Bank of Canada to copy RBNZ with aggressive rate hike

Overnight Headlines

*RBNZ hikes rates by hefty 50bps over inflation worries

*Markets bet on hawkish hike from BoC policymakers

*DXY powers above 100 with euro weighed by fading hopes for Ukraine peace

*Oil surges more than 6%, back above $100 as Putin vows to continue

US equities traded lower again though trading was whippy through the day. Both the US and Europe were green during the trading session. But the S&P500 ended 0.3% lower after being up as much as 1.3%. Small caps and cyclicals saw marginally better performance as bond yields came off their highs. Asian stocks are higher this morning with decent gains in Japan. US futures are currently up and regaining the losses from yesterday.

USD went bid after bottoming out below 100 on the DXY after the US inflation data. EUR saw sellers push the single currency down towards the cycle lows at 1.0805. GBP similarly is trading around swing support at the year-to-date low of 1.2981. USD/JPY again touched long-term highs at 125.85 before printing a doji candle. Both the antipodean currencies found buyers yesterday with the aussie holding above 0.74. NZD spiked higher to 0.6901 after the surprise 50bp hike today, before retracing towards 0.68.

Data Breakdown – Has red hot US CPI peaked?

US inflation hit a new 40-year high as expected with the headline at 8.5% and the core at 6.5%. Only two components showed softness in the core while all others posted solid gains. Economists believe we might be getting closer to a top in CPI with used vehicle prices especially, falling from their peaks.

But it seems fairly clear that prices will remain elevated for some time with ongoing supply chain issues and job market tightness, plus corporate pricing power. The uncertainty from the Ukraine crisis will also weigh.

This means the Fed will likely be aggressive in tightening policy with potentially three half point hikes still needing to be priced in for the next three FOMC meeting. The last rate rise could be in the first quarter of 2023, but then the weak growth environment may mean rate cuts by the end of next year. The greenback should remain bid in the near term.

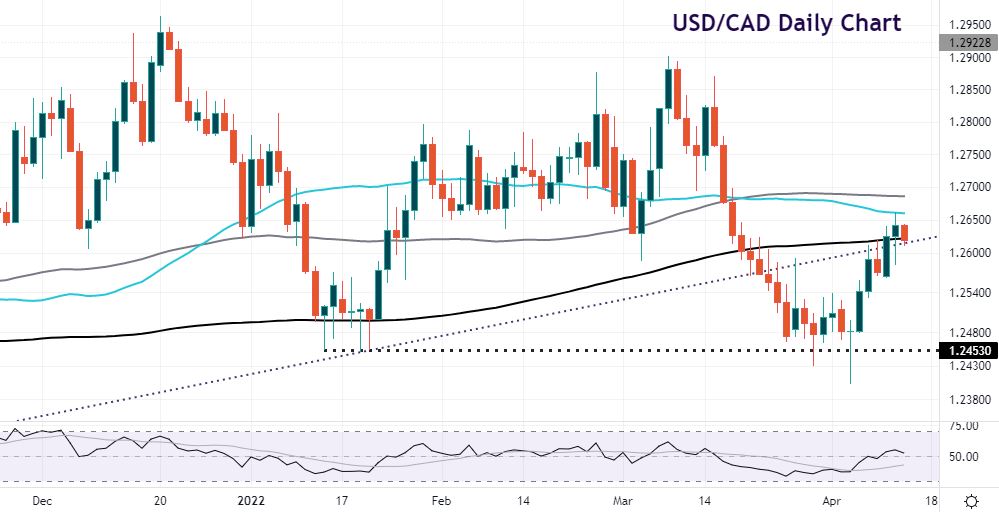

Chart of the Day – USD/CAD bounces up to the 200-day SMA

A 50bp rate hike is pretty much a done deal at today’s Bank of Canada meeting. This would be the second straight rate rise after the 25bp hike in March. Inflation is running at its fastest pace in over 40 years, employment is strong, and output has recovered back to pre-Covid levels. Markets see rates going to around 2.75% from the current 0.5% rate by the end of the year.

The bar seems quite for any more hawkishness and CAD is currently trading at its weakest level since mid-March. Weak risk sentiment and some softness in commodity prices have put off buyers. But elevated energy costs should act as a tailwind over the next few months. The 200-day SMA in USD/CAD is support at 1.2561. Above, resistance is the 50-day at 1.2660 and the 100-day at 1.2686.

The information has been prepared as of the date published and is subject to change thereafter. The information is provided for educational purposes only and doesn't take into account your personal objectives, financial circumstances, or needs. It does not constitute investment advice. We encourage you to seek independent advice if necessary. The information has not been prepared in accordance with legal requirements designed to promote the independence of investment research. No representation or warranty is given as to the accuracy or completeness of any information contained within. This material may contain historical or past performance figures and should not be relied on. Furthermore estimates, forward-looking statements, and forecasts cannot be guaranteed. The information on this site and the products and services offered are not intended for distribution to any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.