Trading Oil During Volatility

Traders eagerly anticipate periods of market volatility. Market moving events like Central bank monetary policies, exchange regime setting and jobs reports like the NFP all cause volatility and increase trading opportunities. Similarly, political turmoil, natural disasters, and war can also increase the volatility of market conditions. The latter is especially true when we refer to gold prices and oil.

Traders can benefit from volatile oil prices by using a variety of strategies, including trading derivative instruments such as contracts for difference (CFDs). Crude oil trading offers excellent opportunities due to its pivotal standing within the world’s economic and political infrastructure. In this article we will look at trading oil during a volatile market. We will also dig into the Ukraine – Russia conflict and how it is impacting oil prices and creating volatility. And, ultimately what traders should watch out for when trading oil during volatility.

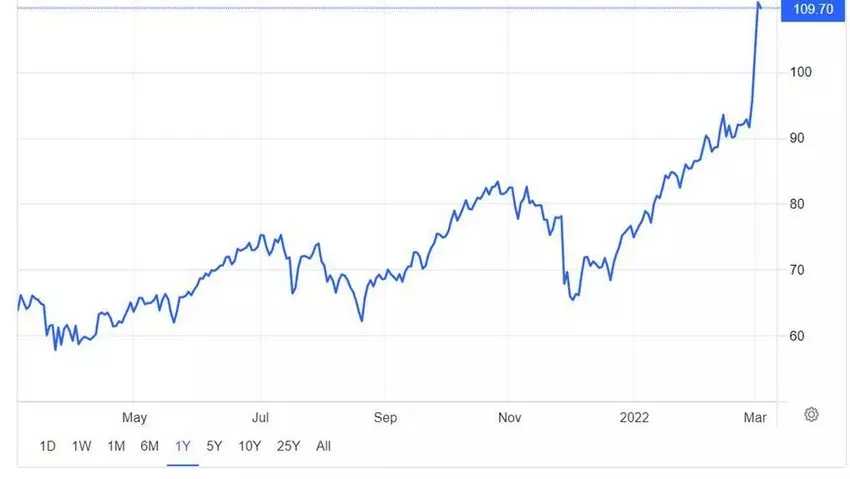

Oil Volatility During The Ukraine/ Russia Conflicts

When Russia launched its invasion of Ukraine on February 24, 2022, oil prices were already trading close to $110 per barrel. The ensuing Russia-Ukraine war put more pressure on an infrastructure that was already coping with a sudden rise in demand and high prices. The US and Europe responded to the Russian invasion by slapping sanctions on Moscow, including its oil exports.

Source: Trading Economics

To ease the pressure on oil prices, OECD members decided to release 60 million barrels of oil on March 4, which would be 12 days’ worth of Russian oil exports. But oil prices shot up, with Brent Crude crossing the $140 mark on March 7, its highest since 2008.

Oil prices have continued to see unprecedented volatility since then with intraday swings of close to $10 not being uncommon. Prices have come down since the highs of early March but only slightly. On March 23, WTI Crude Oil was trading at $110, while Brent was at $116.3.

How Would a Ceasefire Impact Prices?

Let’s imagine what would happen to oil prices if Russia and Ukraine negotiated a ceasefire deal. We had a glimpse when Russia said a deal was close to being agreed upon with Ukraine. On March 16, 2022, Brent Crude fell 1.9% to trade in the range of $97.55 to $103.70 before settling at $98.02. WTI Crude Oil ended the day down 1.5% to $95.04.

Source: Bloomberg

This reveals that sentiment has a much larger impact on oil prices than actual demand and supply metrics. Geopolitics, economic recovery or lack thereof, and other global developments need to be closely followed for informed trading decisions. That’s why experienced traders favour both technical and fundamental analysis while making entry and exit decisions, along with keeping track of market news and analysis. They also favour risk management measures, such as stop-loss, before entering trades.

This is especially important during periods of volatility. Oil prices have seen unparalleled volatility in the first quarter of 2022. Analysts caution that this volatility is unlikely to vanish anytime soon, even if the Russia-Ukraine conflict is resolved. Therefore, it is important to choose your trading instruments and strategy carefully.

Oil Price Volatility And How To Trade It

Price volatility is a good thing for traders. It throws up multiple trading opportunities. The only caveat is that you predict the direction of price movement correctly. For this, you first need to know how to measure the level of volatility.

Volatility is the expected change in the price of an asset, in either direction. For instance, if oil is trading at $100 and the volatility is at 15%, it means that the price will move up or down by 15% over the next 12 months. This means that within a year, oil prices are expected to move from $100 to $115 or $85.

Now, current volatility could be higher or lower than the historical average. If the current volatility is higher than the historical figure, volatility is expected to rise going forward. Similarly, when volatility is lower than the historical level, traders expect a decline in volatility in the future.

One of the most popular ways to trade oil, especially during periods of volatility, is via Contracts for Difference (CFDs).

Open An Account Now to Trade Oil

Why Trade Oil Via CFDs?

Firstly, crude oil is undoubtedly the most traded commodity globally, despite oil prices being volatile in general. Oil CFDs have emerged as one of the most commonly used instruments to trade the commodity. CFDs are a type of derivatives instrument that allow you to trade the price movements of an asset without actually buying or taking ownership of it.

It is essentially a contract between two parties speculating on the future price of an asset. If your prediction pans out at the time the contract is closed, you are paid the difference in price between the opening date of the contract and its closing date. If the market moves unfavourably, you will need to pay the difference to the opposite party.

The biggest advantage of trading CFDs is that you have the opportunity to make money on both rising and falling prices. Plus, you get to trade with leverage. This means you can open a position by putting in only a fraction of the capital required for the total trade value. This allows you to exponentially increase your exposure to the markets.

Understand Leverage First

Remember though, that when you trade with leverage, regardless of whether you speculate on oil or gold prices, both profits and losses can be magnified. So, risk management is crucial while trading CFDs. Learn more about leverage and risk management in our education centre.

Looking to trade oil price volatility? Open a trading account with us today.

The information has been prepared as of the date published and is subject to change thereafter. The information is provided for educational purposes only and doesn't take into account your personal objectives, financial circumstances, or needs. It does not constitute investment advice. We encourage you to seek independent advice if necessary. The information has not been prepared in accordance with legal requirements designed to promote the independence of investment research. No representation or warranty is given as to the accuracy or completeness of any information contained within. This material may contain historical or past performance figures and should not be relied on. Furthermore estimates, forward-looking statements, and forecasts cannot be guaranteed. The information on this site and the products and services offered are not intended for distribution to any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.