Powell’s cautious on cuts comments still see new stock highs

* Fed’s Powell says can afford to be ‘more cautious’ about easing policy

* Dollar steady after Powell remarks, US economic news

* S&P 500 and Nasdaq hit fresh highs, markets await Friday’s NFP report

* Gold finds a small bid but still waiting to break out

FX: USD edged higher initially before the poor ISM Services data hit the greenback. The headline number printed at 52.1 against an expected 55.7 and 56.0 prior print. Fed Chair Powell’s comments didn’t move markets much. But they offered some support to the greenback. The April top is at 106.51 currently capping the upside.

EUR steadied, with prices printing a doji candle. The long-term support level at 1.0448 remains intact. Attention remains on France amid major political uncertainty. A more steady euro and stable French assets suggests investors could be less concerned by the risks. President Macron also helped ease the jitters.

GBP found buyers during a relatively quiet UK news week. PMIs were revised marginally higher. BoE Governor Bailey commented that four rate cuts next year remained his base case. Cable sold off briefly before paring losses.

USD/JPY picked up as the yen slid on reports the BoJ would go slow on policy normalisation. That saw rate hike bets slashed.

AUD sold off aggressively on soft GDP data. The Q3 figures were sluggish, printing at 0.3% vs 0.5% expected and 0.8% y/y vs estimates of 1.1%. This saw traders fully price in an April rate cut by the RBA, compared to odds of around 60% before the data. USD/CAD moved modestly lower as markets await the job data on Friday. Money markets are split between a 25bp and a 50bps rate cut at next week’s BoC meeting.

US stocks: US stocks were strong with the benchmark S&P 500 and the Nasdaq again posting new all-tine highs. The S&P 500 closed up 0.61% at 6,086. The tech-dominated Nasdaq settled 1.24% higher at 21,492. The Dow lagged again but finished up 0.69% at 45,014. Tech led the gainers while energy, materials and financials drove the decliners. Stronger than expected Salesforce and Marvell earnings after hours helped tech. Powell’s barely shifted rate cut expectations (19bps) for the Fed meeting on 18 December.

Asian stocks: Futures are in the green. Asian equities were generally in the green after more record highs Stateside. The ASX 200 hit an all-time top driven by tech and healthcare. The Nikkei 225 outperformed and moved above 39,000 on tech. China stockstraded indecisively after a new package of chip export controls were unveiled by US.

Gold moved marginally higher. The 50-day SMA is at $2668. The precious metal is up 10 of the past 12 sessions.

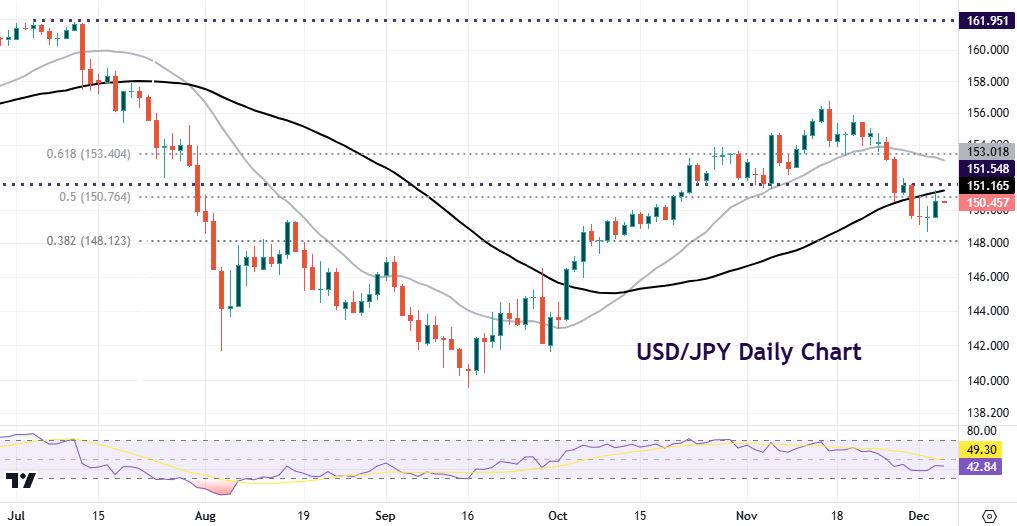

Chart of the Day – USD/JPY in the BoJ and NFP crosshairs

The yen has fared better in the last few weeks as BoJ rate hike odds have oncreased for a December move. But yesterday saw losses driven by a report suggesting that local political concerns were prompting officials to err on the side of cautious reagrding policy normalisation. December money market pricing eased from reflecting 15bps of tightening to less than 8bps after the news.

USD/JPY is also closely tied to the US 10-year Treasury yield. That means tomorrow’s NFP data will have a big bearing on near-term direction for the major. The 50-day SMA is 151.06 with the 50% mark of the summer decline at 150.76. A strong US labour market report may challenge the Fib level (61.85) of that move at `153.40. The retracement level below (38.2%) sits at 148.12. Note too the old intervention levels from 2022 and 2023 around 152.

The information has been prepared as of the date published and is subject to change thereafter. The information is provided for educational purposes only and doesn't take into account your personal objectives, financial circumstances, or needs. It does not constitute investment advice. We encourage you to seek independent advice if necessary. The information has not been prepared in accordance with legal requirements designed to promote the independence of investment research. No representation or warranty is given as to the accuracy or completeness of any information contained within. This material may contain historical or past performance figures and should not be relied on. Furthermore estimates, forward-looking statements, and forecasts cannot be guaranteed. The information on this site and the products and services offered are not intended for distribution to any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.