Powell testimony hits stocks and boosts USD

Headlines

* Investors contemplate fallout from US rates reaching 6%

* Deepest yield inversion since Volcker suggests hard landing

* Bank of Canada expected to take foot off the brake before the Fed

* Asian stocks tumble on heightened hike fears

FX: USD hit a three-month high and has built on those gains further this morning. The upside breakout in the DXY looks impressive. It has taken out the year-to-date top and the 100-day SMA at 105.30. Next up is the 200-day SMA above at 106.59. US Treasury 2-year yield surged to its highest level since 2007. It closed above 5%, while the 10-year yield was trading around 4%. That pushed a closely watched recession indicator (US Treasury yield curve measuring the gap between yields on 2- and 10-year Treasuries) to invert to negative 105bps. That is the deepest since September 1981.

EUR plummeted by 1.23% to 1.0547. The major sits bang on recent support today around 1.0532/36. GBP lost 1.66% to a low at 1.1821. This is below the 200-day SMA at 1.1903 and the January bottom at 1.1841. USD/JPY soared above 137 and has advanced to 137.60 today. This is just above the 200-day SMA at 137.41 which it last crossed in December. This comes just two days before the eagerly awaited BoJ meeting. AUD was the worst major performer, not helped by yesterday’s dovish RBA hike. It finished over 2% lower taking out previous support around 0.6680. A fresh low made today touched 0.6567, a level not seen since early November.

Stocks: US equities tumbled on fears of bigger hikes at the Fed meeting in a couple of weeks and going forward. The blue-chip S&P 500 lost 1.53% weighed down by financials. The tech-laden Nasdaq 100 finished down 1.22%. The Dow sunk 1.72% lower. Losses in New York accelerated in the afternoon after Powell’s speech.

Asian stocks were mostly lower amid Powel and Wall Street headwinds. The ASX 200 was in the red led by underperformance in commodity-related sectors after oil slumped. The RBA Governor did open the door at the next meeting to a pause in rate hikes, but this failed to appease. The Nikkei 225 bucked the trend due to currency effects. A record current account and trade deficits in Japan added to the case for a slow exit from the BoJ’s uber-dovish policies.

US equity futures are flat. European equity futures are pointing to a softer open (-0.2%). The Euro Stoxx 50 cash market finished down 0.8%.

Gold plunged 1.82% as the greenback surged higher to year-to-date highs. The 100-day SMA is just below current prices at $1802 with the cycle low at $1804.

Event Breakdown – Powell goes hawkish

Fed Chair Powell chose to go large on his inflation-fighting credibility. This comes after the recent FOMC Q&A session when he surprised markets with a more dovish bias. He put bigger hikes firmly on the table for the March meeting. He also indicated a higher eventual peak in policy rates amid the economy faring better than expected. Notably, Powell said there was little sign of disinflation, in contrast to his previous remarks. The Fed also needs to see a softer labour market and wage growth remains uncomfortably high.

Markets reacted very strongly. The peak rate is now seen above 5.60%, 10bps higher than before the speech. There is now a 75% chance of a 50bp hike in two week’s time, from below 30% yesterday. The Fed’s blackout period starts on Saturday, and we get NFP on Friday too before US CPI next Tuesday. We will be watching other labour market data today (JOLTS) and tomorrow’s initial jobless claims as well to confirm this new leg of hawkish repricing.

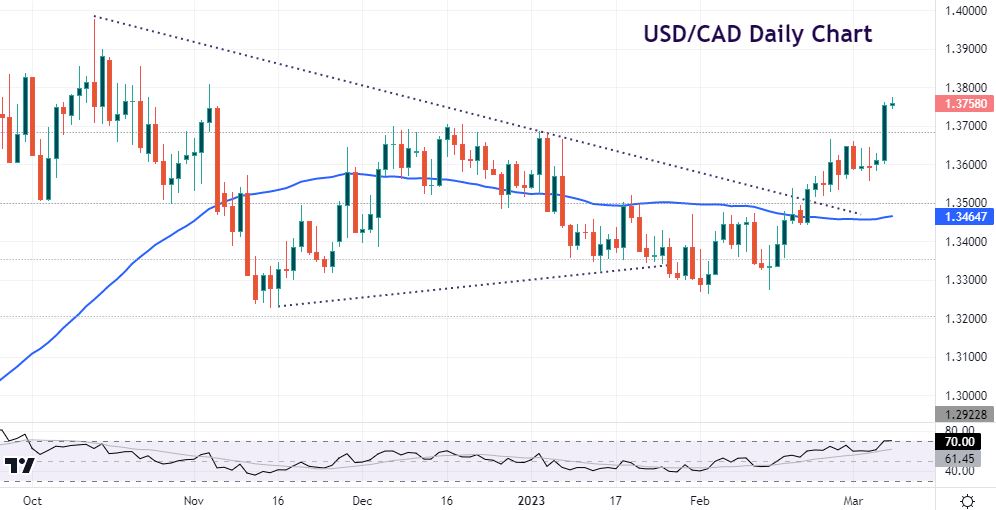

Chart of the Day – USD/CAD breaks to the upside

Risk events come thick and fast this week with the BoC meeting and rate decision next up today at 3pm GMT. After the RBA’s dovish hike, the bank is expected to pause on its tightening cycle. It has raised rates 4.25% in just eight meetings. It said at its most recent meeting it wanted to see the cumulative effect of these rate rises. Recent data has been mixed with slower inflation and GDP clashing with a tight labour market.

If Governor Macklem conveys policy flexibility and leaves the door open to more hikes, this should support the loonie. Prices are overbought on USD/CAD after breaking higher yesterday. This pushed the major to levels last seen in November. Support sits around 1.3682 (minor Fib level of August rally) and the December high at 1.3705.

The information has been prepared as of the date published and is subject to change thereafter. The information is provided for educational purposes only and doesn't take into account your personal objectives, financial circumstances, or needs. It does not constitute investment advice. We encourage you to seek independent advice if necessary. The information has not been prepared in accordance with legal requirements designed to promote the independence of investment research. No representation or warranty is given as to the accuracy or completeness of any information contained within. This material may contain historical or past performance figures and should not be relied on. Furthermore estimates, forward-looking statements, and forecasts cannot be guaranteed. The information on this site and the products and services offered are not intended for distribution to any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.