ECB set to keep options open, though the hawks are circling

Overnight Headlines

*Asian shares track Wall Street higher as US yields stabilise

*Dollar falls from cycle highs as bond markets pare back rate expectations

*Gold enjoys six straight days of gains, posting a one-month high

*Oil edges lower as market weighs mixed supply signals

US equities closed the session higher. The positive day snapped a three-day losing streak for the S&P500 and Nasdaq. The Dow stopped a two-day decline. Growth stocks led the gains with the tech-heavy Nasdaq up just over 2%. Bond markets pushed higher meaning yields moved lower off their highs. Asian stocks are following the lead from the US and enjoying a better day. Futures are showing solid gains to finish off a holiday shortened week.

USD sold off from the highs made earlier in the session. DXY posted a new top at 100.52 before retracing below 100. The euro touched 1.0808 before bouncing off this support towards 1.09. GBP made gains close to 0.9% after making a new cycle low at 1.2971. USD/JPY made a fresh swing high at 126.31 before closing below strong resistance at 125.85. USD/CAD fell sharply after the BoC hiked rates by 50bps. This move was expected but guidance was hawkish as the bank started “QT” and said, “interest rates will need to rise further”. Prices fell below the 200-day SMA at 1.2621 which acts as resistance again.

Day Ahead – ECB Governing Council expected to stand pat

The ECB finds itself in a tough spot at its meeting today. Inflation is at record highs and potentially going higher as energy and commodity prices stay elevated. But growth is being hit by huge uncertainty over the Ukraine conflict with a stagflationary environment looming.

Policymakers are expected to stick to the timetable for exit from QE which it announced in March, with an end date in the third quarter. President Lagarde is set to repeat the gradual but flexible nature of policies at its disposal. It seems expectations are for a hawkish bias which may bolster support for the euro. But it does leave the single currency vulnerable if Lagarde is more cautious or if guidance is unchanged.

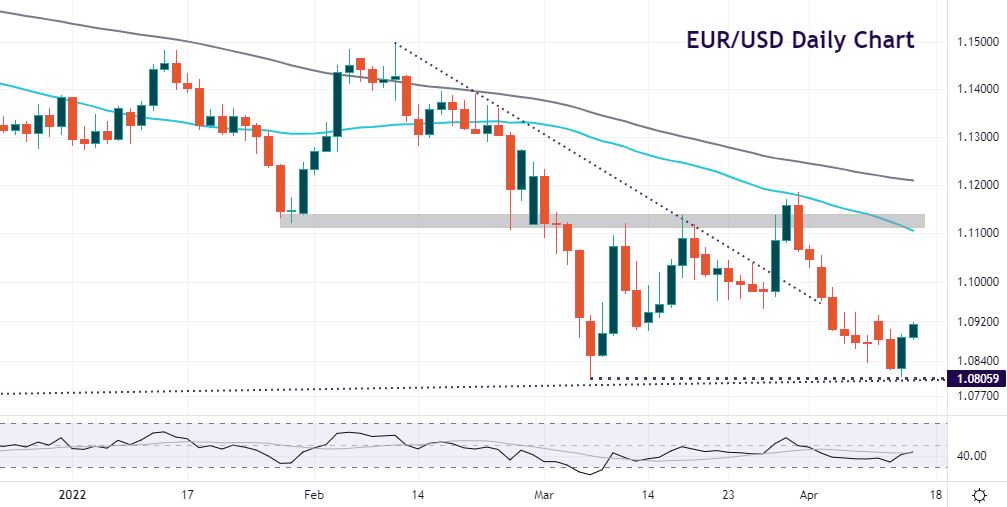

Chart of the Day – EUR/USD bounces off year-to-date lows

A tenth consecutive down day was halted by a decent bid in the euro yesterday. After printing very close to the year-to-date low at 1.0805, the world’s most traded FX pair rebounded strongly back up near to 1.09.

Strong long-term bearish momentum is still evident. But major support is obvious in the 1.08 area. A weekly close below this could see the mid-1.07s and 1.07 quickly. Resistance is around the 1.09 level and then 1.0935.

The information has been prepared as of the date published and is subject to change thereafter. The information is provided for educational purposes only and doesn't take into account your personal objectives, financial circumstances, or needs. It does not constitute investment advice. We encourage you to seek independent advice if necessary. The information has not been prepared in accordance with legal requirements designed to promote the independence of investment research. No representation or warranty is given as to the accuracy or completeness of any information contained within. This material may contain historical or past performance figures and should not be relied on. Furthermore estimates, forward-looking statements, and forecasts cannot be guaranteed. The information on this site and the products and services offered are not intended for distribution to any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.