Dollar treads water, UK Autumn Statement in focus

Headlines

* Wall Street ends down after bleak Target outlook

* Australia jobs top forecasts, boost case for more rate hikes

* UK’s Hunt to pitch spending cut, tax hikes as UK faces into storm

*Asian stocks mixed as China tech sells off, US futures green

FX: USD is little changed overnight after it closed marginally lower. Strong US retail sales saw bouts of a pullback in the risk rally ease. The DXY is down 4.7% this month. US Treasury yields dropped again. The 10-year yield fell towards 3.70% with next support at 3.60%. The break of the neckline in the double top reversal pattern suggests more downside.

EUR/USD is hovering just below 1.04 but above the August high at 1.0368. GBP/USD gained 0.38% and is trading unchanged today around 1.913. USD/JPY failed to sustain a move above 140 and is consolidating its recent sharp move lower.

AUD/USD tapped the 100-day SMA at 0.6695. It currently trades around a Fib level (38.2%) of the April downtrend. USD/CAD again touched support above 1.32 and rebounded. The July high is 1.3223 and 100-day SMA at 1.3242. Gold failed to hold above $1780 again and could be rolling over.

Stocks: US equities closed lower with selling most acute in the morning after Target gave a gloomy forecast for the holiday season.The S&P 500 closed down 0.83% while the tech-heavy Nasdaq fell 1.45%. The Dow gave up 0.12% as better US retail sales offset Target losses.

Asian stocks traded mostly lower throughout the session following Wall Street. The Nikkei 225 traded either side of 28k before stabilising with modest losses. The ASX 200 was the relative outperformerwith gains in IT. The Hang Seng opened lower and extended losses. China suggested that it is able to achieve Covid Zero as mainland cases rose at their fastest pace since April.

US equity futures are bouncing and green. European equity futures are flat overnight. The cash market closed lower -0.8% yesterday.

Day Ahead – UK Autumn Budget in the spotlight

The main event in the UK is the Autumn Statement which will set out PM Sunak’s fiscal plans. This is due at 11.30 UK time. After weeks of speculation, it is widely expected to include tax increases to fill the £50 billion hole in the public finances. That had led to the plunge in GBP and gilts in September after the Trussonomics experiment. Market credibility has been restored generally. But it may well still do battle with political expediency.

More fiscal tightening will mean a bigger gilt rally, especially if it eases the pressure on the BoE to hike. Renewed focus on dire growth could worry foreign investors and see sterling sell off sharply. We note positioning in GBP has been heavily short into October. A renewed squeeze could prevail but the outlook for the UK still appears grim and may be confirmed later today.

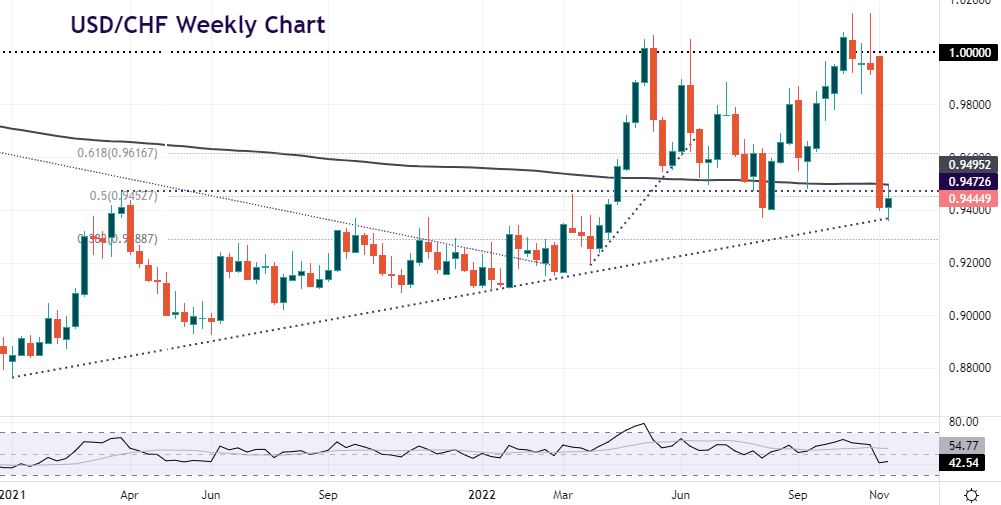

Chart of the Day – USD/CHF on long-term trendline support

The SNB Governor Jordan has been quite vocal and relatively hawkish this week. He said inflation had broadened and predicts the bank needs to tighten conditions. That could possibly be in December but will depend on the data.

USD/CHF has seen a huge move lower recently. The major couldn’t sustain levels above 1.00 and has seen six sharp down days taking it to a major confluence of support above 0.94. The March 2021 high is 0.9472 just above the midway point of the 2021 rally at 0.9452. Critically, prices bounced off long-term trendline support at 0.9368. Recent daily consolidation looks bearish if we break lower.

The information has been prepared as of the date published and is subject to change thereafter. The information is provided for educational purposes only and doesn't take into account your personal objectives, financial circumstances, or needs. It does not constitute investment advice. We encourage you to seek independent advice if necessary. The information has not been prepared in accordance with legal requirements designed to promote the independence of investment research. No representation or warranty is given as to the accuracy or completeness of any information contained within. This material may contain historical or past performance figures and should not be relied on. Furthermore estimates, forward-looking statements, and forecasts cannot be guaranteed. The information on this site and the products and services offered are not intended for distribution to any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.