Week Ahead: NFP to kick off 2023 and volatility

We enter the new year with eyes on some top tier data in the first week, after a brutal year in risk markets. There was no hiding place even in the last month of 2022. It was one of the worst December’s on record for the tech-heavy Nasdaq index, which lost around 9% on the month. Tax-loss selling and carnage among some of the former market darlings (see Tesla and Apple) hit sentiment hard, even though we had the news of China relaxing its zero-Covid policy. It seems it will be a bumpy road to a full reopening and normal economic activity with doubts swirling around the sustainability of the exit path.

The marquee event of this first week will be the monthly employment data from the US in the form of the non-farm payrolls figures released on Friday. The current headline number is expected to be around the 200,000 mark, with payrolls growth continuing to surprise to the upside in recent months. Little change is expected in the jobless rate after November printed at 3.7%. Economists generally reckon that gains of 100,000 per month and softer wages growth are critical to timing the peak Fed funds rate and subsequent cuts. Certainly, it seems as though the earnings data will pose the greatest market sensitivity, after the prior report showed a surge to 0.6% m/m which smashed the estimate of 0.3%. As a forerunner to NFP, we do get JOLTS job openings and the ADP report in the middle part of the week to also watch out for.

The FOMC minutes released Wednesday will be in focus as they may give markets more colour around the risks to the economic outlook and for Fed policy. Discussions around why officials continue to view the risks to inflation as pointed to the upside will be of interest. The meeting was more hawkish than many expected as the “terminal” rate was raised to 5.1% on the interest rate dot plot. Money markets still only price in a peak rate around 4.95%.

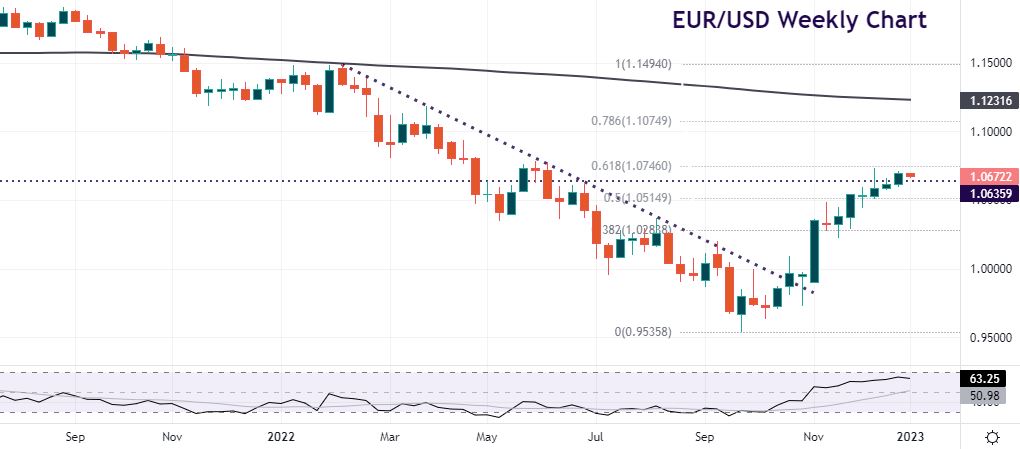

Finally, eurozone inflation is set for another update on Friday as well, so expect some volatility on the last day of the week. Spain kicked off estimates with a strong report and we get other European countries reporting through the week. Energy inflation is set to trend lower due to falling oil prices and base effects. This means the headline figure may fall back into single digits. But core inflation for the region is still running at a record high of 5% and high food prices may persist alongside wage growth. The warmer weather in Europe has seen the ECB adopt a hawkish bias which has helped underpin support for the euro over the last few weeks.

The information has been prepared as of the date published and is subject to change thereafter. The information is provided for educational purposes only and doesn't take into account your personal objectives, financial circumstances, or needs. It does not constitute investment advice. We encourage you to seek independent advice if necessary. The information has not been prepared in accordance with legal requirements designed to promote the independence of investment research. No representation or warranty is given as to the accuracy or completeness of any information contained within. This material may contain historical or past performance figures and should not be relied on. Furthermore estimates, forward-looking statements, and forecasts cannot be guaranteed. The information on this site and the products and services offered are not intended for distribution to any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.