surprising gain which followed an upwardly revised rise of 4.6% for June. The ECB meeting is next week with another quarter-point cut priced in. A support zone sits around 1.1050.

GBP enjoyed gains after inflation expectations figures in the latest BoE Decision Maker Panel survey remained sticky. Elevated wage growth trends point to caution on more BoE rate cuts. There’s around 44pbs priced in for 2024, contrasting with the 100+ by the Fed. Support is at 1.3087.

USD/JPY saw more selling for a third straight day, though less aggressive, with support/resistance at 143.44. The August spike low sits at 141.68. Japan reported stronger than expected wage gains for July. The 3.6% y/y rise was well ahead of forecasts. This bolstered expectations that the BoJ will push ahead with another mild rate increase and policy normalisation before year end

AUD steadied for a second day, printing an inside day after the rebound on Wednesday in risk assets. USD/CAD did the same with a small range trading day just above 1.35. Canada jobs data is expected to print at 25,600, better than the prior net loss of 2,800 jobs. The unemployment rate is seen one-tenth higher at 6.5%.

US Stocks: Stocks were somewhat directionless following varied US data and ahead of NFP. The S&P 500 gained 0.3% to settle at 5,503. The tech-dominated Nasdaq 100 added 0.05% to finish at 18,930. The Dow closed 0.54% lower at 40,755. Financials, healthcare and industrials underperformed. Tesla was among the best performers, rising 4.9% after the EV maker said it plans to paunch its driver assistance system in China and Europe in the first quarter.

Asian stocks: Futures are mixed. Asian stocks also traded mixed with stock treading water ahead of the main risk event today. The ASX 200 was supported by tech and real estate strength. The Nikkei 225 was choppy around 37,000 amid the stronger yen. The Hang Seng and Shanghai Composite were mixed with bank and real estate gains initially helping the indices.

Gold made solid gains after prices had closed above the mid-July top at $2483 on Wednesday. Yields have been falling recently but all eyes are on NFP. Brent crude traded around levels last seen in mid-December. OPEC+ kicked the can down the very uphill road by delaying the production increase by two months.

Day Ahead –US Non-Farm Payrolls

Headline NFP is expected at 165,000, above the prior 114,000, but below the 3-month average of 170k. The unemployment rate is forecast to fall one-tenth to 4.2%. That had triggered the Sahm rule that suggests whenever the 3-month average of the u/e rate rises by more than 0.5% in a 12-month period, we get a recession. The rate of average hourly earnings growth is expected to pick up to +0.3% M/M in August vs 0.2% in July.

The soft July data sparked fears that the Fed could kick off its rate cutting cycle with a jumbo 50bps move. But given the spike in the number of people forced to work part-time or unable to work at all due to the weather, many economists think that Hurricane Beryl did have a significant impact. They reckon the weather conditions subtracted around 30,000 from the July headline, which should be reversed in August. More broadly, despite some signs of stabilisation, hiring activity has generally weakened, with the ISM and S&P Global indices at pandemic lows and weak service sector data.

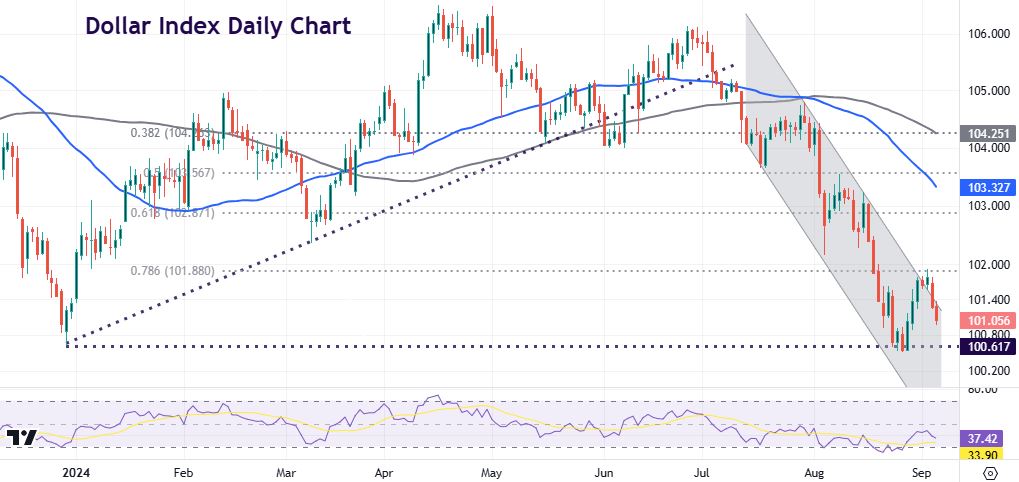

Chart of the Day – USD Index resume downtrend

If we get a sub 100k on payrolls and the unemployment rate ticks up to 4.4% or even 4.5% then 50bps looks more likely given Powell’s recent comment that “we don’t seek or welcome further cooling in labour market conditions”. This should hurt USD while rekindling recession fears. However, if payrolls come in around the 150k mark and unemployment rate stays at 4.3% or dips to 4.2%, as the consensus is currently predicting, a 25bps is much more likely. There’s 110 bps of cuts priced in to the next three meetings.

Last week, the widely followed Dollar Index bounced off a long-term low at The December low of 100.61. Prices rose to the retracement level at 101.88 before turning lower on Wednesday. The long-term descending channel from high in June looks to have stayed intact.

The information has been prepared as of the date published and is subject to change thereafter. The information is provided for educational purposes only and doesn't take into account your personal objectives, financial circumstances, or needs. It does not constitute investment advice. We encourage you to seek independent advice if necessary. The information has not been prepared in accordance with legal requirements designed to promote the independence of investment research. No representation or warranty is given as to the accuracy or completeness of any information contained within. This material may contain historical or past performance figures and should not be relied on. Furthermore estimates, forward-looking statements, and forecasts cannot be guaranteed. The information on this site and the products and services offered are not intended for distribution to any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.