Weekly outlook | Dollar weak, profit-taking in equities

Important events this week:

This trading week is characterized by only few volatile news events. The NASDAQ100 Index and the S&P500 continue to fall, while the Dow Jones was also unable to hold on to its gains. A correction could be imminent here. After initial gains, precious metals were also unable to hold on to their high levels and turned downwards. Gold is now showing potential for a correction on the weekly chart, where a pin bar candle had formed. However, the weak Dollar could limit losses. The key interest rate decision will follow from Canada, which could cause volatility in markets.

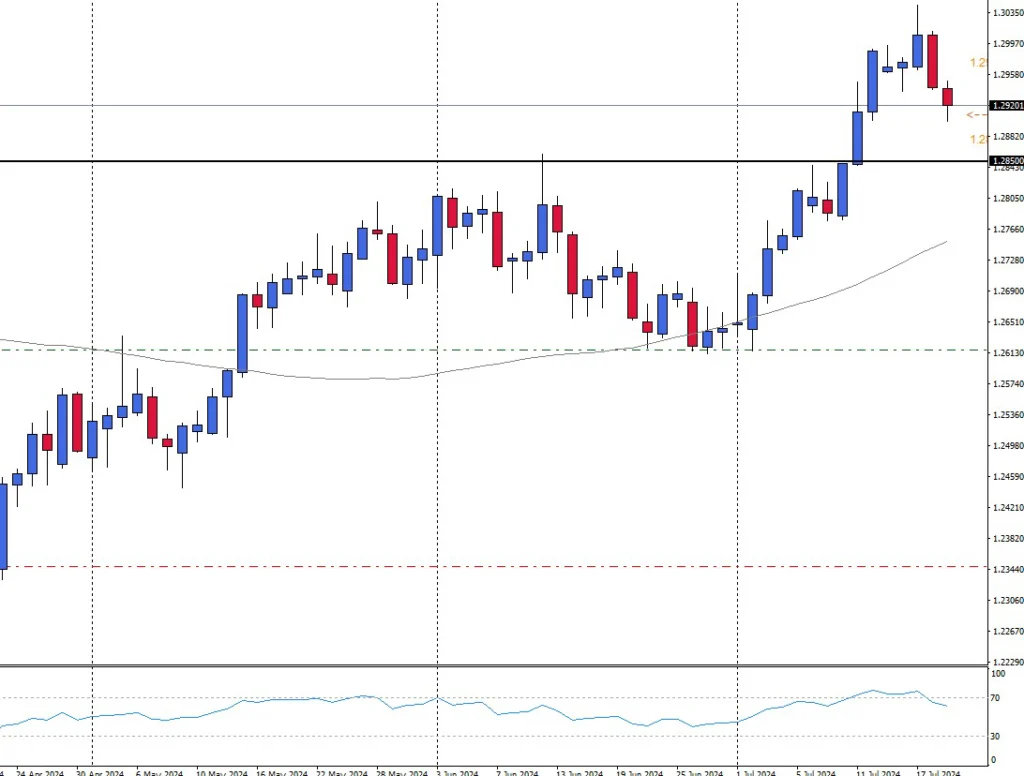

– UK – Purchasing Managers‘ Index – The Purchasing Managers’ Index for services could cause volatility in markets this week. Consumer prices in the UK have recently fallen overall, although data from the services sector remains elevated. This is also reflected in the Purchasing Managers’ Index, which remains stronger than the manufacturing sector, but continues to fall month-on-month.

At the end of the last trading week the GBP was unable to maintain its high level and lost ground, particularly against the USD. The data will be published on Tuesday, 24 July at 10:30 CET.

– CA interest rate decision – No adjustment to the key interest rate decision in Canada is expected this month. Due to last month’s rate cut, the central bank is likely to take time before making further moves. However, the subsequent press conference could move markets. The average consumer price in Canada fell slightly last week, although the figures remain near the 3.0% mark.

The Canadian dollar is very weak against the US Dollar and the EUR. The firm EUR in particular is currently causing problems for the Loonie.

According to the weekly chart, the market was able to rise close to the 1.5000 zones, where there is now strong resistance. There could be slight potential in favor of the CAD for the time being. The interest rate decision will take place on Wednesday, 24 July at 15:45 CET.

– US – PCE Deflator – The important price indicator for the US Federal Reserve continues to fall on a monthly basis. The figure is expected to come in at 0.1% on Friday, which could provide further insight into the central bank’s actions. Although Jerome Powell has so far refused to commit as to whether interest rates will be adjusted, there is currently some evidence in favor of a cut of 25 basis points in September.

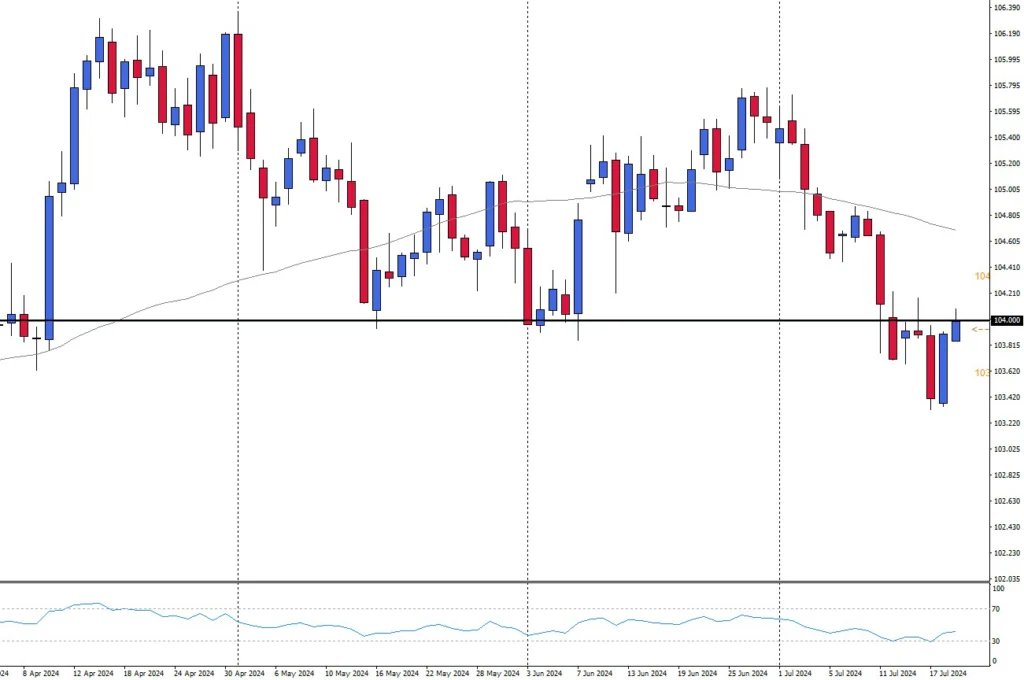

However, the Dollar index, shown above in the daily chart, is currently showing renewed strength. If the current level of 104.00 is broken to the upside, the market could move higher and the Greenback could gain further strength against other currencies. The price index will be published on Friday 26 July at 14:30 CET.

The information has been prepared as of 22nd July 2024 and is subject to change thereafter. The information is provided for educational purposes only and doesn’t take into account your personal objectives, financial circumstances, or needs. It does not constitute investment advice. We encourage you to seek independent advice if necessary. The information has not been prepared in accordance with legal requirements designed to promote the independence of investment research. No representation or warranty is given as to the accuracy or completeness of any information contained within. This material may contain historical or past performance figures and should not be relied on. Furthermore estimates, forward-looking statements, and forecasts cannot be guaranteed. The information on this site and the products and services offered are not intended for distribution to any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

The information has been prepared as of the date published and is subject to change thereafter. The information is provided for educational purposes only and doesn't take into account your personal objectives, financial circumstances, or needs. It does not constitute investment advice. We encourage you to seek independent advice if necessary. The information has not been prepared in accordance with legal requirements designed to promote the independence of investment research. No representation or warranty is given as to the accuracy or completeness of any information contained within. This material may contain historical or past performance figures and should not be relied on. Furthermore estimates, forward-looking statements, and forecasts cannot be guaranteed. The information on this site and the products and services offered are not intended for distribution to any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.