Debt ceiling deal hopes boost risk sentiment

Headlines

* Biden, McCarthy aim for deal on US debt ceiling by Sunday

* BoE Governor admits UK economy suffering from wage price spiral

* Gold futures settle at their lowest in 7 weeks, USD hits multi-week high

* Asian shares follow Wall Street higher amid debt ceiling optimism

FX: USD remains supported and made highs at 103.11 before settling at 102.85. The upside was boosted by the upside in Treasury yields. The 2-year yield moved higher for a fourth day. It is now touching its 200-day SMA at 4.17%. The 10-year yield settled at 3.57% and is currently up for fifth straight day today.

EUR fell to a 7-week low at 1.0810. Its 100-day SMA is at 1.0805. GBP dipped to a low of 1.2421 before settling at 1.2486. The January top at 1.2447 is still holding. USD/JPY extended its win streak for a fifth session. It is through the 200-day SMA at 137.07. Major resistance sits at the March high at 137.91. The yen faces headwinds from yields and a lack of haven demand. AUD closed little changed at 0.6659. Overnight, the April employment unexpectedly fell while the jobless rate ticked up. USD/CNH is up for the ninth day in ten and above 7.03. The December high is at 7.0155. USD/CAD continues to trade around the 200-day SMA at 1.3471.

Stocks: US equities marched higher as investors grew more confident about a deal to avoid a US government default. The benchmark S&P 500 finished 1.2% higher driven by gains in the financial and energy sectors. The Dow jumped 1.24%. Itclosed above both its 50- and 100-day SMAs. The Nasdaq 100 finished up 1.22%. The regional banking index surged 7.3% with Western Alliance adding over 10%. The lender reported deposit growth in the current quarter. Target also released better than expected Q1 results as its stock gained 2.6%. But the retailer warned of soft sales in Q2 and set guidance below forecasts.

Asian stocks were higher on optimism Stateside, though some of the gains were capped by soft data. Alibaba reports today. The Nikkei 225 surged at the open but stalled at the best levels in three decades after weaker than expected trade data. The Hang Seng was positive, but upside was limited by Tencent’s earnings which missed expectations.

US equity futures are flat and uneventful. European equity futures are pointing to a higher open. The Euro Stoxx 50 closed up +0.2% yesterday.

Gold is down for a third consecutive day. It is trading around its 50-day SMA at $1985 amid a steady dollar, rising yields and a lack of haven demand. There is a risk of long liquidation from big speculators who have been strong buyers in recent months.

Day Ahead – Data worth watching

There are a few data points on the calendar. The weekly US initial jobless claims have gained focus after last week’s higher than expected reading. It showed claims at their highest level since October 2021. That triggered hopes of a cooling in the labour market even if it still remains tight. There’s around a 28% chance of a 25bp rate hike at the Fed’s June meeting. The dollar has hit the 100-day SMA at 102.88 on the DXY. Yesterday’s top at 103.11 might also offer potential resistance.

Japan CPI is released overnight. Prices pressures are forecast to remain concerning for the BoJ. Consensus predicts the headline print will rise to 3.5% from 3.2%. The core is also seen higher at 4.2% versus 3.8% in March. That was the fastest pace of increase in over four decades. Higher readings will spark chatter about BoJ tweaks at its June meeting. The bank’s price goal is 2% though policymakers remain focused on seeing wage growth.

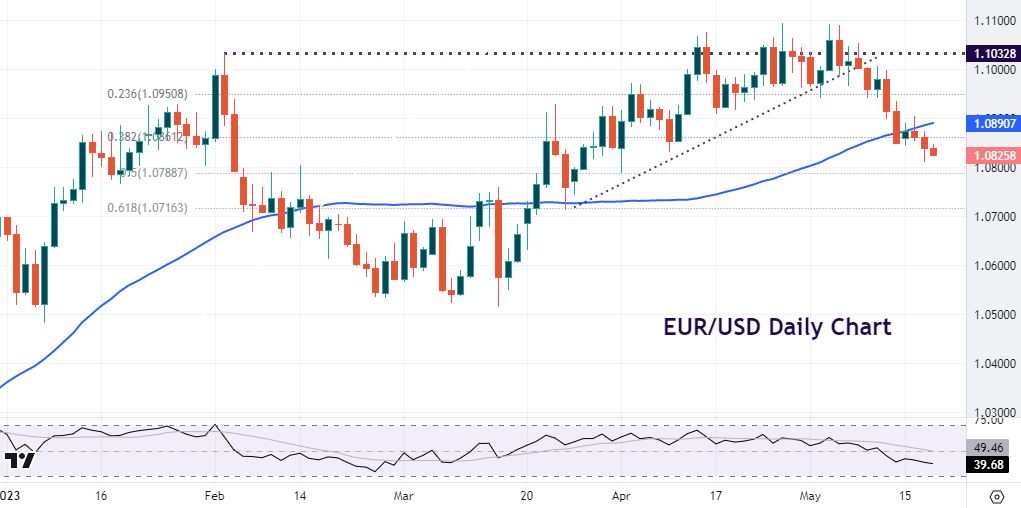

Chart of the Day – EUR/USD takes another leg lower

There’s not been much out on the euro side of the docket on this major. ECB speakers have generally remained relatively hawkish. After the nailed on 25bp rate hike in June, speculation surrounds one more hike in July. But the dollar is driving this pair with the debt ceiling ructions to the fore. There’s also been hawkish rhetoric from Fed speakers as the chance of another 25bp at next month’s FOMC steadies as yields rise. This was given nigh on zero chance just one week ago.

EUR/USD has tumbled from its highs above 1.1032. We had that January top as major support/resistance. The near-term trendline support was also crushed. The 50-day SMA around 1.0890 held up prices briefly on Monday and Tuesday. But a textbook flag breakdown now targets the 100-day SMA at 1.0805. This is an important psychological level too.

The information has been prepared as of the date published and is subject to change thereafter. The information is provided for educational purposes only and doesn't take into account your personal objectives, financial circumstances, or needs. It does not constitute investment advice. We encourage you to seek independent advice if necessary. The information has not been prepared in accordance with legal requirements designed to promote the independence of investment research. No representation or warranty is given as to the accuracy or completeness of any information contained within. This material may contain historical or past performance figures and should not be relied on. Furthermore estimates, forward-looking statements, and forecasts cannot be guaranteed. The information on this site and the products and services offered are not intended for distribution to any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.