12th record high for S&P500 this month

Overnight Headlines

*USD printed a “doji” yesterday and is selling off this morning

*US stocks closed mostly at record highs for a second day

*Oil prices extended their climb after Ida made landfall

*China PMI data weighs with both factory and services activity disappointing

USD was mixed yesterday as FX price action was limited due to the UK bank holiday. DXY closed lower but is on the defensive this morning. Upside breakouts are being confirmed in several majors. EUR is at three-week highs above the mid-August peak around 1.18. USD/CAD is approaching the 50-day and 200-day SMAs, through trendline support. AUD looks to have broken trend resistance. The aussie is pushing up into the late July/early August range around 0.7370.

US equities hit fresh highs again with the broad S&P500 and Nasdaq notching new record closes. The Goldilocks scenario dominated on the back of the dovish Powell speech Friday. US bond yields dropped back so growth outperformed with big tech leading the way. Banks were the clear laggards. Asian markets are mixed with US and European futures mainly positive.

Market Thoughts – China data softens

Chinese PMI data released overnight came in weaker than analyst’s estimates. Factory activity expanded at a slower pace in August. This was due to increased virus restrictions following spikes in the Delta variant and high raw material prices.

Notably the non-manufacturing services component contracted sharply missing consensus expectations. It fell to 47.5 which is the lowest level in more than a decade (except for readings at the start of the pandemic). This is another data point supporting the view that the global economic cycle peak is now behind us.

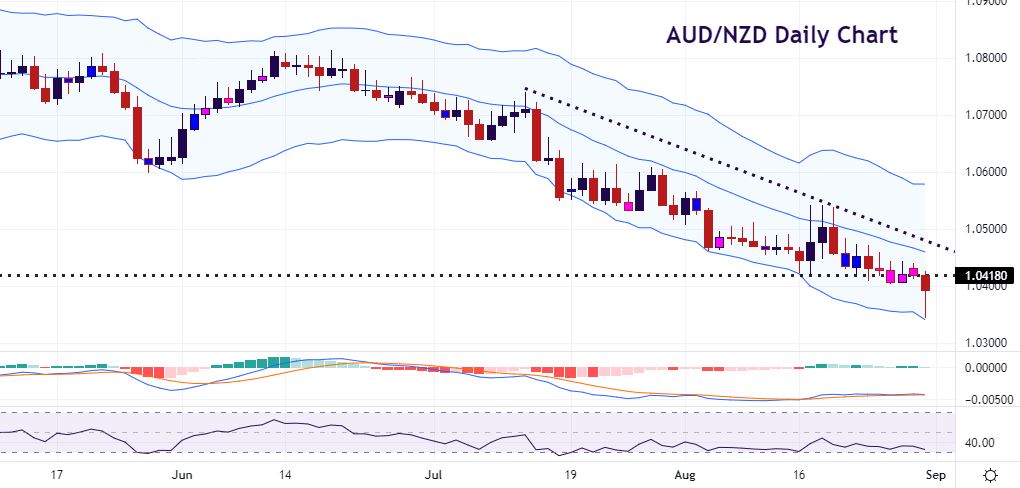

Chart of the Day – AUD/NZD spikes to 16-month lows

NZD is the strongest major this morning with no obvious news catalysts. AUD/NZD has been the most volatile pair with a slew of option-related bids at 1.04. Australian GDP data is due tomorrow with forecasts being downgraded after today’s exports miss. Risks remain and appear to be titled to the downside.

AUD/NZD had been consolidating bearishly at its recent lows just above 1.04. The December bottom at 1.0418 was key long-term support. Today’s sharp spike lower overnight made a new low at 1.0345, a level last seen in April 2020. Prices have made a corrective pullback. But a daily close above the downward sloping trendline from mid-July around 1.0480 is needed to slow the bearish price action.

The information has been prepared as of the date published and is subject to change thereafter. The information is provided for educational purposes only and doesn't take into account your personal objectives, financial circumstances, or needs. It does not constitute investment advice. We encourage you to seek independent advice if necessary. The information has not been prepared in accordance with legal requirements designed to promote the independence of investment research. No representation or warranty is given as to the accuracy or completeness of any information contained within. This material may contain historical or past performance figures and should not be relied on. Furthermore estimates, forward-looking statements, and forecasts cannot be guaranteed. The information on this site and the products and services offered are not intended for distribution to any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.