Dollar looks to US CPI and Fed minutes for support

Headlines

* US inflation expected to have eased to lowest level in two years

* FOMC meeting minutes to detail how officials weighed bank risks

* Dollar dips, gold advances towards recent high at $2032

* Asia stocks pare gains as traders await key risk events

FX: USD turned lower, falling by nearly 0.4%. It has moved back down towards 102 and the 50% mark of the 2021-22 rally at 101.99. Markets are braced for “Whipsaw Wednesday” with the release of US CPI and the FOMC minutes from its March meeting hours later. The US Treasury 2-year yield continued higher. It currently trades just below the 200-day SMA at 4.05%. The 10-year yield trades above 3.40% after last week’s low at 3.25%.

EUR traded to an intraday high at 1.0928 and has pushed on this morning. The halfway point of the 2021-22 decline sits at 1.0942. GBP has moved up to the January high at 1.2447. USD/JPY continues to test the topside, now just below 134. The AUD is narrowly outperforming again but is still languishing comfortably below 0.67. USD/CAD fell sharply below 1.35. the April ow is at 1.3405.

Stocks: US equities were mixed and traded choppy. The Dow gained 0.29%. The benchmark S&P 500 was flat. The Nasdaq 100 closed down 0.67%. There was rotation out of defensives and tech and into cyclicals. The quiet trade had all the hallmarks of investors staying on the sidelines ahead of the inflation data.

Asian stocks were mixed like Wall Street. The Nikkei 225 extended further above 28k. Bullish comments by Warren Buffett saying he intends to add to Japanese stock holdings helped sentiment. The Hang Seng underperformed amid losses in large-cap stocks like Tencent and Alibaba after weakness from US peers.

Gold pushed up well above $2k regaining the losses from a two-day correction. Hedge funds lifted bullish bets to a one-year high in the week to April 4. Data on inflation, the Fed minutes and Friday’s US retail sales should be closely watched about the near-term direction for interest rates. The March 2022 record high is at $2070. The 21-day SMA is $1952.

Day Ahead – Busy calendar of risk events

Today’s US CPI is the marquee event of the week. The headline likely slowed for a ninth straight month. It is forecast to hit 5.2% from 6.0% in February led by falling fuel costs, although this may be offset by high food inflation. This would be the lowest reading since June 2021. Shelter prices remain the wildcard and the key contributor to recent price pressures. Economists reckon another solid monthly core number (0.4% is expected) will worry policymakers as that is more than double the rate required over time to push back inflation to the FOMC’s 2% target. The Fed’s favourite CPI indicator – core services inflation less shelter – will also be in focus as this is wage driven and remains sticky.

Recent commentary from Fed officials suggests they feel they have more work to do to ensure persistent inflation is eliminated. This could be highlighted in the minutes from the FOMC’s March meeting which are released a few hours after the inflation data. Stubborn core figures should underpin support for the dollar as at least one more rate hike looms. Money markets currently give a 70% chance of a 25bp May Fed rate hike. But a downside surprise in the data could add fuel to the disinflation story that Chair Powell has talked about recently. This would push the greenback towards its year-to-date lows. That could see EUR/USD try to break the 1.10 barrier.

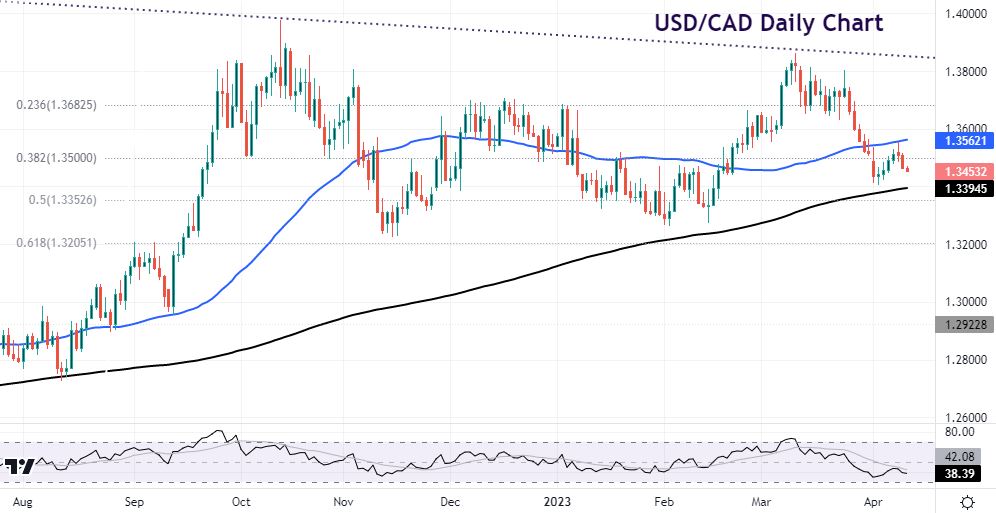

Chart of the Day – USD/CAD rolling over

Money markets fully expect the Bank of Canada to hold rates at 4.5% in what should be a fairly easy decision. The rebound in first quarter GDP and the tight labour market put some pressure on policymakers but the recent banking stress and falling inflation have removed any need to move rates at this meeting. Balancing stronger growth and a more ominous outlook could result in a mixed tone by the bank with the “conditional pause” phrase used previously wheeled out again.

USD/CAD looks to be turning lower after printing a “doji” candle on Monday. A soft close yesterday could now see a drop to the recent early April bottom at 1.3405. The 200-day simple moving average just below here at 1.3394. A better risk mood and firmer crude have been helping the loonie. CAD positioning by major funds and speculators remains one of the biggest bearish bets in over a decade so the major could be vulnerable to a squeeze.

The information has been prepared as of the date published and is subject to change thereafter. The information is provided for educational purposes only and doesn't take into account your personal objectives, financial circumstances, or needs. It does not constitute investment advice. We encourage you to seek independent advice if necessary. The information has not been prepared in accordance with legal requirements designed to promote the independence of investment research. No representation or warranty is given as to the accuracy or completeness of any information contained within. This material may contain historical or past performance figures and should not be relied on. Furthermore estimates, forward-looking statements, and forecasts cannot be guaranteed. The information on this site and the products and services offered are not intended for distribution to any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.