Relief for EUR after Lagarde calms rate hike bets

Overnight Headlines

*Global bond market meltdown intensifies in Asia on relentless rate hike bets

*ECB President Lagarde pledges “gradual” adjustment as ECB debate heats up

*Putin: Some of Macron’s ideas could form the basis to move forward

*Euro bounce pauses ahead of US inflation

US equities closed a mixed bag with the Dow flat, the S&P 500 slipping 0.37% and the Nasdaq lower by 0.58%. Defensive, value sectors outperformed with energy continuing to do well. Intraday volatility calmed, though indices were higher during the day before closing nearer their lows. Asian markets are mixed with tech lower in Hong Kong while Japanese stocks move higher. US and European futures are mixed.

USD edged higher and is now trading above previous resistance at 95.51. It was relatively quiet start to the week with EUR attempting to push up to last Friday’s 10-week high at 1.1483 before sliding back to the 100-day SMA above 1.14. USD/JPY is on the move up, looking to break through 115.52 as 10-year US Treasury yields push to a new cycle peak. Small strength seen in CAD and AUD with USD/CAD falling back below the 50-day SMA at 1.2708.

Market Thoughts – Lagarde pushback on early hike

All eyes were on ECB President Lagarde yesterday in her first appearance since her hawkish shift last week at the ECB meeting. She said, “a rate hike will not happen before net asset purchases finish”. There is limited time for this to happen because of the defined sequencing the ECB will follow between the end of QE and the lift-off date for a rate move.

Markets are pricing in an aggressive 28bps for September so this would require a fast end to QE. Investors believe central banks are underestimating how much inflationary pressure there is and don’t believe that more gradual tightening is the answer. A known ECB hawk over the weekend also said hikes wouldn’t start until October at the earliest.

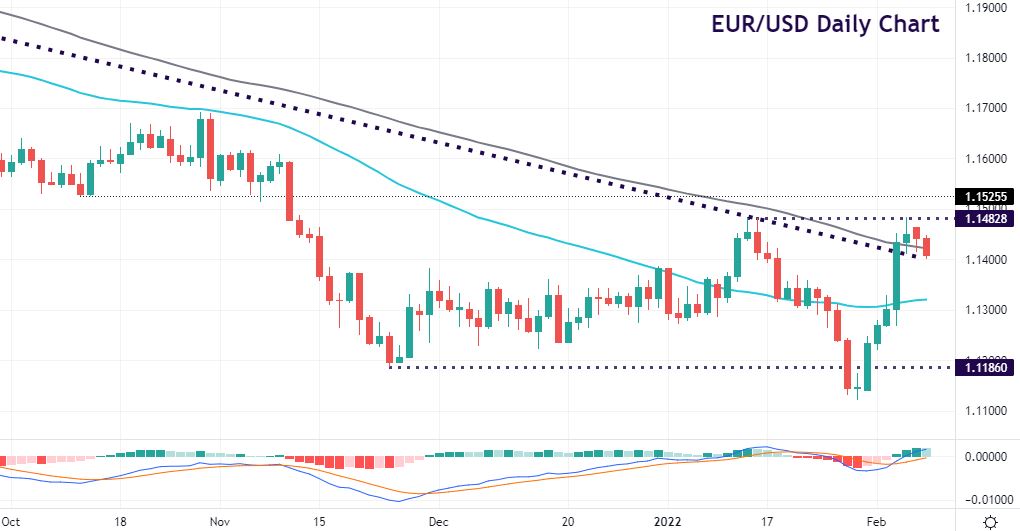

Chart of the Day – EUR rally pauses

The EUR’s bullish run has stalled after six consecutive days of gains. Prices remain just above trendline resistance from the June high and are currently trading around the 100-day SMA at 1.1422. This support zone is significant as a drop below 1.14 leaves the euro looking at a swift fall to test the 50-day SMA at 1.1320.

Resistance at Friday’s high is reinforced by the January tops around 1.1481/83. Above here are the October lows around 1.1524/29. The US CPI data released Thursday is the major risk event for the week.

The information has been prepared as of the date published and is subject to change thereafter. The information is provided for educational purposes only and doesn't take into account your personal objectives, financial circumstances, or needs. It does not constitute investment advice. We encourage you to seek independent advice if necessary. The information has not been prepared in accordance with legal requirements designed to promote the independence of investment research. No representation or warranty is given as to the accuracy or completeness of any information contained within. This material may contain historical or past performance figures and should not be relied on. Furthermore estimates, forward-looking statements, and forecasts cannot be guaranteed. The information on this site and the products and services offered are not intended for distribution to any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.