Markets quiet ahead of Powell and data

Headlines

* RBA delivers “dovish hike” with further tightening data dependent

* ECB battle lines form for March decision as future hikes debated

* Dollar subdued ahead of Fed Chair Powell’s Testimony

* Asian markets little changed as risk events loom on horizon

FX: USD was modestly lower against most of its peers. The DXY dipped to 104.16 before closing at 104.29. Markets are relatively calm ahead of US policy comments by the Fed’s Powell and the US jobs report out on Friday. The benchmark US Treasury 10-year yield has fallen off its recent three-month high. The yield dropped to 3.89% before closing at 3.96%.

EUR gained 0.43% to near two-week highs at 1.0693. The ECB’s Holzmann called for rates to be lifted by 50bps at each of the next four meetings. Forward guidance in the extreme! GBP closed moderately softer at 1.2017 printing a doji candle. USD/JPY dipped to 135.36 before bouncing to close near unchanged just below 136. AUD finished down by 0.54%. It has continued lower after a dovish bias by the RBA suggesting inflation may have peaked. It had raised rates for a tenth consecutive time, by 25bps as expected. Major support sits at 0.6681. USD/CAD printed an inside day as traders await Powell, the BoC meeting and NFP.

Stocks: US equities finished very marginally in the green. The major indices gave up earlier gains that had seen big tech strength. The benchmark S&P 500 added 0.07% and closed just above the crucial 4k level. The tech-heavy Nasdaq 100 finished up 0.10% after earlier rising 1.2%. The Dow edged 0.12% higher.

Asian stocks traded mostly in the green as traders digested the latest China trade data. The mood was cautious ahead of Powell. The ASX 200 pared losses after the less hawkish tone from the RBA. The Hang Seng was choppy amid mixed data.

US equity futures are very modestly positive. European equity futures are pointing to a contained open. The Euro Stoxx 50 cash market closed up 0.4%.

Gold lost some of the ground it had made after Friday’s 1% jump higher. The uneventful dollar has seen some selling in the precious metal this morning.

Day Ahead – Major focus on Powell

Fed Chair Powell presents his semi-annual Monetary Policy Report to the Senate Banking committee today at 3pm GMT. He will likely repeat his remarks to the House Financial Services committee on Wednesday. This comes ahead of key economic releases like Friday’s NFP and next Tuesday’s CPI data, before the FOMC meeting on March 22.

This is probably the last time we will hear from Powell ahead of the black out period prior to the Fed meeting. So, this will give him some scope to possibly alter his recent messaging. This comes after the hot run of data and hawkish repricing of rate hike expectations in recent weeks. The terminal rate is close to 5.50% and there is a 28% chance of a 50bps rare rise in a few weeks’ time. Powell may simply state that the Fed remains data dependent and the job of manging inflation has not yet concluded. If he is more hawkish, then of course the dollar will go bid and stocks may dip.

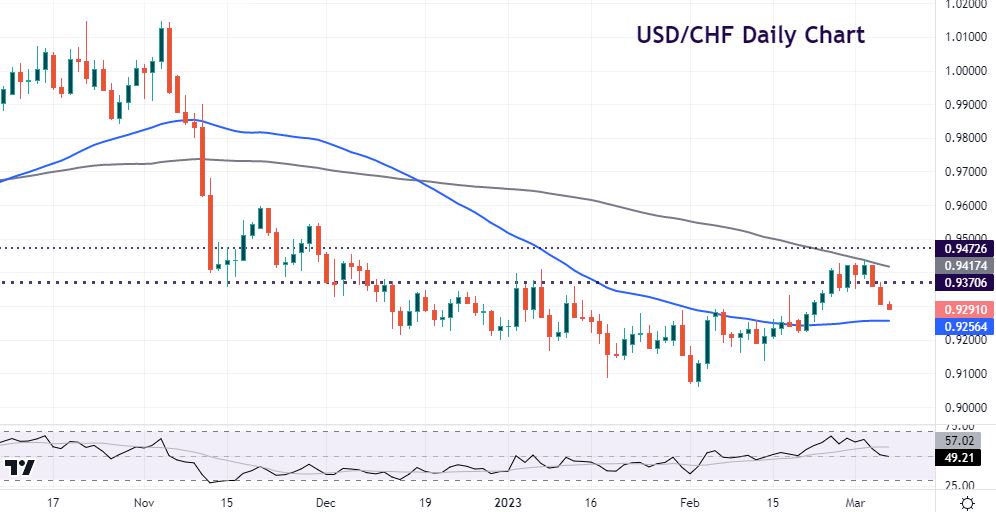

Chart of the Day – USD/CHF rolls over

A rare appearance for USD/CHF in the COTD! But when you get an inflation upside surprise in Switzerland, you know something is going on. The Swiss CPI for February printed at 3.4% y/y versus the analyst estimate of 3.1%. This stronger than expected print means higher for longer is the path of least resistance. Inflation is not falling for the SNB to conclude its hiking cycle or allow major depreciation of the CHF. A 50bp rate hike looks highly possible at its next meeting on March 23.

Prices tracked sideway over the turn of the year but looked to have moved higher at the end of last month. But the August 2022 pivot low at 0.9370 looks to have capped the upside. Initial support is the 50-day SMA at 0.9256 with the February low at 0.9059.

The information has been prepared as of the date published and is subject to change thereafter. The information is provided for educational purposes only and doesn't take into account your personal objectives, financial circumstances, or needs. It does not constitute investment advice. We encourage you to seek independent advice if necessary. The information has not been prepared in accordance with legal requirements designed to promote the independence of investment research. No representation or warranty is given as to the accuracy or completeness of any information contained within. This material may contain historical or past performance figures and should not be relied on. Furthermore estimates, forward-looking statements, and forecasts cannot be guaranteed. The information on this site and the products and services offered are not intended for distribution to any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.