CFDs and Spread Bets are complex instruments and come with a high risk of losing money rapidly due to leverage. 70.5% of retail investor accounts lose money when trading CFDs and Spread Bets with this provider. You should consider whether you understand how CFDs and Spread Bets work and whether you can afford to take the high risk of losing your money.

SEARCH

-

AllTradingPlatformsAcademyAnalysisPromotionsAbout

-

Keywords

Popular Search

TRADING ACCOUNTS

SPREAD BETTING

-

WHAT IS A SPREAD BETTING ACCOUNT?

-

ADVANTAGES OF VANTAGE SPREAD BETTING ACOUNT

-

Risk Warning

-

Frequently Asked Questions

VANTAGE SPREAD BETTING ACCOUNT

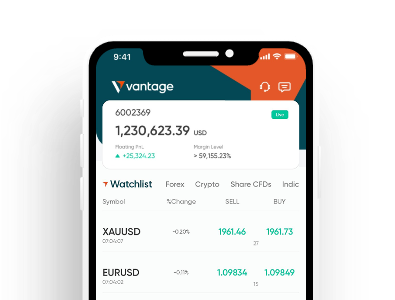

Experience the ease of trading a variety of financial products like shares, forex, indices, and currencies with Vantage, all without the need to own the underlying assets. Benefit from the tax-free* advantages that come with spread betting.

-

0.0

spreads from*

*Other fees may be applicable -

$50

minimum deposit

-

$0

deposit fees*

*Other fees may be applicable

Experience the ease of trading a variety of financial products like shares, forex, indices, and currencies with Vantage, all without the need to own the underlying assets. Benefit from the tax-free* advantages that come with spread betting.

TRADE NOWWHAT IS A SPREAD BETTING ACCOUNT?

A spread betting account allows clients to speculate on the fluctuations in prices of various financial products, such as shares, indices, currencies, and other financial assets, without the necessity of owning them. This type of account does not incur any commissions; the only cost to clients is the spread, which is the difference between the buying and selling prices.

ADVANTAGES OF VANTAGE SPREAD BETTING ACOUNT

Tax Efficiency

Our platform offers notable tax efficiencies, as clients are not required to pay capital gains tax* on their transactions. Additionally, there is no stamp duty associated with the trades, further enhancing the cost-effectiveness of trading activities. Clients also benefit from the flexibility of 24-hour dealing and the ability to go long or go short, providing diverse trading strategies.

Zero Commission*

Clients enjoy the benefit of zero commission* fees when trading, with the only cost being the spread, which is the difference between the buying and selling price of a financial product. This approach simplifies the trading process, as traders only need to focus on the spread without worrying about additional commission charges. It offers a more transparent and cost-effective way of trading, enhancing the overall trading experience for our clients.

*On selected contracts. Other fees may be applicable

FOREX

Indices

GOLD & SILVER

|

Instrument |

Buy/ |

Change |

% |

TRADE |

|---|---|---|---|---|

|

EURUSD Euro/US Dollar |

-

- (-) |

- |

- |

TRADE |

|

GBPUSD Great Britain Pound/Australian Dollar |

-

- (-) |

- |

- |

TRADE |

|

USDJPY US Dollar/Japanese Yen |

-

- (-) |

- |

- |

TRADE |

|

USDCAD US Dollar/Canadian Dollar |

-

- (-) |

- |

- |

TRADE |

|

AUDUSD Australian Dollar/US Dollar |

-

- (-) |

- |

- |

TRADE |

|

DJ30 Dow Jones Index Cash CFD (USD) |

-

- (-) |

- |

- |

TRADE |

|

NAS100 NAS100 Cash |

-

- (-) |

- |

- |

TRADE |

|

GER40 GER40 Index Cash CFD (EUR) |

-

- (-) |

- |

- |

TRADE |

|

SP500 S&P Index Cash CFD (USD) |

-

- (-) |

- |

- |

TRADE |

|

FRA40 France 40 Index |

-

- (-) |

- |

- |

TRADE |

|

XAUAUD Gold vs Australian Dollar |

-

- (-) |

- |

- |

TRADE |

|

XAUEUR Gold vs Euro |

-

- (-) |

- |

- |

TRADE |

|

XAUUSD Gold vs US Dollar |

-

- (-) |

- |

- |

TRADE |

|

XAGAUD Silver vs Australian Dollar |

-

- (-) |

- |

- |

TRADE |

|

XAGUSD Silver vs US Dollar |

-

- (-) |

- |

- |

TRADE |

Flexible Trading Options

Our platform offers an extensive range of flexible trading options, granting access to over 1,000+ diverse assets. This includes a variety of markets such as forex, shares, indices, gold, and commodities, catering to a wide range of trading preferences and strategies. With such a broad selection, clients can diversify their portfolios and explore numerous investment opportunities across different asset classes.

24/5 customer support

At Vantage, we focus on two things: our clients' success and their peace of mind. That's why we have a dedicated customer support team available 24/5 to quickly and efficiently handle any questions or concerns our clients may have. We make it easy and convenient to get in touch with us. Whether it's a phone call, email, live chat, or our customer service portal, we're just a few clicks or a phone call away.

Risk Warning

Spread betting is a leveraged product and carries a high level of risk to your capital as prices may move rapidly against you. You could lose more than your initial investment and in that situation would be required to make further payments. As these products may not be suitable for all clients, please understand the risks sufficiently and seek independent advice, where necessary.

*UK tax laws are subject to change and please ensure you take independent taxation advice on this topic. Vantage is not a tax adviser but is expressing its understanding of the general position, which could be or become incorrect at any time. Each individual client's tax treatment depends on his/her specific circumstances.s.

-

1

Register

Quick and easy account opening process.

-

2

Fund

Fund your trading account

with an extensive choice

of deposit methods. -

3

Trade

Trade with spreads starting as

low as 0.0* and gain access

to over 1,000+ CFD

instruments.

*Other fees may be applicable

Frequently Asked Questions

-

1

Is spread betting legal in the UK?

Spread betting, while regulated by the Financial Conduct Authority (FCA), is a leveraged product that involves substantial risk to your capital due to the possibility of rapid price fluctuations against your position. It is important to be aware that losses can exceed your initial investment, potentially leading to the requirement of additional payments. Given that these products might not be appropriate for everyone, it is essential to fully comprehend the associated risks and, if necessary, obtain independent advice. -

2

How does spread betting work?

Spread betting involves speculating on the price movement of financial instruments, such as stocks or commodities, without actually owning them. You bet on whether the price will rise or fall, and your profit or loss is determined by the extent of the price movement. The amount you wager per point of price movement is known as the 'spread'. However, because spread betting is leveraged, even small price movements can result in significant profits or losses relative to your initial capital. This leverage will potentially amplify both gains and risks, making it important for traders to manage your speculative trade carefully to avoid substantial losses. -

3

What is the difference between spread betting and cfd trading?

Spread betting and CFD (Contract for Difference) trading both allow speculation on the price movements of financial assets, but they have key differences. Spread betting is a tax-free method in many jurisdictions, where traders bet a certain amount per point of price movement, and profits or losses are based on the degree of movement. CFD trading, meanwhile, involves trading the difference in price of an asset between the opening and closing of the contract, subject to capital gains tax, and allows both long and short positions with the use of leverage. -

4

Is spread betting taxable?

Spread betting is a type of derivatives trading where traders predict the future direction of market prices. In spread betting, you don't actually own the underlying assets you are speculating on; rather, you bet on the price movements (up or down) of various financial products. In certain tax jurisdictions, spread betting is categorised as gambling, and as a result, any potential earnings made may be subject to taxation as gambling winnings, not as capital gains or income. It is advisable for spread bettors to maintain detailed records and consult a tax professional for guidance when filing their taxes.