Stocks break new records even as Trump tariff talk increases

* Dollar gets some support from Trump tariff threats; CAD and MXN hit

* FOMC Minutes don’t rule out or guarantee December rate cut

* S&P 500 and Dow make fresh all-time highs despite tariff talk

* Israel PM Netanyahu approves US plan for ceasefire with Lebanon

FX: USD was choppy but ultimately found a bid on the Trump tariff outburst. Tariff gradualism went out of the window as he threatened 25% levies on Canada and Mexico goods, plus 10% on China produce. The national security grounds for the tariffs cited by the President-elect (borders, drugs) provide him with cover to impose tariffs under executive order as soon as he is sworn in. The FOMC minutes didn’t move markets as they offered little guidance on the future rate path. Last Friday’s two-year top is at 108.07

EUR breathed a small sigh of relief (for now) as Trump didn’t include the zone in his tariff chatter. Short-term spreads between the two-year yields of EZ and US remain near the widest levels in around two years. That means the euro will likely struggle looking ahead. The October 2023 low is at 1.0448 and the spike low from last week at 1.0331.

GBP dipped as bears aim for 1.2486 in cable. The UK’s limited trade relationship with the US (relative to China, the Eurozone, Mexico and Canada) indicate it will be a low priority for the Trump trade team. That may allow for some sterling outperformance, if tariffs are deployed more broadly in the coming months.

USD/JPY moved below the 50-day SMA day 153.86 and a Fib level (61.8%) of July-September move at 153.32. Japan was not in the Trump crosshairs as trade focus turned elsewhere. PPI data also put more BoJ policy normalisation on the table.

AUD struggled again breaking to new cycle lows at 0.6433 before paring losses and holding the prior low. Tariffs threaten global trade which is not good for the aussie. USD/CAD spiked higher to levels last seen in April 2020 at 1.4177. The 25% tariff sabre rattling spooked the loonie, though prices pulled back quite sharply through the day.

US Stocks closed in the green with more record highs in the S&P 500 and Dow. The S&P 500 settled 0.57% higher at 6,038. The tech-laden Nasdaq 100 added 0.57% to finish at 20,993. The Dow closed up 0.28% at 44,860. Utilities led the gainers while materials and energy lagged, being the only two sectors in the red. US consumer confidence increased for a second straight month while the annual inflation outlook fell to its lowest level in more than four and a half years. Amgen fell nearly 5% and was the steepest drop on the Dow on disappointing phase 2 obesity drug trials.

Asian stocks: Futures are mixed. Asian equities were also mixed with concerns around Trump’s tariff comments. He said he will charge China an additional 10% above any additional tariffs. The ASX 200 declined on energy and gold stocks falling with commodity prices. The Nikkei 225 underperformed as better data supported marginally a December BoJ rate hike. The Hang Seng and Shanghai Composite were mixed as Trump tariff talk was offset by possible further support measures by the authorities.

Gold steadied after its big plunge yesterday. That took prices below both the 50-day and 100-day SMAs around $2666. The next level of support is at $2594 – the 38.2% Fib level of the May to October bull move.

Day Ahead – Australia CPI, US Core PCE

Economists says that a fall in prices for rents, electricity, holiday travel and fuel was expected to keep Australia headline inflation near the bottom of the RBA’s 2-3% inflation band. But less favourable base effects should mean some mixed outcomes for the various core measures of inflation. According to money markets, the RBA is currently on hold until past February next year. A series of softer inflation reports will be needed to justify a rate cut.

US core PCE inflation should be modestly stronger again following a 0.3% m/m increase in September. But economists say that strength should mainly be concentrated in volatile components that will not repeat, like used car prices and airfares. Another inline 0.3% m/m core print is still too hot for the Fed. They generally need to see readings of 0.17% m/m over a prolonged period to hit their 2% y/y target.

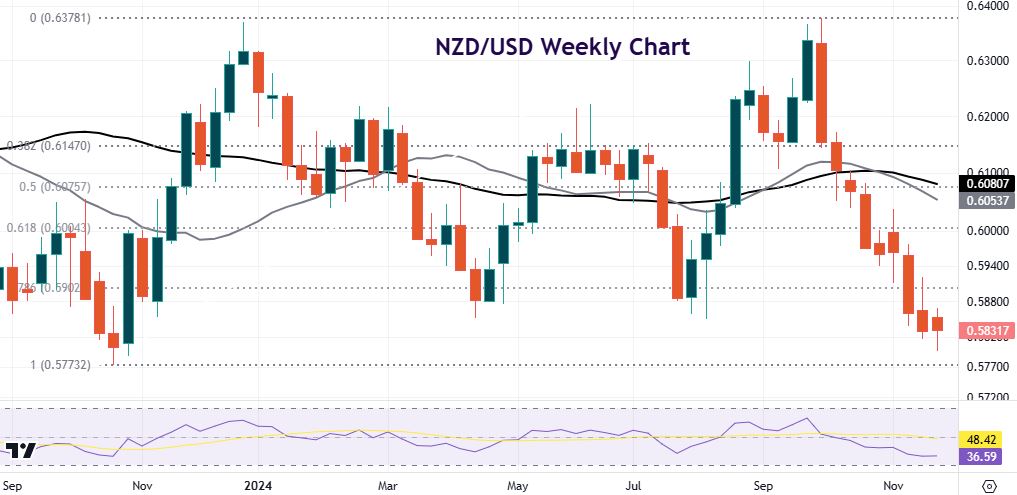

Chart of the Day – NZD tumbles to new low

Consensus predicts the RBNZ will cut the Overnight Cash Rate by a further 50bps to 4.25% at its November meeting. The back-to-back jumbo-sized move is justified by falling inflation and employment contraction in Q3. Policymakers are also expected to revise down their OCR forecast profile to be consistent with the rate reaching around 3.5% by the end of 2025, compared with 3.85% in the prior report. Growth is the main concern over inflation going forward.

External drivers and the strong US economy and USD will likely continue to drive the major. Trump’s protectionist stance has hurt the kiwi already. Prices broke down through the previous year-to-date lows around 0.5855. The October 2023 bottom at 0.5773 is the next key level of support.

The information has been prepared as of the date published and is subject to change thereafter. The information is provided for educational purposes only and doesn't take into account your personal objectives, financial circumstances, or needs. It does not constitute investment advice. We encourage you to seek independent advice if necessary. The information has not been prepared in accordance with legal requirements designed to promote the independence of investment research. No representation or warranty is given as to the accuracy or completeness of any information contained within. This material may contain historical or past performance figures and should not be relied on. Furthermore estimates, forward-looking statements, and forecasts cannot be guaranteed. The information on this site and the products and services offered are not intended for distribution to any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.