Markets choppy on Trump tariff chatter

* Dollar sells off before bouncing on Trump denial of sector-based tariffs

* Tech and Nvidia lead stocks higher as chipmakers jump

* Bitcoin returns above $100k as early 2025 crypto rebound continues

* Canada PM Trudeau resigns after nine years in power as Liberals force him out

FX: USD fell sharply on reports in the Washington Post that President Trump was ready on universal tariffs. But these would only be on certain sectors so much less pared back than initially expected. The less inflationary impact saw the DXY drop below 108 before rebounding on a denial by Trump. Welcome to 2025, with price action volatility on two-way Trump news!

EUR outperformed having been one of the major currencies hit the hardest since Trump’s election victory last November. The Trump tariff story, as well as statewide German inflation data helped the euro. The latter came in hotter than forecast and tees up today’s eurozone HICP figures. Markets trimmed rate cut bets which saw two-year spread differentials narrow. The major popped up to a major resistance zone before pulling back.

GBP also performed well though it lagged the euro. Cable rose to a minor Fib level of the April to September move at 1.2540 before falling back. Prices had broken down to a fresh cycle low at 1.2351 on the first trading day of 2025.

USD/JPY again traded within the recent range, matching the small range in the 10-US Treasury yield. Resistance sits around 158 with support at 156, give or take. As we always say, the longer prices track sideways, the greater the breakout will likely. This is typically in line with the long-term dominant trend.

AUD popped higher to 0.6301 before closing below 0.6250. Prices had been drifting lower into the key long-term low from October 2022 at 0.6169. The 21-day SMA sits at 0.6292. USD/CAD dropped sharply to a low of 1.4278 before bouncing back above 1.43. PM Trudeau announced he was stepping down. A possible lengthy leadership contest may ensue, but some hoped-for clarity amid the recent political fog is pushing the loonie higher. That said, prices are back in their recent (lower part of the) range around 1.44 in the major.

US stocks: The S&P500 closed up 0.55% at 5,975. The tech-laden Nasdaq settled 1.09% higher at 21,559. The Dow finished at 42,706, down 0.06%. Tech led the way again after the decent move higher on Friday. Chips stocks got a boost on Microsoft’s announcement that it is planning to invest $80bn this year on developing data centres to train AI models and deploy AI apps. The top 11 companies by market cap are expected to have 50% earnings growth this year. This is a high bar with associated high valuations, but investors remain big believers.

Asian stocks: Futures are mixed. Asian markets saw mixed performance on Monday with the Nikkei 225 slipping more than 1% on its first trading day of the new year. The index fell 1.4% after adding 4.4% in December, its biggest monthly gain since February last year. China stocks extended losses to 3-month lows, continuing the 5.2% drop from last week. Sentiment remains fragile even with services activity expanding at the fastest pace in 7 months in December, though orders from abroad declined reflecting growing trade risks.

Gold had a bumpy session with prices initially falling, before then rising as yields and the dollar fell back. Bullion ultimately printed a doji, with prices roughly in the middle of the day’s high and low, denoting some indecision. The 100-day SMA is at $2625 and has offered support to prices recently.

Day Ahead – Eurozone CPI, ISM Services

December Eurozone headline inflation is forecast to tick up to 2.4% from 2.2%, due to higher energy and food inflation. The prior release saw CPI rise as exepcted on account of base effects. The core rate is predcited to hold steady at 2.7%. Services inflation ticked marginally lower to 3.9% in October from 4.0%. In line outcomes would mean that inflation would have undershot the baseline forecasts in the ECB’s December Staff Projections in Q4 by 0.1% on both headline and core inflation. If that is the case, it would cement calls for further easing by the ECB, particularly if weak survey data were to be borne out in ‘hard’ economic nubmers.

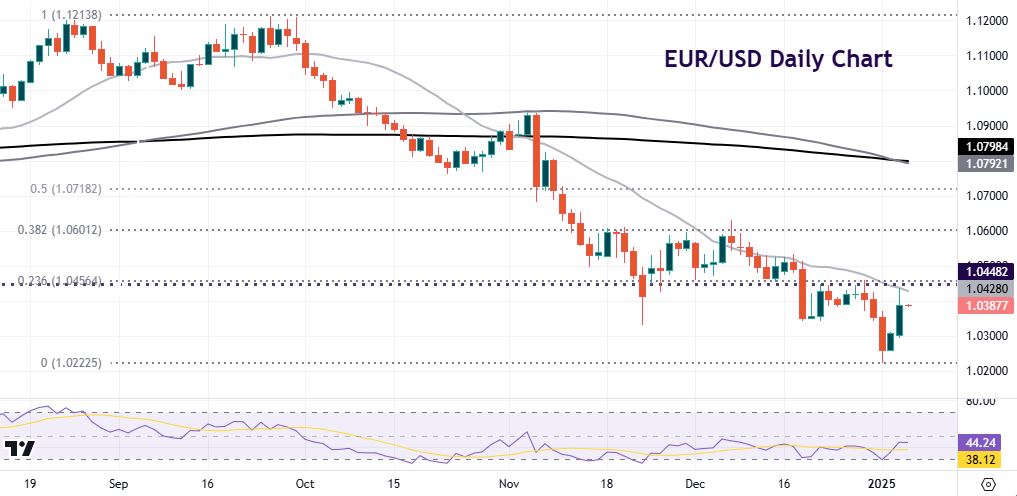

Chart of the Day – Oversold EUR/USD finds a bid

There is much uncertainty in the eurozone as we kick off 2025. Will the Ukraine conflict be stopped in the next few months as US President Trump has promised? Can the German and French polticial chaos calm and stability return? Will the ECB cuts rates aggressively to offset long-term stagnation, and potential Trump tariff ructions? Current ECB pricing sees around 26bps of easing at the January meeting, with a total of 103bps by year-end. The euro will need some material upside CPI surprises to push out the four rate cuts seen this year. Sticky and stubborn core and services inflation would help for starters.

The recent cycle low is at 1.0222. Numerous Wall Street strategists think parity will come soon. There is a resitance zone above at the October 2022 bottom at 1.0448, the 21-day SMA at 1.0437 and the first minor Fib level of the September bear move down at 1.0456.

The information has been prepared as of the date published and is subject to change thereafter. The information is provided for educational purposes only and doesn't take into account your personal objectives, financial circumstances, or needs. It does not constitute investment advice. We encourage you to seek independent advice if necessary. The information has not been prepared in accordance with legal requirements designed to promote the independence of investment research. No representation or warranty is given as to the accuracy or completeness of any information contained within. This material may contain historical or past performance figures and should not be relied on. Furthermore estimates, forward-looking statements, and forecasts cannot be guaranteed. The information on this site and the products and services offered are not intended for distribution to any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.