Hawkish Fed helps the dollar, upsets stocks

Overnight Headlines

*Fed leaves interest rates on hold, but March rise likely

*Dollar nears 2022 high as market prices in five hikes this year

*Commodities index hits fresh record as inflation concerns spread

*Asian shares retreat after Fed’s hawkish hold

US equities ended a mixed bag with another intraday sharp reversal after the Fed meeting. The Dow was up over 500 points, but settled 129 points lower (-0.38%), the S&P500 closed marginally down, and the Nasdaq ended modestly in the green. There was no clear direction with very varied sector performance between value and growth. The VIX remains high above 30 suggesting elevate uncertainty remains. Asian markets are in broad declines with Evergrande issues again in focus in China. Futures are 1%+ lower.

USD gained on the back of a relatively hawkish Powell as yields drove higher. The DXY rose to three-week highs, closing around 96.47. The recent November top is at 96.93. EUR fell sharply through 1.13, with eyes firmly on 1.1186. GBP broke recent support around 1.3436 and USD/JPY moved above 114.50. USD/CAD cleared its lost-BoC high as policymakers in Ottawa held off raising rates.

Market Thoughts – Fed (hawkish) action in yo-yo markets part II

As many expected, the Fed hinted that it would hike for the first time at the next meeting in March. Chair Powell sounded hawkish during the press conference declining invitations to rule out raising rates at every meeting or moving by more than 25bps at a time.

The FOMC didn’t go through with ending QE or hiking rates immediately. But Powell talked a lot about upside risks to inflation while also arguing that the Fed is now at maximum employment. Policymakers need to tighten financial conditions further to try and end strong inflation readings.

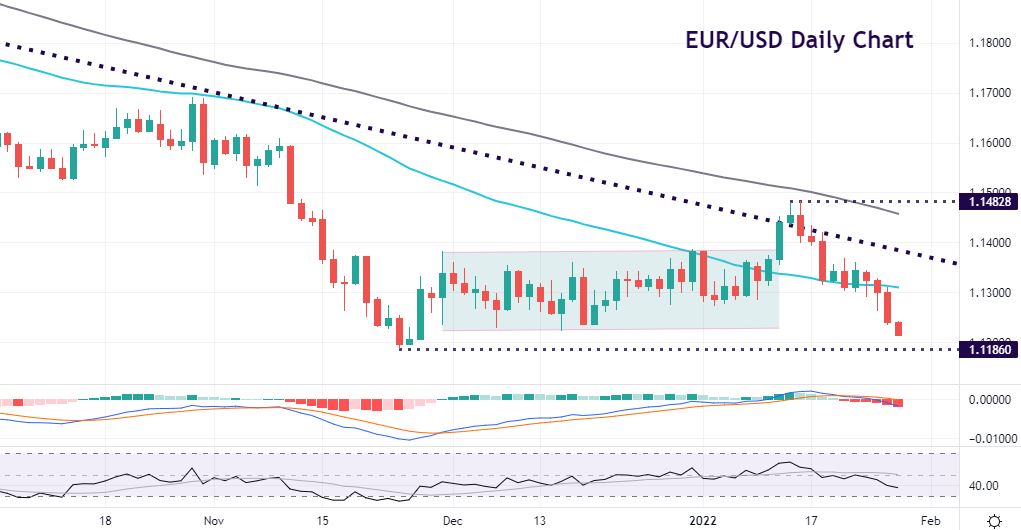

Chart of the Day – EUR/USD eyes long-term low

Markets reacted swiftly to the Fed’s hawkish comments, with stocks selling off and bond yields shooting higher. The two-year yield was flat for the day when Powell rose to speak and had risen 13bps by the end of the session. Apart from one day during pandemic meltdown, this was the biggest one-day rise since the GFC in 2008.

The dollar powered higher against the low-yielders like JPY, CHF and EUR. These currencies are most susceptible to higher US interest rates, with their central banks stuck on hold. Ukraine tensions are also continuing to dampen the euro especially. Bears are eying up the November low at 1.1186. With many analysts now revising higher their Fed rate forecast, expect more dollar strength towards 1.10 and below.

The information has been prepared as of the date published and is subject to change thereafter. The information is provided for educational purposes only and doesn't take into account your personal objectives, financial circumstances, or needs. It does not constitute investment advice. We encourage you to seek independent advice if necessary. The information has not been prepared in accordance with legal requirements designed to promote the independence of investment research. No representation or warranty is given as to the accuracy or completeness of any information contained within. This material may contain historical or past performance figures and should not be relied on. Furthermore estimates, forward-looking statements, and forecasts cannot be guaranteed. The information on this site and the products and services offered are not intended for distribution to any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.