Dollar selling makes new lows this morning

Headlines

*Tensions between China and the US show signs of easing

*Japan’s economic recovery slams into reverse on weak yen

*RBA’s minutes: Prepared to pause or return to outsized hikes

*Dollar bounces as Fed officials say hikes to continue, yen slumps

FX: USD is trading lower this morning and has made new cycle lows. Last week’s bottom at 106.28 was a level last seen in mid-August. Next support is 105.78. US Treasury yields rebounded from their recent lows (3.80% on the 10-year US Treasury). Support is found at the 50-day SMA at 3.84%.

EUR/USD shed 0.26% but closed off its lows. Buyers are being seen today pushing above 1.04. GBP/USD also closed lower but is consolidating not far from its recent highs around 1.18. USD/JPY rebounded by 0.79%. It is trading below 140 after last week’s low at 138.45. The 100-day SMA is initial resistance at 140.83. Q3 Japanese GDP printed an unexpected contraction.

AUD/USD is pushing towards new cycle highs above the 100-day SMA at 0.6697 and the July low at 0.6681. The aussie was unmoved by the RBA minutes which left all policy options open. USD/CAD is also consolidating its recent losses. Support is the July high at 1.3223 and 100-day SMA at 1.3234. Gold trades through its recent high at $1775 this morning. The 200-day SMA sits above as a target for gold bugs at $1803.

Stocks: US equities reversed to kick off the week as investors weighed the outlook for interest rate rises. The broad S&P 500 closed lower 0.89% after making a new high at 4,008. The tech-heavy Nasdaq dropped 0.98% as yield sensitive sectors underperformed. The Dow closed lower by 0.63%.

Asian stocks mixed following a weak lead from Wall Street and quiet overnight news flow. The Nikkei 225 saw some downside after softer than expected Q3 GDP. But losses were trimmed as the yen weakened. The Hang Seng cheered the meeting between Presidents Xi and Biden. The contraction in retail sales and below forecast industrial production had little impact.

US equity futures are showing solid gains. European equity futures are modestly higher +0.2% after the cash market closed +0.5% yesterday.

Market Thoughts– China and Fed speakers

It was a relatively quiet start to the week with unexpected positivity on the geopolitical front. A candid meeting between Chinese President Xi and US President Biden discussed Taiwan and the use of nuclear weapons by Russia. A follow up meeting is scheduled between senior Chinese officials and Secretary of State Blinken. This is far more progress than anyone had predicted. The easing of covid restrictions plus support for the Chinese property sector and Chinese central bank liquidity are further supporting sentiment.

We have multiple Fed officials on the wires this week who are expected to push back on the pivot idea. Brainard, a well-known dove, said it was appropriate “soon” to move to a slower pace of increases as it will take time for cumulative tightening to flow through. She added that the Fed has done a lot but has “additional work” to do. The peak rate question will be informed by the data. Over the weekend, Daly had warned the next phase of policymaking would be “difficult”, while the hawk Waller said rate were going to “keep going up” and stay high until inflation gets down closer to target.

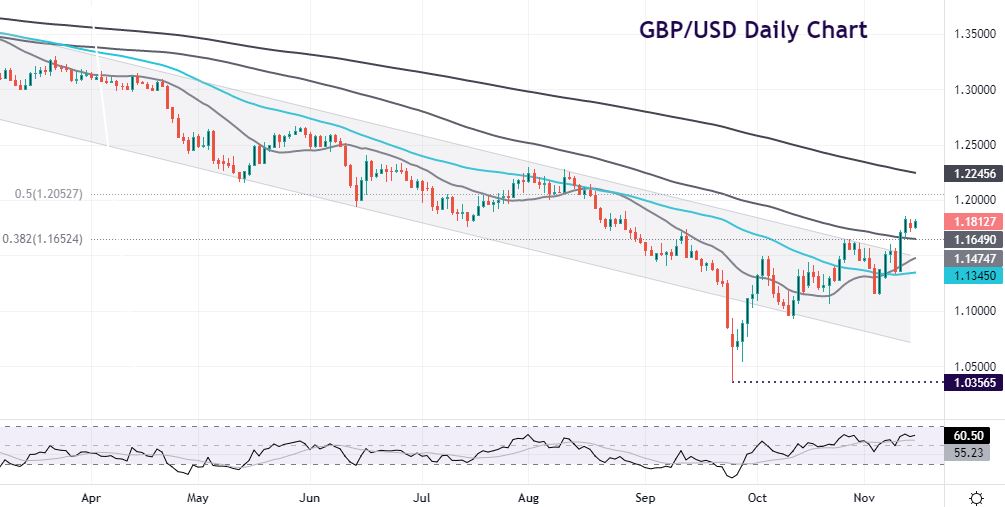

Chart of the Day – GBP/USD looking to make new highs

It’s a big week for the UK with lots of data and the Autumn Statement by the Chancellor. We had job numbers released this morning which showed a slight uptick in the unemployment rate to 3.6%. But the report signalled relatively decent momentum despite the gloomy headlines and headwinds approaching. CPI figures tomorrow are set to climb with the headline near 11%. The Autumn Statement is a balancing act between market credibility and political support with swinging tax rises and spending cuts expected.

Dollar dynamics and risk sentiment will also drive GBP this week. Cable paused yesterday after two bullish days saw a 500 pip rise from low to high at the end of last week. Prices are consolidating with the break of the major bear trend since the start of the year. Support is 1.1649/52 and 1.1550 is the top of the downward channel. The main upside target is 1.2052. That’s the 50% Fib level of the 2022 decline.

The information has been prepared as of the date published and is subject to change thereafter. The information is provided for educational purposes only and doesn't take into account your personal objectives, financial circumstances, or needs. It does not constitute investment advice. We encourage you to seek independent advice if necessary. The information has not been prepared in accordance with legal requirements designed to promote the independence of investment research. No representation or warranty is given as to the accuracy or completeness of any information contained within. This material may contain historical or past performance figures and should not be relied on. Furthermore estimates, forward-looking statements, and forecasts cannot be guaranteed. The information on this site and the products and services offered are not intended for distribution to any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.