Did you know that the NASDAQ was the first stock exchange to introduce online trading in 1971? There’s been no stopping since then. Retail investors made up 25% of the stock market as of 2021, compared to 10%-15% just a decade ago. And that’s just the equity markets. Unfortunately, the reality is also that 80% of traders fail and quit the markets. This is because they either haven’t been able to establish robust strategies or don’t have access to powerful tools to help with informed trading.

So, how do you not only jump-start your trading journey but ensure that you remain in the markets for the long term? Choose a broker who eases technical and fundamental analysis for you, while offering you the latest market news and analysis. Here’s what you need to look for before you open an online trading account.

The Foundations of Informed Trading

Asset prices fluctuate constantly, driven by economic and geopolitical events, supply and demand, and even tweets by Elon Musk. As a beginner trader, it might seem overwhelming to keep track of so many factors. This is where tools for technical and fundamental analysis come to the rescue.

Technical analysis looks at historical price and volume data for an asset to predict future price direction. This analysis is then presented in the form of charts for traders to easily understand expected price movements. For instance, one of the most popular online trading platforms in the world, MT4, offers 30 different technical indicators. These are powerful tools to identify price and volume patterns, trends, support and resistance levels, entry and exit points and risk management measures.

On the other hand, fundamental analysis looks at qualitative and quantitative, macro and micro economic, and financial and non-financial data to determine the fair or intrinsic value of an asset. This helps us understand whether the asset is currently overvalued or undervalued. For this, you will need to stay updated with announcements by central banks, such as the Federal Reserve or Bank of England, GDP numbers, unemployment and inflation rate data, etc., to power your trading decisions. The good news is that there are trading tools that can help you with this as well.

Must-Have Trading Tools

While choosing the broker to open your trading account, beginner traders check for tight spreads, fast execution, deep liquidity, commission rates and licenses. But it is also important to check the trading resources being offered. These resources will support you in understanding price trends and direction to make informed trading decisions. Here are some of the must-have tools and resources you should check for:

MT4 SmartTrader Tools

Historically, institutional traders have had access to much more powerful tools than retail traders. The MT4 SmartTrader Tools package levels the playing field, offering retail traders a much more powerful experience of MetaTrader 4. It includes:

Alert Manager

This is not just a notification tool. It can also automate trading for you. You can:

- Choose from 6 types of alarms

- Set up your own rules and triggers so that market or pending orders are automatically executed. You can also automate the closing of all or some trades.

Receive alerts via email, SMS, pop-ups, sound notifications, and even via Twitter.

Correlation Matrix

This is an easy-to-use and customisable matrix for all assets. Correlation scores and pattern strength can be viewed at a single glance. This eliminates the need for separate spreadsheets for each asset being traded. With this tool, you can:

- Choose your timeframe, from 1 hour to 1 week

- Choose the display, range and size of correlations

- Choose the assets you wish to follow, including forex, stocks, commodities, indices or CFDs.

Correlation Trader

Aren’t things easier to understand when they are presented in a visual form? That is what this tool does. It goes beyond just giving you a quick correlation score to show you correlation patterns over various timeframes. This makes it easy for you to compare charts. Plus, this trading tool allows you to directly place trades from it. You can:

- Choose the market and the timeframe for which you wish to compare key data, such as net profits for specific stock tickers.

- Open and close trades from the tool.

- Place stop-loss and take-profit orders, for both hedging and non-hedging modes, directly from the correlation charts.

Excel RTD Link

Where would the world be without MS Excel spreadsheets? With the Excel RTD Link tool, you can analyse, compare and create rules with your favourite spreadsheets in real-time. In fact, you can use it across multiple trading accounts, without needing to log in and log out each time. It allows you to:

- Add real-time data, such as account, ticket and price.

- Send trade execution orders directly from the VBA code in MS Excel.

The best part is that you don’t need to use any macros or XLL add-ins. You don’t even need to know programming to make the most of this tool.

Market Manager

Wouldn’t it be incredibly convenient if you could easily customise your watchlists? You can do just that in MT4 and MT5 with this tool. It gives you complete control over the assets you wish to follow. Also, you can view all your order activity from a single window. You can:

- Rename asset symbols and save them in convenient groups in the order of your preference.

- View market data as graphs for your chosen timeframe, such as for the last 60 minutes, 5 days or 24 hours.

- Trade directly from the Market Manager window.

Mini Terminal

Need support for fast and flexible trading? With the Mini Terminal, you can not only enter and exit positions quickly, but you can also place multiple complex order types with just one click, including One-Cancels-the-Other (OCO) orders. For advanced traders, this trading tool offers the ability to multitask across multiple positions from a single MT4 or MT5 window.

Sentiment Trader

Market sentiment can have a powerful influence on asset prices. This is why successful traders keep their eye on sentiment. You can do that too with this tool. You can observe the current and historic sentiment, plotted as a graph against asset price for your chosen symbols. Plus, you can customise your view of market and historical sentiment. It also allows you to directly open and close positions, as well as set stop-loss and take-profit orders.

Session Map

To give you an overview of the major markets and time zones across the world, the Session Map offers a visual display that reflects your local timeline. To make it even easier for you, future market events are marked and the potential impact on price movement is colour-coded for current and previous market sessions, and information regarding your trading account, such as margin usage and floating profit/loss.

Trade Terminal

To make the most of market moves, you need a trading terminal that allows quick and precise order execution, minimising slippage. This is exactly what you get with the advanced Trade Terminal, which offers one-click trading and multiple built-in functions, such as:

- Open and close trades quickly for all order types

- Close positions for individual, specific or all trades

- Create your own templates for the most commonly used or preferred orders

- Modify stop-loss, take-profit and trailing stop orders

- Risk and trade calculators and analysis functions

- Set alarms that trigger actions

Free Forex VPS

If you’re using EAs or other automated trading tools, you would want your trading terminal to have market access 24/5. You can achieve just this with a virtual private server. It will give MT4 uninterrupted access to the market that never sleeps – forex. No longer do you need to miss trading opportunities due to downtime associated with computer or electrical issues. With the Forex VPS, your trading platform is hosted on an external server to ensure continuous connectivity. The best part is that you can use the VPS services from your laptop or mobile trading app, giving you truly anytime, anywhere market access.

Image Source: Forex VPS

Registering for the Forex VPS and creating your account is a quick and simple process. After that, all you need to do is log in and set up your EAs, as you usually would. You can choose from various VPS plans, based on your trading needs.

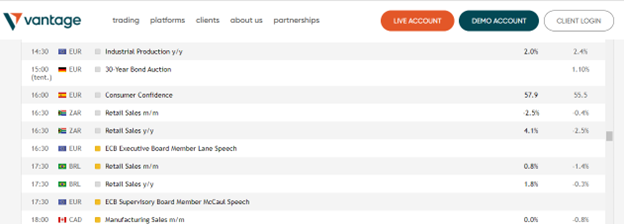

Economic Calendar

Remember what we said about fundamental analysis right in the beginning? An economic calendar is an invaluable tool for this type of analysis. Traders of all experience levels, from beginners to highly-experienced institutional traders, can benefit from a calendar that gives them information on all market-moving economic events for every day of the year. With an economic calendar, you are well-positioned to prepare for price fluctuations and market volatility because it not only gives you the date and time of economic announcements, but also tells you about the previous data and the market expectations for the current release.

Image Source: Economic Calendar

Sentiment Indicators

Remember the stock market crash of 2020, soon after COVID-19 was declared a pandemic? That is possibly the biggest example of investor sentiment impacting the markets. Now, if you had access to a trading tool that could give you insight into market sentiment, you could be in a better position to plan your trades.

The Forex Sentiment Indicator looks at both long and short positions on various forex pairs to tell you whether the overall sentiment is bullish or bearish on that pair.

Image Source: Forex Sentiment Indicators

Similarly, the Indices Indicator provides insights into major global indices, such as the FTSE100, S&P500, DAX, DJ30 and more, while the Commodities Indicator offers sentiment information on the most popular commodities, such as gold, silver, oil and copper.

Market Buzz

This tool helps traders keep up with the latest “buzz” in the markets. With the use of Artificial Intelligence, the latest news, media coverage and economic events are tracked across currencies pairs, stocks, indices and commodities. The power of AI helps you stay updated with real-time market occurrences for more than 35,000 tradable assets.

This saves you the trouble of checking the internet constantly for live market news. All you need to do is search for your chosen assets, and all the related information will be displayed, so that you can make informed trading decisions. You even get to know the volume of news about the asset and whether the overall news sentiment is positive or negative.

Image Source: Market Buzz

Artificial Intelligence sifts through the infobesity online to bring you valuable and actionable market insights.

Online Calculators

Online calculators have made life so much easier. Now, you can use them to calculate position sizes, potential profits, margins, and swap/interest rates. This can help you make trading decisions according to your available capital and financial goals. All you need to do is fill in some simple information, such as asset type, lot size, leverage used, etc., and all the hard work of calculations is done on your behalf.

Social Trading

Love social media? Now, you can connect with traders from all across the world on a social media platform built specifically for this purpose – V-Social. This is an active community of traders of all experience and skill levels, where you can share your own insights, learnings and trading plans, as well as learn from others. You can chat with mentors, get questions answered and form bonds with other traders. You can even gamify the trading experience by challenging a friend’s trade or inversing a trade when you believe the trader has gotten it wrong.

Words of Wisdom from Expert Traders

Before you get started, here’s a look at what experienced traders have to say:

- Plan and Practice: Have a trading plan and practice your strategy on a demo account before applying it to the live markets. Demo accounts simulate real trading scenarios to help you fine-tune your trading.

- Protect Your Capital: Invest only the amount of capital that you can afford to lose. Some experts say that you should not invest more than 2% of your total trading capital in a single trade.

- Risk Management: Use appropriate risk management measures for every trade, especially stop-loss and take-profit.

- Use Technology to Your Advantage: Check for the latest tools and powerful platforms to ease trading.

Whether you are a beginner or a veteran trader, trading tools can enhance your trading journey and experience. But don’t overdo it. Too many tools can give you confusing signals. Choose your assets carefully, and then pick the most suitable tools for informed decision-making.

The information has been prepared as of the date published and is subject to change thereafter. The information is provided for educational purposes only and doesn't take into account your personal objectives, financial circumstances, or needs. It does not constitute investment advice. We encourage you to seek independent advice if necessary. The information has not been prepared in accordance with legal requirements designed to promote the independence of investment research. No representation or warranty is given as to the accuracy or completeness of any information contained within. This material may contain historical or past performance figures and should not be relied on. Furthermore estimates, forward-looking statements, and forecasts cannot be guaranteed. The information on this site and the products and services offered are not intended for distribution to any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.