Stocks post more all-time highs, USD continues north

* S&P 500, Dow close at fresh record peaks on tech buying

* US dollar climbs to 10-week peak, euro and China’s yuan fall

* China may issue CNY6 trillion in Treasury bonds to buttress economy

* OPEC cuts global oil demand growth forecasts for third consecutive month

FX: USD pushed higher to start the week for a fourth straight session. There have actually only been two very marginal down days in the eleven sessions going back to the cycle low in late September. The 100-day SMA sits at 103.23. Hawkish comments from Fed officials helped the dollar as they favoured a slow pace to rate cuts.

EUR slipped to a nine-week low at 1.0887 ahead of this Thursday’s ECB meeting. Markets see a back-to-back 25bps rate cut as a given, and also at the final meeting this year in December. The 200-day SMA is at 1.0873.

GBP outperformed its peers and closed only very marginally lower on the day versus the buck. There is strong support around 1.30. It’s a heavy UK data week with jobs, CPI and retail sales released, starting with all-important wage growth figures today. The next BoE meeting is at the start of November – the same day as the FOMC meeting.

USD/JPY edged higher as the yen hit a 10-week low. A big long-term retracement Fib level sits at 148.68. Above here is the 200-day SMA at 151.11 and 100-day SMA at 151.19. The key long-term highs from intervention in previous 2022 and 2023 Octobers sits at 151.94. The US 10-year Treasury yield continues to edge higher.

AUD traded mixed but pulled back from its intraday lows. Job figures are released on Thursday. The 10-day SMA is at 0.6692. USD/CAD moved north for a ninth day in a row. That was last seen in late July. Prices have moved beyond the 61.8% retracement Fib level of the August sell-off at 1.3745. The April high sits at 1.3846 with the August spike top at 1.3946.

US Stocks made more fresh record highs with tech leading the way. The S&P 500 closed 0.77% higher to settle at 5,859. The tech-dominated Nasdaq 100 added 0.82% to finish at 20,439. The Dow settled up 0.47% at 43,065. Investors await more Q3 corporate earnings including Goldman Sachs, Bank of America and Citigroup, as well as healthcare giants Johnson & Johnson and UnitedHealth Group, before the US open. Morgan Stanley and Netflix publish their results on Thursday ET. Last week’s positive start in some of the major financial institutions buoyed Wall Street. Tech outperformed on Monday with the semiconductor index jumping to a more than two-month high.

Asian stocks: Futures are in the green. Asian stocks traded higher after the positive Wall Street handover. But the upside was limited by the lack of China stimulus details and soft Chinese inflation data. The ASX 200 was helped by strength in mining stocks. The Nikkei 225 was closed for a holiday. The Hang Seng and Shanghai Composite both traded mixed with the latter hit by those lack of stimulus details, though there were some support pledges by government areas. The Hang Seng suffered from tech and consumer stocks weakness.

Gold moved up above the 21-day SMA at $2631 on Friday but had a relatively quiet day to kick off the week. US bond markets were closed for the Columbus holiday.

Day Ahead – UK Jobs, Canada CPI

UK jobs data is likely to show that wage growth, the key metric for the MPC, has softened further to 3.8% on the back of a loosening labour market. The ex-bonus figure is expected to slip below 5% to 4.9%. Headline rates may tick up in the coming months due to public sector pay deals and base effects, but rate setters will have their eyes on private sector regular pay momentum, which should continue to decline. The deceptively low headline unemployment rate is forecast to remain at 4.1%.

Canada reports CPI figures for September later today. It will be the last major data release ahead of next week’s BoC policy decision. At present, markets are on the fence over whether policymakers will cut by 25bps or 50bps at the October 23rd meeting. Consensus is somewhat divided on the magnitude of the reduction. That is because the job market remains strong while consumer and business surveys of inflation expectations have improved but remain too high on balance. The CPI report will be used to finalise the call with the preferred trimmed mean and weighted median gauges most important.

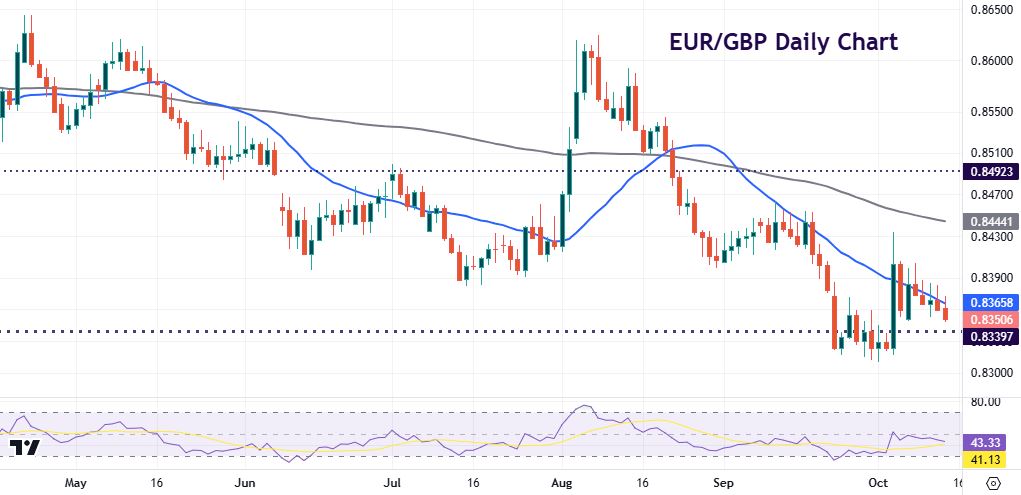

Chart of the Day – EUR/GBP nearing big support

It’s the middle of the month so we typically get a slew of important UK data. This is especially the case this week, as it’s the last time the MPC receives these latest figures. With the ECB meeting on Thursday, EUR/GBP will be in the crosshairs.

The long-term low from August 2022 at 0.8339 has acted as strong support already in recent weeks. But prices are closing in on this once more after the cross spiked higher above 0.8430 at the start of the month. If we do lose the October low at 0.8310, next downside levels are 0.8294 and then 0.8202. We are likely to need much hotter data or a more dovish ECB to decisively break the recent lows. A big rebound, possibly on a less dovish ECB and softer UK data, needs to move above 0.8433 and the 100-day SMA at 0.8444 to slow the downtrend.

The information has been prepared as of the date published and is subject to change thereafter. The information is provided for educational purposes only and doesn't take into account your personal objectives, financial circumstances, or needs. It does not constitute investment advice. We encourage you to seek independent advice if necessary. The information has not been prepared in accordance with legal requirements designed to promote the independence of investment research. No representation or warranty is given as to the accuracy or completeness of any information contained within. This material may contain historical or past performance figures and should not be relied on. Furthermore estimates, forward-looking statements, and forecasts cannot be guaranteed. The information on this site and the products and services offered are not intended for distribution to any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.