US CPI inflation is likely to remain high

US equities drifted with the S&P500 falling 0.24% and the Nasdaq dropping 0.14%. The looming start to the earnings season has probably deterred some investors from placing large positions. Soaring power prices fuelling inflation are also weighing on sentiment. Risk appetite is slightly better in Asia this morning with most markets higher. The broadest index of Asia-Pac shares (MSCI ex-Japan) steadied after falling to it worst daily performance in three weeks on Tuesday. Futures are mixed.

USD is trading just off yesterday’s peak at 94.56, the highest level since September 2020. Next resistance on the DXY comes in at 94.65. The dollar was especially strong versus the yen again, making a new high at 113.78, a near three-year top. Japan buys the bulk of its oil from overseas so is struggling with rocketing prices. Commodity currencies continued higher versus JPY and CHF. EUR/USD made a new low at 1.1524 but is bouncing this morning.

Market Thoughts – US Inflation…

Consensus sees the monthly US CPI reading released later today at 0.3% and the annual rate at 5.3% in September, unchanged from the prior readings. The core number will be the focus and has fallen to average 0.2% in July and August after peaking at 0.9% earlier in the year after a reopening spike.

The rate of price increases is still faster than in pre-pandemic times. This will keep the year-on-year figures elevated and the risk is for still higher prices due to ongoing supply chain issues and inventory shortages as we go into holiday season. The “team transitory” versus more persistent inflation debate rumbles on and this data will further frame the discussion. With the Fed already prcied to taper next month, the question is whether we get another rise in bond yields and the dollar on the back of elevated figures.

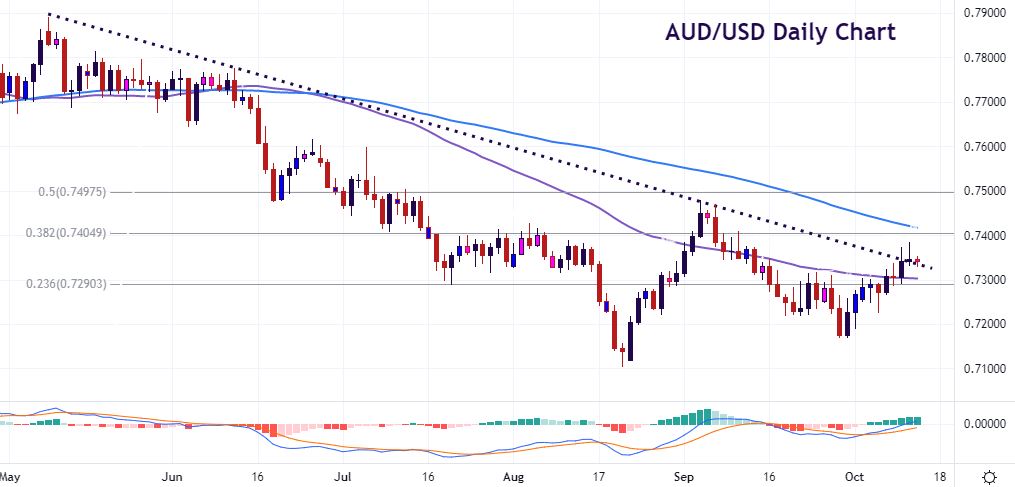

Chart of the Day – AUD/USD hits trendline resistance

The aussie has been enjoying itself this month, vying with the loonie as the best performing major. Australia is a major exporter of coal and natural gas so is benefiting from rising energy prices. No doubt the sizeable speculative short in AUD has been trimmed on this move higher.

AUD/USD has risen steadily after dipping below 0.72 again late last month. Prices have gone up through the 50-day SMA but have struggled to break longer-term trendline resistance from the May high. If this line can act as support, buyers will target 0.74. Initial support sits at 0.7304.

The information has been prepared as of the date published and is subject to change thereafter. The information is provided for educational purposes only and doesn't take into account your personal objectives, financial circumstances, or needs. It does not constitute investment advice. We encourage you to seek independent advice if necessary. The information has not been prepared in accordance with legal requirements designed to promote the independence of investment research. No representation or warranty is given as to the accuracy or completeness of any information contained within. This material may contain historical or past performance figures and should not be relied on. Furthermore estimates, forward-looking statements, and forecasts cannot be guaranteed. The information on this site and the products and services offered are not intended for distribution to any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.