Stocks downbeat into half year-end as safe havens gain

Overnight Headlines

*China’s June factory, services activity expands for the first time in 4 months

*Fed’s Powell: Fed is on track for 0.75-point July rate hike

*Euro under pressure as inflation fears send investors to dollar haven

*APAC stocks were varied at month-end amid a slew of data

US equities ended a mixed bag with the Dow enjoying its first positive session in three days. But the broader S&P500 and Nasdaq both posted their third straight losing sessions. Asian stocks are lowerwith the MSCI’s broadest index of Asia-Pacific shares outside Japan easing another 0.5%. This brings its losses for the quarter to 10%. The Nikkei 225 fell 1.4% though its quarterly fall has been a relatively modest 5%. Futures are subdued and indicative of a negative open.

USD rose with the DXY gaining another 0.6%. Bulls are looking to break the 105 handle. EUR fell below 1.05 and extended losses through 1.0450. GBP fell through 1.2155 but is trading near that support/resistance this morning. EUR/CHF fell below parity on CHF strength. USD/JPY posted a new multi-decade high at 137.00 before paring back as US Treasury yields fell. Price action in the commodity currencies was muted as risk sentiment remained cautious.

Market Thoughts – Swissy is the strongest major on the month

We have highlighted the “regime shift” at the SNB during our weekly webinars. This entailed a shock half-point interest rate rise as well as a major change in its currency policy. Looking at recent (sight deposits) data, this may well support the latter as the SNB now wants a stronger CHF in order to curb inflation pressures.

This goes against a central bank who had historically looked to actively intervene in the FX market to weaken the swissie. In fact, for over ten years the SNB has been seen fighting deflation and warding off currency strength by accumulating over CHF800 billion in reserves. The bank has now indicated that an appreciating CHF is no longer an issue. This means we should look for further CHF strength on the back of fundamentals and the global stagflation shock.

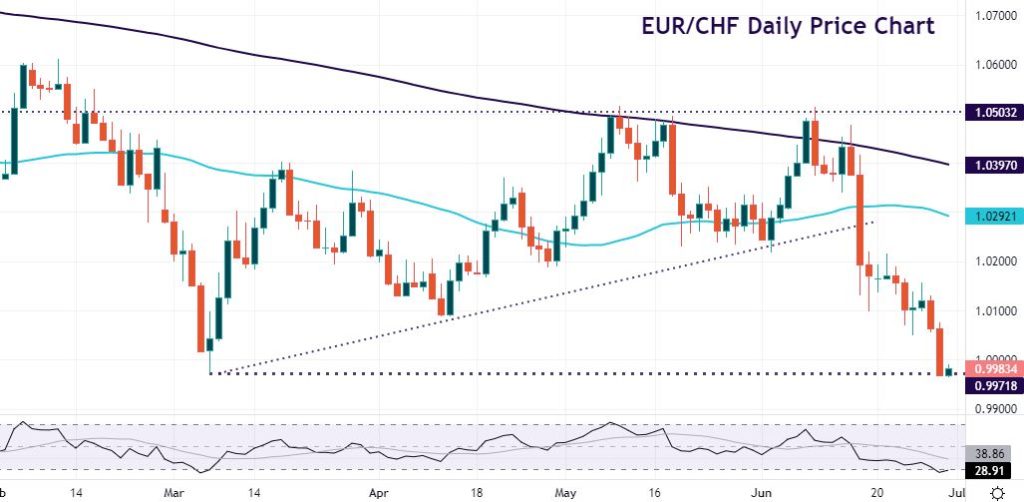

Chart of the Day –EUR/CHF hits parity

EUR/CHF broke below 1.00 yesterday afternoon and continues to trade below that key psychological level this morning. This is only the third time this has happened it has happened since the euro was established in 1999. The SNB is now refraining from intervening in FX markets to weaken the CHF and this should be a driver for this pair and other CHF crosses going forward. Of course, the swissie acts as a safe haven currency too which should underpin support if risk sentiment remains sour.

Resistance at 1.05 has been strong on a few occasions in recent weeks. That also tallied with a long-term low and the 200-day SMA which capped the upside. The most recent fall in June crashed through the short-term upward trendline from the March low at 0.9971. We made a new low at 0.9965 yesterday and prices are trading just above here this morning. We would expect this pair to drift lower in due course unless the ECB springs a hawkish surprise.

The information has been prepared as of the date published and is subject to change thereafter. The information is provided for educational purposes only and doesn't take into account your personal objectives, financial circumstances, or needs. It does not constitute investment advice. We encourage you to seek independent advice if necessary. The information has not been prepared in accordance with legal requirements designed to promote the independence of investment research. No representation or warranty is given as to the accuracy or completeness of any information contained within. This material may contain historical or past performance figures and should not be relied on. Furthermore estimates, forward-looking statements, and forecasts cannot be guaranteed. The information on this site and the products and services offered are not intended for distribution to any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.